Understanding the Concept of a Credit Bank

When we think about managing our finances, it’s essential to explore the various institutions that help us navigate this complex world. These entities offer a range of solutions aimed at facilitating our monetary needs, whether it’s for personal projects, business ventures, or everyday expenses. Understanding what these services provide can significantly enhance our financial literacy.

In this discussion, we’ll dive into a specific type of institution that offers various transactional services and lending options. They play a crucial role in both individual and corporate finance. Along the way, we’ll examine how they operate, what makes them unique, and the benefits they offer to clients seeking to fulfill their financial aspirations.

By unraveling the intricacies of these financial establishments, you’ll gain valuable insights into how to make informed decisions tailored to your financial objectives. Let’s embark on this journey to better understand the pivotal role these institutions play in our financial ecosystem.

Understanding the Concept of Credit Banks

When we talk about financial institutions that facilitate borrowing and lending, we often think about the essential role they play in our daily lives. These entities provide individuals and businesses with the necessary resources to manage their finances, invest in opportunities, or handle unexpected expenses. But what exactly do they offer, and how do they operate? Let’s dive into the fundamental ideas surrounding these establishments.

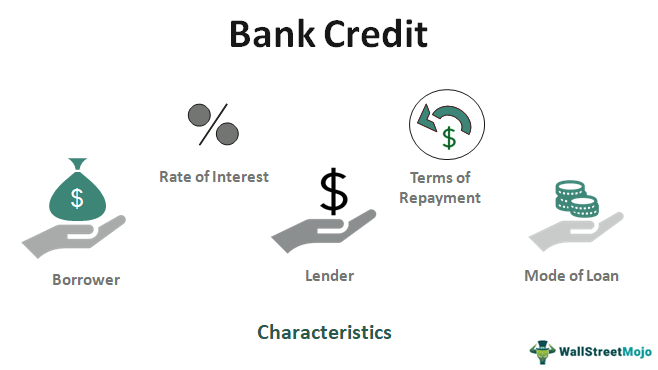

At their core, these institutions serve as intermediaries in the financial ecosystem, connecting those in need of funds with those willing to lend. They analyze the financial profiles of potential borrowers to assess risks and determine appropriate terms for borrowing arrangements. This process not only helps ensure that individuals can access the money they require but also safeguards the interests of those providing the funds.

Moreover, these institutions often offer various services beyond just lending. From savings accounts to investment advisories, they aim to create a comprehensive financial experience. This multifaceted approach allows clients to manage their finances effectively, making informed decisions about saving and investing.

One intriguing aspect is the regulation surrounding these entities. Governments often set rules to ensure transparency, fairness, and customer protection. This framework helps maintain the trust of the public, enabling smoother transactions and fostering a healthier economic environment.

In summary, understanding these financial institutions involves recognizing their pivotal function in facilitating resource allocation and supporting individuals’ and businesses’ financial goals. By grasping how they work, you can better navigate your own financial landscape and make strategic choices that align with your aspirations.

How Financial Institutions Impact Personal Finance

The role of financial institutions in managing personal finances can be quite significant. They offer individuals a variety of tools to handle their monetary resources, enabling better planning and budgeting. Understanding how these services work can reshape one’s approach to spending, saving, and investing.

One major way these establishments influence finances is through lending options. Access to loans can provide financial flexibility, making it possible for people to make larger purchases, invest in education, or even start a business. However, the terms of these loans often dictate how individuals manage their payments and savings moving forward.

Additionally, the savings products offered by these entities can play a pivotal role in wealth accumulation. High-interest accounts allow individuals to grow their funds over time, fostering a culture of savings. This can encourage people to set aside money for emergencies or future goals, reinforcing responsible financial behavior.

Moreover, the convenience of digital services and tools provided by these organizations creates a more accessible way to monitor one’s finances. From budgeting apps to financial planning resources, individuals are better equipped to make informed decisions about their money, leading to greater financial stability.

Ultimately, the relationship between individuals and financial institutions is complex and multifaceted. By utilizing these resources wisely, people can enhance their financial health and work towards achieving their long-term goals.

The Role of Financial Institutions in Economic Growth

When we think about the drivers of progress in an economy, financial institutions often come to mind. They serve as crucial nodes in the flow of resources, enabling individuals and businesses to access the necessary funds for development and expansion. By facilitating lending and investment, these entities play a pivotal role in shaping the economic landscape.

Additionally, such organizations contribute to stability and confidence within the market. They help minimize risks associated with ventures by providing the necessary support and guidance to entrepreneurs and companies. This not only encourages new businesses to rise but also supports existing ones in scaling their operations, which ultimately leads to job creation and innovation.

Moreover, enhancing accessibility to financial services can lead to greater inclusivity. When various segments of the population can participate in economic activities, overall productivity increases, fostering a healthier economy. People from different backgrounds gain opportunities to invest in education, healthcare, and housing, which can have far-reaching effects on societal well-being.