Exploring the Current Viability of Cryptocurrency as a Worthwhile Investment Option

In recent years, the realm of virtual currencies has garnered significant attention, captivating the interest of countless individuals and institutions alike. What was once considered a niche market has evolved into a dynamic ecosystem with the potential for substantial returns. As this sector faces ever-changing landscapes, a pressing question emerges: is placing your resources into these digital assets a wise decision in today’s financial climate?

Multiple factors come into play when assessing the viability of entering this space. Market fluctuations, regulatory developments, and technological innovations all weave together a complex tapestry that potential participants must navigate. For many, the allure of potential gains is undeniable, yet the associated risks cannot be ignored. As we venture deeper into the nuances of this topic, let’s explore the current state of affairs and the perspectives that can guide your evaluation.

Ultimately, understanding the landscape of technological currency markets is crucial for anyone considering allocating their assets in this arena. While some proclaim it as the new frontier of finance, others express skepticism regarding its sustainability. Through analysis and discussion, we aim to demystify these digital currencies and assist you in making an informed decision about whether they deserve a place in your financial strategy.

The Current State of Cryptocurrency Markets

In recent times, the landscape of digital assets has experienced significant fluctuations, capturing the attention of various stakeholders. The market has seen a mix of excitement and skepticism, with many pondering its future trajectory amid changing economic conditions and regulatory developments.

Currently, volatility remains a defining feature, with values rising and falling dramatically over short periods. Traders and enthusiasts alike are staying alert, analyzing trends and news that could drive market behavior. Institutional involvement has notably increased, with several large players entering the arena, thereby adding a layer of legitimacy and influence to ongoing discussions.

On the other hand, regulatory scrutiny has intensified, prompting both innovation and caution among participants. Different jurisdictions are adopting diverse approaches, creating an intricate web of compliance that stakeholders must navigate. The emergence of decentralized finance and non-fungible tokens has also reshaped perceptions, presenting new opportunities while posing their own set of challenges.

As interest in these digital currencies persists, many are reflecting on their long-term viability. The amalgamation of technological advancements, investor sentiment, and market dynamics shapes the conversation. It’s a captivating period, and for many, the question of potential returns remains at the forefront of their minds.

Long-term Potential of Digital Assets

When we think about the future of virtual currencies and similar innovations, it’s crucial to consider their potential to reshape the financial landscape. These assets are more than just fleeting trends; they represent a shift in how we conceive of value, transactions, and trust. Below, we explore several factors contributing to their long-term viability.

-

Adoption and Integration: As more businesses start to accept these assets, they gain legitimacy. This growing acceptance can lead to increased usage in daily transactions, further embedding them in our economy.

-

Technological Advancements: Ongoing innovations in blockchain technology enhance security, scalability, and efficiency. These improvements can foster greater confidence among users and investors alike.

-

Diverse Applications: Beyond currency usage, these assets enable various applications such as smart contracts, decentralized finance, and supply chain management. Their versatility opens up new markets and opportunities.

Furthermore, as regulatory frameworks evolve, they may provide a clearer picture, which could create a more stable environment for these assets to thrive. The increasing recognition from governments and institutions hints at a future where they play a pivotal role in the financial systems worldwide.

-

Store of Value: Many view these assets as a hedge against inflation, similar to gold. This perception can drive demand, especially in uncertain economic climates.

-

Community and Ecosystem: The vibrant communities and ecosystems surrounding these assets contribute to their resilience. Users, developers, and enthusiasts are continually driving progress and innovation.

Ultimately, while challenges remain, the underlying potential of digital assets suggests a promising horizon. Staying informed and open-minded can help us navigate this exciting landscape as it continues to evolve.

Risks and Challenges in Digital Currency Ventures

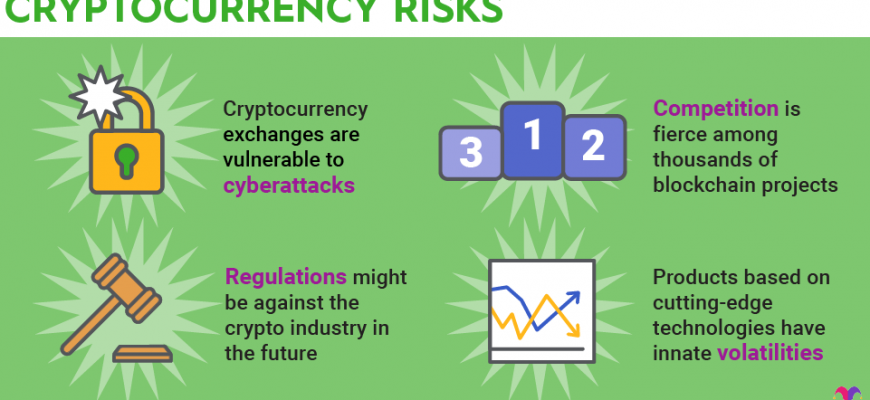

Diving into the world of digital currencies can be an exhilarating experience, but it comes with its share of pitfalls and uncertainties. Understanding the landscape is crucial for anyone thinking about stepping into this arena. There are numerous factors at play that can affect both newcomers and seasoned players in this ever-evolving market.

First off, volatility is one of the most significant aspects to be aware of. Prices can swing dramatically within short periods, which means potential gains are often accompanied by equally substantial losses. This rollercoaster nature can lead to stress and impulsive decisions, making it essential to maintain a cool head.

Furthermore, security concerns can’t be overlooked. With mounting reports of hacks and scams, safeguarding your assets is paramount. Choosing the right storage solutions and being vigilant about online safety can make all the difference in protecting your holdings.

Regulatory changes are another critical element to keep in mind. Governments around the world are continually adjusting their approach to manage the digital finance landscape. These shifts can impact the usability and legality of various platforms, influencing overall market stability.

Lastly, while there are significant opportunities, the knowledge gap presents its own challenges. Many individuals jump in without fully grasping how these currencies function or the mechanics behind trading. Dedicating time to research and education can empower participants to make informed decisions, rather than succumbing to hype and speculation.