Understanding the Concept of a Credit Note and Its Importance in Business Transactions

When it comes to managing finances, especially in the realm of business transactions, certain tools help maintain clarity and fairness between parties. One such tool plays a crucial role in reconciling accounts and ensuring that all transactions are accurately represented. It serves as a formal acknowledgment of adjustments to previous sales, making the process smoother for both sellers and buyers.

Imagine you’ve made a purchase, but due to some unforeseen circumstances–maybe a return or an overcharge–things need to be rectified. In these situations, having a systematic way to document and communicate these changes is essential. This is where the idea of reverting financial transactions through formal documentation comes into play, providing a structured approach to manage disputes and corrections.

Exploring this concept further, it becomes evident that it offers significant benefits not only to businesses in terms of maintaining accurate records but also to customers seeking transparency. By effectively utilizing this mechanism, relationships between buyers and sellers can be strengthened, ensuring that everyone is on the same page regarding financial exchanges.

Understanding Credit Notes in Business

In the realm of commerce, there are various transactions that may require adjustments after the original deal has been finalized. Sometimes, a buyer needs to return goods, or there might be a discrepancy in billing. In these scenarios, businesses often rely on specific documents to keep everything in order and ensure accurate accounting.

These documents serve as a formal acknowledgment of such adjustments, providing a way to rectify errors or manage returns smoothly. They not only help in maintaining financial integrity but also foster trust between the parties involved. By issuing such a document, companies can efficiently address issues while ensuring that their financial records reflect the true state of affairs.

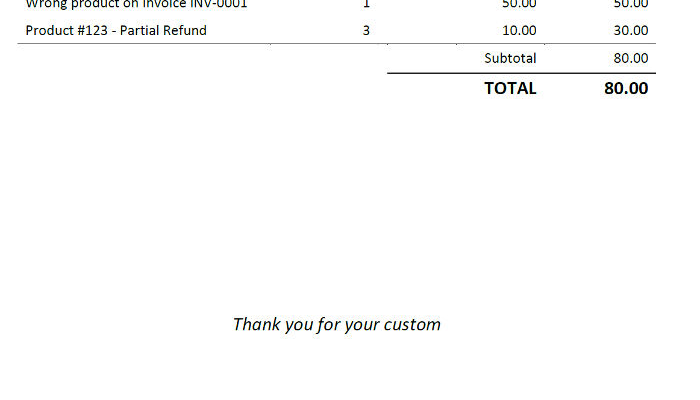

Typically, these amendments include crucial details such as the reason for the adjustment, the amounts involved, and references to the original transaction. This information is essential for any future audits or financial reviews, making it clear why changes were necessary. In essence, they play a vital role in good business practices, helping to clarify and streamline financial interactions.

Understanding how to utilize these documents effectively can significantly enhance your financial processes. Both sellers and buyers can benefit from knowing the ins and outs of these adjustments, ensuring that their dealings remain transparent and fair. Whether you’re adjusting an invoice or handling returns, having a solid grasp of these formal acknowledgments empowers you to navigate the complexities of business transactions with confidence.

The Role of Credit Notes in Transactions

In the world of commerce, adjustments are sometimes necessary to keep everything running smoothly. Whether due to returns, overcharges, or changes in order quantities, the ability to amend financial records can be crucial for maintaining good relationships between buyers and sellers. This flexibility helps ensure transparency and trust, allowing both parties to feel secure in their dealings.

When discrepancies arise, having an efficient way to document these changes is vital. This mechanism serves as a formal acknowledgment of corrections, enabling businesses to maintain accurate accounts and facilitating hassle-free returns or refunds. As such, it plays an essential part in the broader scope of financial transactions, ultimately supporting both operational integrity and customer satisfaction.

Moreover, the use of such adjustments can simplify financial reporting. By systematically addressing and recording alterations, companies can provide clearer insights into their financial health. This clarity is not only beneficial for internal management but also enhances communication with stakeholders and auditors, showcasing an organization’s commitment to accuracy and accountability.

In summary, these tools are more than just administrative paperwork; they are integral components that foster accountability and build trust in business relationships. They create a more seamless experience for all involved, underlining the importance of adaptability in a dynamic marketplace.

Benefits of Issuing a Credit Document

When it comes to managing transactions, having a mechanism to address returns, adjustments, or overpayments can significantly enhance the customer experience. Providing a formal acknowledgment of these situations can foster trust and long-term relationships with clients. This approach not only smooths out any discrepancies but also offers various advantages for both businesses and their patrons.

One major benefit of creating such an acknowledgment is the ability to maintain a positive cash flow. By allowing customers to offset future purchases, you encourage them to return, ensuring continued revenue. This method often decreases the chances of them seeking refunds, which can be more complicated from an administrative standpoint.

Furthermore, it serves as a transparent way to rectify errors. When a company issues a formal document indicating a correction, it shows professionalism and accountability. This openness enhances brand reputation and may lead to more referrals and repeat business.

Additionally, providing this form of documentation helps in simplifying accounting processes. It creates a clear record of transactions and adjustments, making financial tracking and reporting much easier. Auditors and accountants appreciate straightforward documentation that aligns with best practices, ultimately saving time and reducing potential errors in future financial statements.

Lastly, a thoughtful approach to adjustments can enhance customer loyalty. When clients feel valued and understood during a hiccup in their purchasing journey, they are more likely to share positive experiences with others. This budding loyalty can elevate a company’s standing in a competitive market while promoting an environment of trust and reliability.