Understanding the Benefits and Process of Increasing Your Credit Limit

Managing your finances effectively often involves navigating various scenarios, one of which is the potential for heightened borrowing capacity. This topic brings to light the various factors that play a crucial role in determining whether individuals can expand their purchasing power. As we delve into this subject, you’ll discover how such adjustments can impact your financial freedom and overall lifestyle.

Many people find themselves contemplating whether it’s the right time to request a boost in their available funds. This decision is influenced by numerous aspects, including spending habits, payment history, and current economic conditions. Understanding these elements can make the process smoother and more beneficial in the long run.

In this article, we’ll explore the advantages and considerations of these enhancements to your financial resources. By examining the implications, you’ll be better prepared to make informed choices that align with your financial goals. Let’s dive into the details and uncover what you need to know!

Understanding Credit Limit Increases

Have you ever wondered how financial institutions decide to give you a bump in your borrowing ability? It’s a fascinating process that can vary from one lender to another, but there are some common themes worth exploring. Essentially, it’s about evaluating your financial behavior and the level of trust the provider places in you as a borrower.

So, what goes into this evaluation? Here are some key factors:

- Payment History: Lenders want to see that you’ve been responsible with settling your dues on time. This establishes a pattern of reliability.

- Utilization Rate: How much of your available funds have you been using? Keeping it low shows that you’re not overly dependent on borrowed funds.

- Income Changes: A bump in your earnings can impact how much a lender is willing to extend to you. More income can equal more opportunity.

- Credit Score: A higher rating signals a higher likelihood of repayment, making you a more attractive candidate for a boost.

- Account Longevity: If you’ve maintained your account for a considerable time, it builds a sense of trust between you and the provider.

It’s also essential to understand when you might want to seek an extension. For instance, if you have upcoming expenses that you wish to manage without stress, having a larger pool of resources can be beneficial. However, be cautious; more accessible funds can sometimes lead to overspending.

Overall, grasping how these financial institutions view your profile can help you make informed decisions. Whether you’re looking to expand your purchasing power or simply understanding the process, knowing the ins and outs can pave the way to better financial management.

Benefits of Raising Your Spending Capacity

When you think about expanding the amount you can borrow, there are numerous advantages that come into play. Having a higher allowance can enhance your financial flexibility and provide you with a buffer for unexpected expenses. It opens up more opportunities for managing your funds effectively and taking advantage of various offers that may suit your needs.

One significant benefit is the potential boost to your overall financial health. A larger borrowing threshold can lower your utilization ratio. This, in turn, might positively affect your score, showing lenders that you are responsible with your finances. A better score can lead to more favorable borrowing terms in the future.

Moreover, if you find yourself in a pinch, a larger borrowing capability allows you to tackle emergency situations more easily. Whether it’s a medical expense, car repair, or home maintenance cost, having that extra cushion can relieve stress and prevent financial strain.

Additionally, with more purchasing power, you can take advantage of rewards and cashback offers when shopping. Many rewards programs offer higher returns on larger transactions, allowing you to maximize your benefits simply by spending more through your available resources.

Lastly, increasing your borrowing threshold can lead to peace of mind. Knowing you have access to more funds if needed can be a comforting thought, especially in uncertain times. It’s all about making your financial journey smoother and more sustainable.

How to Request a Credit Limit Boost

As life evolves, so do our financial needs. Sometimes, we find ourselves in situations where we could benefit from a bit more purchasing power. Whether it’s for an unexpected expense or simply to manage our finances more comfortably, seeking an enhancement to your available funding can be a useful step. Here’s how to approach the request process smoothly and effectively.

First things first, preparation is key. Before reaching out to your financial institution, take some time to review your current account status. Gather details about your payment history, income changes, and any other relevant factors that might support your case. A solid understanding of your financial position will not only give you confidence but also strengthen your request.

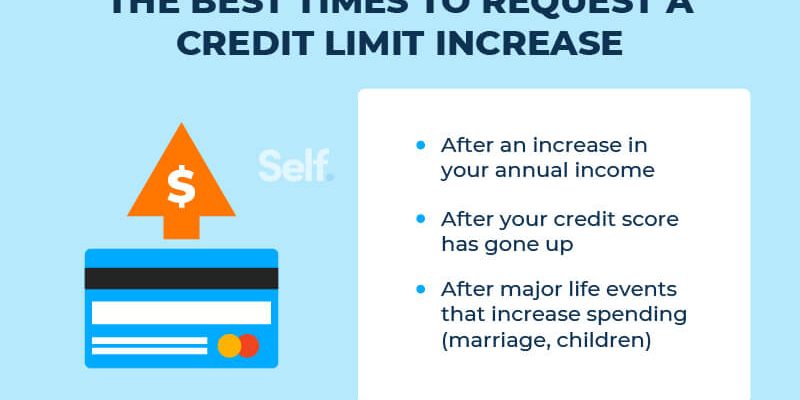

Next, consider the timing of your inquiry. Institutions often look favorably on requests submitted after a positive change in your situation, such as a salary increase or a new job. Additionally, maintaining a strong payment record plays a pivotal role. If you’ve consistently paid off your balances on time, that’s a significant point in your favor.

Once you feel prepared, initiate contact. You can either call the customer service number or submit your request through their online portal, depending on their process. Clearly articulate your desire for more flexibility in your financial dealings and share the reasons you believe this adjustment is warranted. Be polite and concise, as a positive tone goes a long way.

Finally, be ready for any outcome. Sometimes requests are granted right away, while other times, financial institutions may need to review your account further. Stay patient and open to feedback, as they may provide additional steps or information required before any changes can be made.

Totally in awe of your skills! This video had me hooked from the first second to the last.

Your content never disappoints! This video was pure perfection from start to finish.