Exploring the Potential of Dell as a Smart Investment Choice

When it comes to navigating the world of investments, many individuals are on the lookout for opportunities that promise strong returns and long-term growth. This is especially true for those focusing on the technology sector, which has shown remarkable resilience and innovation over the years. Understanding whether a particular entity is a viable option requires careful analysis and consideration of various factors that impact its market performance.

In this discussion, we’ll dive into the key indicators that suggest whether a well-known player in the tech industry is worthy of your financial consideration. From examining the company’s financial health to assessing its competitive edge and market position, there are numerous elements to explore. It’s all about making informed decisions based on thorough research and reliable insights.

Investors are often intrigued by what sets a company apart from its competitors. Factors such as product innovation, customer loyalty, and overall market trends come into play when deciding if an investment is a smart move. As we explore this topic, we’ll address the potential challenges and opportunities that might influence your decision-making process in this ever-evolving landscape.

Analyzing Financial Performance

When delving into the financial metrics of a company, it’s essential to understand its overall health and growth trajectory. By examining various indicators, one can gauge whether a company is on solid ground or facing challenges. This analysis often includes reviewing revenue trends, profitability ratios, and cash flow statements to form a comprehensive picture.

One of the key aspects to consider is revenue growth. A consistent increase in sales can be a strong sign of market demand and effective management strategies. It’s also vital to look at profit margins, as they indicate how well the business translates its revenue into actual income. High margins often suggest efficient operations, while lower margins might point to increased costs or pricing pressures.

Moreover, examining the balance sheet provides insight into the company’s financial stability. Key metrics such as debt-to-equity ratio and current ratio can reveal how well a firm manages its liabilities in relation to its assets. A healthy balance between debt and equity often indicates a balanced approach to growth and risk management.

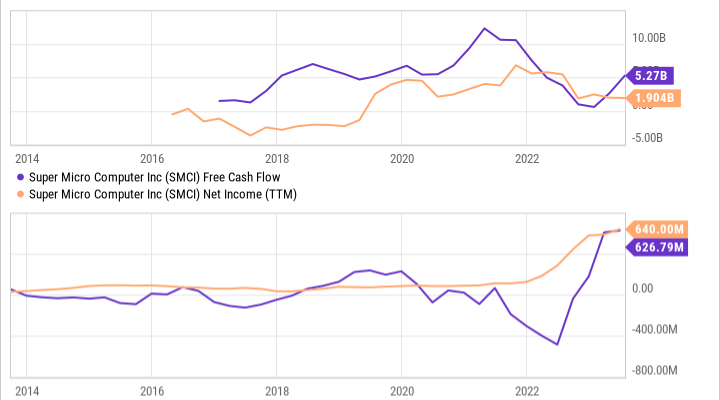

Finally, analyzing cash flow is crucial. Positive cash flow from operations means that the business generates enough money to maintain its operations, invest in future growth, and return value to shareholders. Investors often seek companies with strong cash flow as this can provide a safety net during unpredictable market conditions.

Market Trends Impacting Dell’s Future

As we navigate through the evolving landscape of technology, several key trends are shaping the horizon for major players in the industry. These trends not only influence the strategies companies adopt but also affect consumer preferences and investment decisions. Understanding these dynamics is crucial for anyone looking to assess the potential of any tech company.

One significant trend is the increasing demand for cloud computing solutions. With businesses migrating their operations to the cloud, firms that can provide robust infrastructure and services stand to benefit immensely. This shift not only creates new opportunities but also intensifies competition among service providers.

Moreover, the rise of artificial intelligence and machine learning has opened up new avenues for innovation. Companies that embrace these technologies can enhance their product offerings and streamline operations, positioning themselves as leaders in the market. It’s fascinating to observe how these advancements can redefine existing business models and create new ones.

Additionally, sustainability is becoming a priority for consumers and businesses alike. Companies that focus on eco-friendly practices and products can gain a competitive edge. This trend reinforces the importance of aligning business strategies with environmental considerations, which not only appeals to customers but can also drive loyalty and trust.

Lastly, the ongoing shifts in global supply chains can create both challenges and opportunities. As companies reassess their sourcing and manufacturing strategies, those that can adapt quickly may find themselves ahead of the curve. Understanding these supply dynamics is essential for gauging future prospects.

Expert Opinions on Investing in Dell

When it comes to making informed decisions about financial investments, insights from seasoned professionals can be incredibly valuable. Experts often analyze various factors, including industry trends, company performance, and market positioning, to offer their perspectives on potential opportunities. In this context, discussions surrounding a particular tech giant have gained traction, leading investors to weigh their options carefully.

Many analysts point to the company’s strong performance in the technology sector, highlighting its robust product lineup and strategic initiatives. They emphasize the importance of looking at quarterly earnings reports, market share, and innovations, which can significantly influence the long-term trajectory of any enterprise. With an attentive eye on these indicators, investors can form a more comprehensive understanding of the landscape.

Some financial advisors suggest considering the overall economic environment as well. Factors such as supply chain challenges, shifts in consumer behavior, and global market fluctuations can all play a crucial role in shaping future growth. Hence, experts advise that a well-rounded approach, taking both internal and external factors into account, is essential for anyone looking to make savvy financial decisions.

In conclusion, varied opinions abound, but what remains clear is the importance of thorough research and careful consideration. Engaging with multiple analyses can provide a clearer picture and help potential investors navigate through the complexities of the market effectively.