Understanding Credit Limits and Their Importance in Financial Management

Have you ever wondered about the numbers that dictate your borrowing power? It’s all about the quirky world of financial allowances that institutions set for individuals. These figures play a crucial role in your spending habits, impacting everything from your shopping sprees to your monthly budget management. Knowing how these allowances work can empower you to make smarter decisions.

In this discussion, we’ll delve into the basics of these monetary thresholds and what they mean for your overall financial health. It’s essential to grasp how these limits are established and how they can fluctuate based on various factors–like your spending discipline, payment history, and even market trends. By decoding these concepts, you’ll be better equipped to navigate your financial landscape.

Ultimately, understanding these guidelines helps you strike a balance between leveraging available resources and maintaining a healthy financial life. Whether you’re looking to improve your purchasing power or simply manage your expenses more effectively, this topic is worth exploring. Let’s unlock the secrets of your financial limits together.

Understanding the Concept of Credit Limits

When it comes to financial products, especially those related to borrowing and spending, there is an important aspect that determines how much you can access. This concept helps consumers manage their finances effectively while also serving as a protective measure against overextension. It is critical to grasp how this figure is established and the factors influencing it, as it plays a significant role in personal financial health.

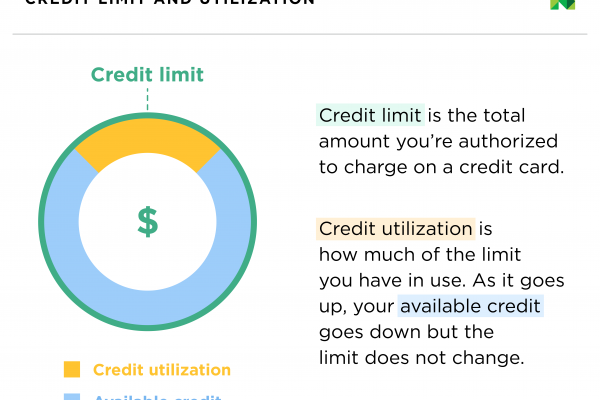

So, what exactly is this measure? Essentially, it refers to a predetermined amount that a financial institution allows you to utilize. This can apply to various platforms including revolving accounts, personal loans, and different types of accounts. It acts like a safety net, ensuring you don’t spend beyond your means or fall into unmanageable debt.

Understanding how this threshold works can empower you to make informed decisions. Factors such as your income, payment history, and overall financial behavior significantly influence its evaluation. Being aware of your usage and how it can impact your financial profile is essential for maintaining a healthy relationship with borrowing.

Factors Influencing Your Credit Limit

When it comes to the availability of funds through various lending options, several elements come into play that determine how much you can borrow. Understanding these factors can help you manage your financial health and navigate the borrowing landscape more effectively.

Income Level: One of the primary considerations is your earnings. Lenders typically assess your ability to repay by looking at your monthly or annual income. Higher earnings often suggest a greater capacity to handle debt, which can lead to more favorable borrowing terms.

Credit History: Your financial track record speaks volumes about your reliability. A history of timely payments and responsible borrowing can position you for higher accessibility, while missed payments or defaults may hinder your options.

Debt-to-Income Ratio: This ratio is a vital metric that lenders use to gauge your financial stability. It compares your monthly debt obligations to your income. A lower ratio indicates that you manage your debts well, potentially allowing you to qualify for more substantial borrowing amounts.

Length of Financial History: The duration of your financial activities also plays a role. A longer history with varied types of accounts can showcase your experience and responsibility in managing funds, which may influence the amount you can access.

Type of Account: Different lending products come with their own criteria. For instance, a personal loan might have different parameters compared to a revolving line of credit. Each type can impact how much you can feasibly utilize.

Economic Conditions: Lastly, the broader economic environment can affect lending practices. During stable economic times, lenders may be more inclined to offer higher borrowing potentials, whereas tightening economic conditions can lead to more cautious lending behaviors.

By being aware of these elements, you can proactively improve your financial situation and better position yourself for favorable borrowing opportunities.

How to Manage Your Credit Effectively

Maintaining financial health can often feel like a balancing act. It’s essential to understand how to navigate your financial options while ensuring you stay in control of your expenditures. By adopting a few practical strategies, you can optimize your spending power while reducing the risk of falling into debt.

Here are some key tips to help you manage your finances wisely:

- Set a Budget: Create a monthly spending plan that outlines your income and expenses. This will give you a clear picture of what you can afford.

- Monitor Your Usage: Keep an eye on your spending patterns. Use apps or tools that allow you to track where your money is going.

- Pay On Time: Always settle your bills on or before the due date to avoid late fees and maintain a good standing. Timely payments can also help improve your financial reputation.

- Avoid Unnecessary Debt: It can be tempting to make impulsive purchases, but think twice before adding to your financial obligations. Stick to your budget and prioritize needs over wants.

Implementing these strategies can help you feel more confident in your financial decisions. Remember, the goal is to create a sustainable approach to your spending that aligns with your long-term objectives.

In summary, managing your financial resources effectively involves planning, monitoring, and making informed choices. By following these guidelines, you’ll be better equipped to navigate your financial landscape with ease.