Exploring the Investment Potential of Coca-Cola Stock for Savvy Investors

When thinking about putting your hard-earned money into a particular company, it’s essential to analyze various factors that could influence its future performance. The beverage industry has long been a significant player in the market, providing a range of products that many consumers consider essential. But with so many choices out there, how do you determine whether one brand stands out from the crowd?

In today’s discussion, we’ll explore the track record, market position, and potential growth of this iconic brand. With a portfolio that boasts widespread recognition and a loyal customer base, it seems reasonable to ask if now is the right moment to invest. Strong financial fundamentals, innovative strategies, and adaptability to market trends will play a crucial role in shaping our understanding of its investment potential.

As we dig deeper, we’ll examine the company’s historical performance, dividends, and overall market presence. By assessing these components, we’ll aim to provide a clearer perspective on whether investing in this renowned industry leader could align with your financial goals. Let’s get started and uncover the insights that could guide your decision-making process!

Understanding Coca-Cola’s Market Position

When we discuss a certain beverage giant, it’s essential to take a closer look at its standing in the marketplace. This brand is not just about drinks; it’s a symbol of a global industry with a unique ability to adapt and thrive. The company has cultivated a robust presence in various sectors, making its products a staple in countless households and social gatherings.

One of the key factors contributing to its dominance is the comprehensive strategy to build a diverse portfolio. By offering a wide range of options, from sugary refreshers to healthier alternatives, this giant meets the varying preferences of consumers around the globe. This diversification not only caters to different taste profiles but also positions the brand favorably against potential market shifts.

Moreover, the brand’s marketing prowess cannot be overlooked. It has mastered the art of storytelling, connecting with its audience on an emotional level. This connection fosters brand loyalty, ensuring that consumers think of its products first when quenching their thirst. The promotional campaigns are often memorable and resonate deeply with diverse demographics, reinforcing its iconic status.

Finally, the ability to innovate consistently ensures that this beverage powerhouse remains relevant. Whether it’s introducing new flavors or healthier options, the focus on evolving consumer needs keeps it competitive. In a world where trends change rapidly, such agility is invaluable.

Financial Performance and Future Projections

When evaluating the fiscal health and potential of a beverage giant, it’s essential to delve into its numerical results and forecasts. This segment will shed light on the economic indicators that illustrate the company’s past workings and what expectations might be set for the future. Analyzing key metrics can reveal how well the entity has navigated market challenges and capitalized on growth opportunities.

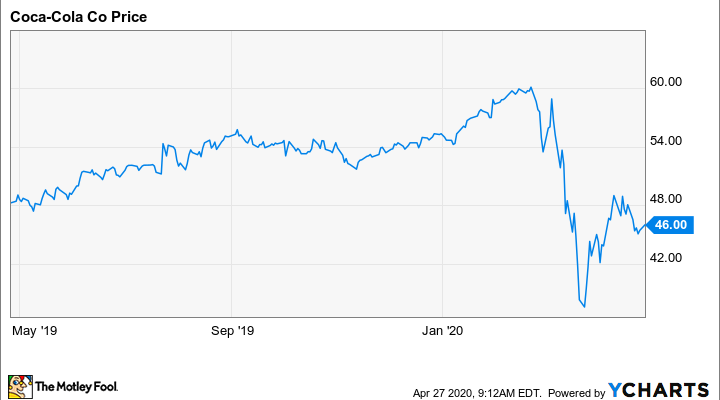

Recent quarterly reports suggest a solid revenue stream, reflecting consistent demand and effective marketing strategies. Despite fluctuations in the global market, the entity’s strong brand identity and diversified product range have helped maintain its competitive edge. Furthermore, profitability ratios indicate a favorable position, showcasing efficient cost management and sustained margins. Investors often look for these indicators when considering the health and stability of a company.

Looking ahead, analysts are optimistic about the potential for expansion in emerging markets and the development of new product lines. With evolving consumer preferences leaning towards healthier options, the organization is poised to adapt and innovate. Projections suggest that continued investment in sustainability and digital marketing will further enhance its market presence and drive revenue growth in the coming years.

In summary, while past performance provides a foundation, future possibilities hold significant promise. Monitoring trends and emerging opportunities will be crucial for stakeholders wishing to capitalize on the evolving landscape of this iconic beverage entity.

Risks and Opportunities in the Beverage Sector

The beverage industry is a dynamic landscape filled with both challenges and exciting prospects. Companies in this sector must navigate various factors that can influence their growth and overall performance. Understanding these elements is crucial for anyone looking to enter this market or evaluate its potential.

Opportunities abound in this field, particularly with the rise of health-conscious consumers. As people become more aware of their dietary choices, there is a growing demand for low-calorie, organic, and functional drinks. This shift opens the door for innovative products that cater to these preferences, allowing businesses to capture a broader audience.

Moreover, emerging markets present a significant chance for expansion. Developing countries are experiencing shifts in lifestyle, leading to increased consumption of various liquid refreshment options. Companies that effectively tap into these regions can see substantial growth and increased revenue streams.

However, along with opportunities come various risks. Market saturation is a real concern, as the industry becomes increasingly competitive. Brands constantly vie for consumer attention, making it crucial to differentiate offerings and maintain relevance. Additionally, fluctuations in raw material prices can pose challenges, impacting profit margins and pricing strategies.

Regulatory changes are another aspect to consider. As governments implement stricter health regulations, businesses must adapt their formulations and marketing strategies to comply. This can lead to increased operational costs, which may affect profitability.

In conclusion, the beverage sector presents a mix of exciting possibilities and considerable hurdles. Awareness and adaptability are vital for navigating this complex environment, allowing firms to leverage opportunities while managing inherent risks effectively.