Understanding the Earned Income Tax Credit and Its Benefits for Low-Income Workers

Many individuals may find themselves overwhelmed during tax season, especially when it comes to maximizing their potential benefits. One aspect that often escapes attention is the opportunity for financial assistance provided for those who work and meet certain criteria. This can significantly impact your annual return and offer a helpful financial boost.

When we talk about this particular program, we refer to a support mechanism designed to uplift those striving to make ends meet while contributing to the economy. It’s not just about receiving a sum back; it’s about recognition of hard work and creating a safety net for low to moderate earners. By understanding how this benefit operates, workers can potentially improve their financial well-being.

In this article, we will delve into the specifics of this financial assistance, exploring eligibility requirements, benefits, and the application process. It’s essential to grasp the full picture so that you can take full advantage of what’s available to you. Financial savvy isn’t just for accountants; it can empower anyone navigating the complexities of employment and taxation.

Understanding Earned Income Credit Eligibility

When it comes to financial support from the government, many people may find themselves wondering if they qualify for specific benefits designed to assist those with lower wages. This segment will explore the criteria that determine who is eligible to receive these types of financial relief. It’s crucial to understand the factors that influence your qualification status, as it can significantly impact your overall financial well-being.

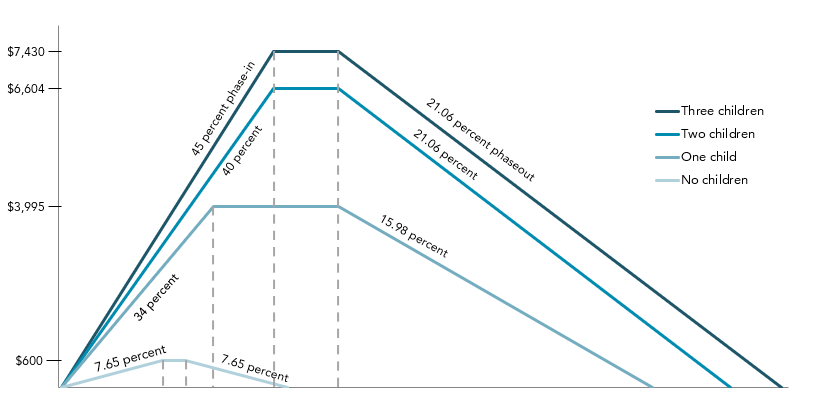

To be considered for this type of assistance, individuals typically need to meet several conditions related to their employment and dependents. Firstly, there are limits on how much one can earn in a given year, which helps ensure that the support is directed towards those who need it the most. Additionally, having children can enhance your chances, as the presence of dependents often results in higher eligible amounts.

Furthermore, age and filing status also play vital roles in determining eligibility. Applicants usually need to be at least a certain age and may benefit from filing jointly if they are married. Understanding these stipulations is essential for anyone hoping to navigate the process successfully.

In summary, recognizing the various elements that affect your ability to receive financial assistance can empower you to take advantage of available programs. By reviewing your circumstances against the outlined requirements, you’re better positioned to make informed decisions and potentially receive the help you deserve.

Benefits of Claiming Earned Income Credit

When you take advantage of this valuable tax benefit, you open the door to several positive opportunities. This financial boost can significantly lighten your tax burden, making it easier for you to manage everyday expenses. Many individuals and families find that receiving this benefit can help them achieve greater financial stability and even pave the way for future investments in education or housing.

One of the most compelling advantages of this initiative is the potential for increased refunds. For those who qualify, the additional funds can provide a much-needed cushion during challenging financial times. This means more money in your pocket, allowing for better budgeting and the ability to cover essential costs like rent, utilities, or groceries.

Moreover, utilizing this financial support can enhance your overall quality of life. The extra funds can free up resources, enabling you to save for future goals or even indulge in a few well-deserved treats. This can foster a sense of relief and empowerment, as it takes some pressure off your daily financial responsibilities.

In addition to immediate financial relief, claiming this benefit can also create long-term advantages. For example, accessing this support may help you qualify for other assistance programs, expanding your financial options further. This creates a more stable foundation for both you and your family, ultimately leading to a brighter financial future.

How to File for Tax Benefits

Filing for specific tax benefits can be a great way to boost your financial situation, especially if you meet certain criteria. This section will guide you through the steps you need to take to access these valuable resources, ensuring that you don’t miss out on potential savings during tax season.

First things first, you’ll want to gather all necessary documents. This includes your W-2s, 1099s, and any other relevant paperwork that reflects your earnings throughout the year. Having all this information on hand will make the process smoother and help you claim what you’re eligible for.

Once you’re organized, it’s important to understand the eligibility requirements. Generally, you need to have a qualifying child or meet specific guidelines based on your financial situation. Be sure to check the latest criteria to ensure you qualify, as they can change from year to year.

Next, you can choose how to file your taxes. You may opt for traditional methods, such as using paper forms, or take advantage of modern solutions like tax software or professional services. Many of these tools offer step-by-step instructions and can automatically calculate potential benefits, making the application process much less daunting.

After completing your forms, don’t forget to double-check everything. Even a small mistake can delay your benefits. Once you’re confident that all information is accurate, submit your documents to the IRS, either electronically or via mail.

Lastly, keep track of your application. After filing, monitor the status of your refund to ensure everything goes smoothly and to see when you can expect your financial boost. With a little preparation and attention to detail, you’ll be well on your way to receiving your refund and improving your financial well-being.