Understanding the Child Tax Credit and Its Impact on Families

As families navigate the often-challenging waters of daily life, financial support can make a significant difference. Many parents find themselves juggling expenses, from everyday necessities to unexpected surprises. Understanding available assistance options is crucial for those looking to ease their financial burdens without compromising on the quality of life for their loved ones.

The support designed to help households can vary widely, and it’s essential to examine what these programs entail. Not all assistance is created equal; some provide a more substantial cushion than others. This financial aid aims to enhance the well-being of younger members while recognizing the unique challenges that parents face today.

In this discussion, we’ll delve into the nuances of this type of support, exploring how it functions, who is eligible, and its potential impact on family dynamics. We’ll unpack the details to determine whether it truly offers a substantial benefit or if it’s merely a temporary fix for deeper issues that families contend with daily.

Understanding the Child Tax Credit

When it comes to supporting families, there are various programs designed to ease the financial burden that comes with raising young ones. This assistance aims to provide some relief to parents, allowing them to allocate resources toward important needs such as education, healthcare, and everyday expenses. It’s a way for the government to recognize the effort and costs of nurturing the next generation.

The essence of this support mechanism rests in its ability to provide additional funds during tax season, which can lead to significant savings for households. Many families may not fully grasp how it operates or the potential benefits it offers. The initiative is structured to offer financial help based on certain criteria, ensuring that it reaches those who might need it the most.

Understanding eligibility requirements is crucial, as they can vary depending on factors like income and the number of dependents. By navigating these stipulations, families can maximize the benefits available to them, turning what could be an overwhelming financial landscape into a more manageable situation.

Moreover, the program has undergone changes over the years, reflecting shifting priorities and economic realities. Staying informed about these updates can help parents make informed financial decisions. As you delve deeper into how this assistance interacts with your overall financial plan, you might discover additional avenues for support that complement these funds.

Eligibility Requirements for Families

When it comes to financial assistance aimed at supporting households with dependents, it’s important to understand who qualifies for these benefits. Various criteria help determine if families can access this type of financial support. These guidelines often take into account factors like income levels, family size, and other specific conditions that could affect eligibility.

Income thresholds play a crucial role in determining qualification. Generally, families must fall within certain limits to be considered for financial aid. Lower income earners are often prioritized, ensuring that those who need help the most can receive it. It’s worth checking the specific figures that apply annually, as they can change and vary based on location.

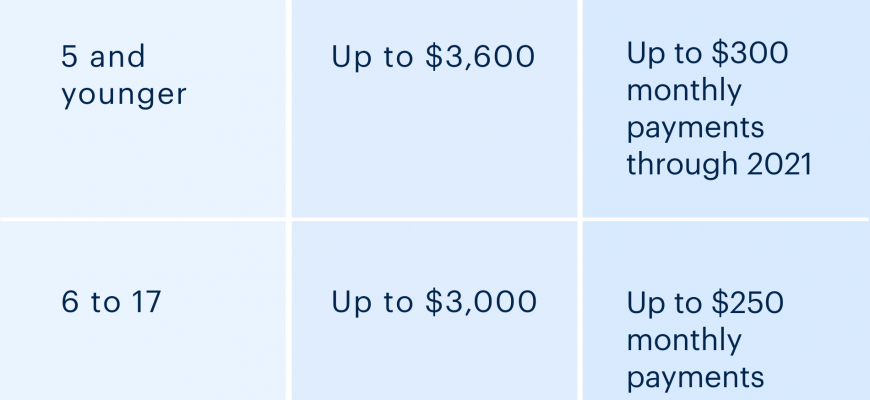

Additionally, dependents served by the household are a key aspect of eligibility. Not only does the number of dependents matter, but their ages and statuses also come into play. For example, certain age groups may be more likely to meet the requirements, making it essential for families to assess their unique situations.

Lastly, residency status is another factor to keep in mind. Many assistance programs require participants to be legal residents or citizens of the country, which can limit access for some families. Understanding these various parameters will help ensure that those who genuinely qualify can receive the necessary support to aid in their financial journey.

Impact on Family Finances and Support

Financial assistance aimed at families can make a significant difference in everyday life. These funds help with various expenses, easing the burden on parents and guardians while ensuring the well-being of their loved ones. Let’s explore how such support influences household finances.

- Budget Relief: Extra financial resources allow families to better manage their monthly budgets. They can allocate funds for essentials like groceries, utilities, and housing costs.

- Educational Expenses: Support can be directed toward educational needs, such as school supplies, extracurricular activities, and even tuition fees, promoting a brighter future for the young ones.

- Healthcare Costs: Access to additional funds can help families cover medical expenses, ensuring that all members receive necessary care without financial strain.

- Savings Opportunities: With reduced pressure on daily expenditures, families often find it easier to set aside money for savings, emergencies, or future investments.

- Improved Quality of Life: Overall financial stability can lead to less stress, allowing families to focus more on enjoyment and togetherness, enhancing their quality of life.

In summary, supplementary support plays a crucial role in shaping family finances. It empowers households to meet their needs more effectively and promotes a secure and nurturing environment for growth.