Exploring the Investment Potential of Eli Lilly as a Promising Stock Option

When considering where to allocate your financial resources, it’s essential to scrutinize various entities vying for attention in the market. Understanding the health and future prospects of these organizations can significantly influence your investment strategy. This section delves into the viability of a certain pharmaceutical giant, exploring whether it merits a spot in your portfolio.

Investors often seek companies that demonstrate resilience and growth potential. With a rich history in the healthcare sector, this firm has been at the forefront of innovation and product development, consistently adapting to the ever-changing landscape. But how do its current performance metrics hold up against the competition?

Ultimately, the decision comes down to thorough analysis and personal risk tolerance. Let’s explore the financial indicators and market trends associated with this prominent player, aiming to provide you with a clearer picture of its viability as a strategic investment choice.

Evaluating Market Performance

When assessing the prospects and suitability of a particular entity in the pharmaceutical sector, it’s essential to dive into various metrics and indicators that define its market standing. Understanding how this company has navigated through economic fluctuations, regulatory changes, and competitive landscapes provides valuable insights for potential investors.

Analyzing historical price movements can shed light on the trends that have influenced its share valuation over time. Factors such as earnings reports, product pipeline developments, and strategic partnerships can significantly impact perceptions and, consequently, market performance. Additionally, examining broader industry trends and the company’s response to emerging challenges is crucial in forecasting future growth.

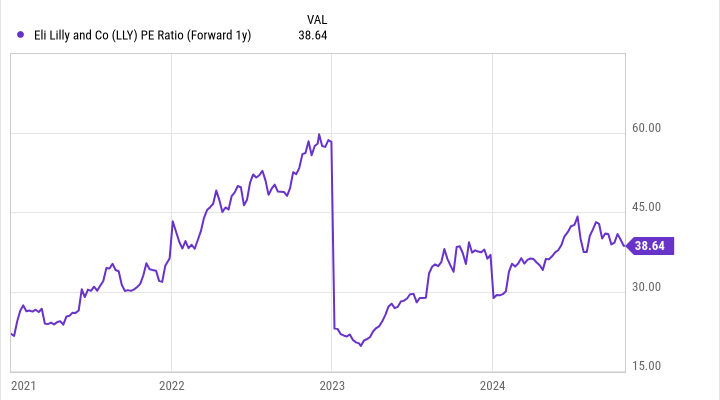

Furthermore, comparing this company’s performance with its peers enhances the understanding of where it stands in the marketplace. Metrics like price-to-earnings ratios and dividend yields can serve as benchmarks, guiding potential stakeholders in making informed decisions. Overall, a thorough evaluation requires a balanced perspective on both numerical data and qualitative factors.

Current Trends in Biopharmaceutical Stocks

The biopharmaceutical sector has been experiencing some fascinating developments lately, reflecting its dynamic nature and responsiveness to global needs. Investors are keenly observing these shifts, as they can significantly impact market performance and opportunities. Innovative therapies, technological advancements, and regulatory changes are driving this vibrant landscape, creating both challenges and prospects for companies within the industry.

One notable trend is the increasing focus on personalized medicine. As more companies invest in tailoring treatments to individual genetic profiles, we see a growing demand for precision therapies. This not only enhances patient outcomes but also attracts considerable interest from investors who want to be part of groundbreaking health solutions. In addition, the rise of artificial intelligence and data analytics in drug development is reshaping how firms approach research, bringing efficiencies that weren’t possible before.

Moreover, the global pandemic underscored the importance of rapid response capabilities, prompting biopharmaceutical firms to enhance their agility. This has led to a surge in collaborations and partnerships across the industry, allowing companies to pool resources and expertise to accelerate the development of new therapies. As a result, we are witnessing a renaissance in research and development, which can potentially lead to lucrative breakthroughs.

Regulatory environments are also evolving, with agencies adapting to the fast pace of innovation. Streamlined approval processes and more flexible guidelines foster a supportive atmosphere for emerging treatments. This adaptability of regulators is crucial for maintaining investor confidence and encouraging ongoing investment in new technologies and therapies.

Overall, the landscape for biopharmaceutical entities is vibrant and full of potential. By keeping an eye on these trends, stakeholders can make more informed decisions and strategically position themselves within this ever-evolving market.

Risks and Rewards of Investing in Eli Lilly

When considering putting your money into a particular pharmaceutical company, it’s essential to weigh both the potential benefits and the drawbacks that could arise. The landscape for healthcare and drug development is dynamic, and understanding the intricacies can help you make informed choices. With robust innovations and a strong market presence, there are significant opportunities for growth, but there are also challenges that investors should keep in mind.

On the positive side, this corporation has established itself as a leader in producing groundbreaking treatments for various medical conditions. Their commitment to research and development often leads to new products that can capture market share and generate substantial revenue. Additionally, the health sector typically remains resilient during economic downturns, providing some level of stability to investments.

However, potential investors must also recognize the inherent risks associated with this industry. Regulatory hurdles can delay product launches, and the competition is fierce, with many players vying for dominance in the marketplace. Moreover, any adverse reactions to drugs or changes in market sentiment can impact valuations significantly. Keeping an eye on patent expirations is also crucial, as they can affect future earnings projections.

Ultimately, understanding both the upsides and downsides is vital for anyone looking to engage with this prominent entity in the health sector. A balanced perspective is key to navigating the complexities of such investments effectively.