Exploring the Benefits and Drawbacks of Credit Karma for Financial Health

In today’s fast-paced financial landscape, understanding your financial standing has become essential. Many individuals seek out platforms that promise insights into their fiscal health, helping them make informed decisions. But with numerous options available, it’s crucial to explore the effectiveness and reliability of such services.

When it comes to tracking your financial well-being, one platform has garnered significant attention. Users are drawn in by the allure of personalized analysis and the potential perks that come with staying informed. However, the real question is whether these offerings truly live up to the expectations set by their marketing.

Diving deeper into the features and functionalities reveals a mixture of advantages and drawbacks. While some users praise the convenience and accessibility of monitoring their financial metrics, others express skepticism about the accuracy and depth of the information provided. Ultimately, understanding these nuances will guide consumers in making the best choices for their financial journey.

Understanding Credit Karma’s Services

When it comes to managing personal finances, having access to the right tools and resources can make a world of difference. This platform offers a variety of features designed to help individuals keep track of their financial health and make informed decisions. By simplifying the process of monitoring scores and reports, it empowers users to take control of their financial journeys.

Key offerings include personalized insights, which guide users through the often confusing realm of financial management. Rather than solely focusing on numeric scores, the service provides valuable recommendations tailored to individual circumstances. This paves the way for informed choices that can lead to improved financial standing over time.

Moreover, the platform enhances transparency by allowing users to view their financial reports without the traditional hurdles. This easy access not only demystifies financial data but also encourages proactive planning. By understanding potential pitfalls, individuals can avoid costly mistakes and work towards long-term goals.

Another significant aspect is the educational content available. Users can dive into articles and resources that cover a wide range of topics, from the fundamentals of responsible financial habits to advanced strategies for building wealth. This knowledge can be invaluable, equipping everyone with the tools they need to navigate the financial landscape confidently.

Additionally, the community aspect cannot be overlooked. Engaging with a network of like-minded individuals creates opportunities for shared learning and support. Whether through forums or social media connections, this interaction fosters an environment of encouragement and growth.

Benefits of Using Credit Monitoring Services

Utilizing a service focused on financial health can offer numerous advantages for individuals looking to enhance their financial stability. These platforms provide a range of tools and resources that help users navigate their credit landscape with ease. From tracking scores to offering personalized recommendations, the benefits are substantial.

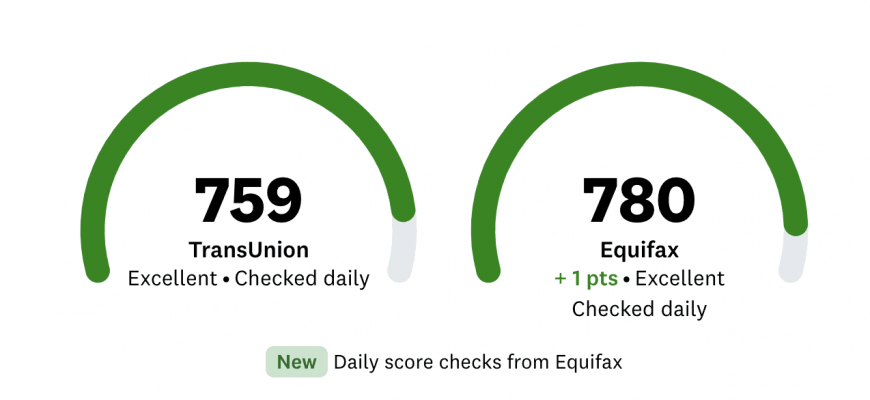

One of the primary perks is the ability to monitor your financial score regularly without any hidden costs. This ongoing oversight not only empowers you but also allows for timely adjustments to your financial strategies as needed. Knowing where you stand can motivate you to make wiser spending choices and improve your overall financial habits.

Additionally, these services often provide educational resources that help users understand the factors influencing their scores. By equipping you with essential knowledge, they foster a more proactive approach to financial management. This understanding can lead to better decision-making, paving the way for improved financial opportunities.

Another significant benefit is the alerts and notifications that keep you informed about important changes or potential fraud. Being aware of any unauthorized activity can prevent serious setbacks and give you peace of mind. It’s reassuring to know that you have a safeguard in place to protect your financial identity.

Finally, many platforms offer customized advice based on your unique financial situation. This tailored guidance can be tremendously helpful in navigating complex financial decisions and achieving your goals, whether it’s securing a favorable loan rate or improving overall financial literacy. Embracing such a service can truly set you on a path towards greater financial well-being.

Limitations and Considerations for Users

When exploring online platforms for financial insights and tools, it’s important to be aware of certain boundaries and aspects that may influence your experience. While these resources can be incredibly useful, they come with their own set of challenges that users should keep in mind.

One key factor to consider is the accuracy of the information provided. While many platforms strive to offer reliable data, discrepancies can occur. Users might find that the scores or evaluations they see do not perfectly align with the figures from traditional financial institutions. It’s wise to approach these figures as a guide rather than absolute truths.

Another aspect is the nature of the services offered. Some tools are free to use, but this often comes with trade-offs, such as advertisements or limited features. Users should investigate what additional functionalities might be available through premium subscriptions, keeping in mind whether they truly need those extras.

Privacy is another crucial consideration. Sharing personal financial information can expose users to risks if the platform’s security measures are inadequate. Always review privacy policies and understand how your information will be used and protected.

Lastly, while such platforms can provide valuable resources for making informed decisions, it’s crucial for users to maintain an independent approach. Relying solely on one tool may lead to a narrow perspective. Exploring multiple options can enrich one’s understanding and lead to better financial choices overall.