Analyzing the Potential of BMY as a Promising Investment Opportunity

When navigating the world of investments, making informed decisions is crucial. With so many options available, identifying which companies hold promising potential for the future can be quite the challenge. Today, we will take a closer look at a particular player in the healthcare sector, examining its financial health, market position, and growth prospects to uncover whether it’s worth considering for your portfolio.

As you delve into the specifics, it’s essential to assess various factors, such as recent performance statistics, industry trends, and innovations that may bolster the company’s standing. In a landscape that is constantly evolving, being well-informed can give you a significant advantage. So, let’s explore the intricacies of this intriguing corporation and determine if it aligns with your investment strategy.

Understanding the broader implications of investing in such enterprises involves looking beyond mere numbers. Key developments, partnerships, and shifts in market demand all play a role in shaping their future. By analyzing these elements, you can make a more educated judgement on whether this entity may be a fitting addition to your collection.

Analyzing BMY’s Financial Performance

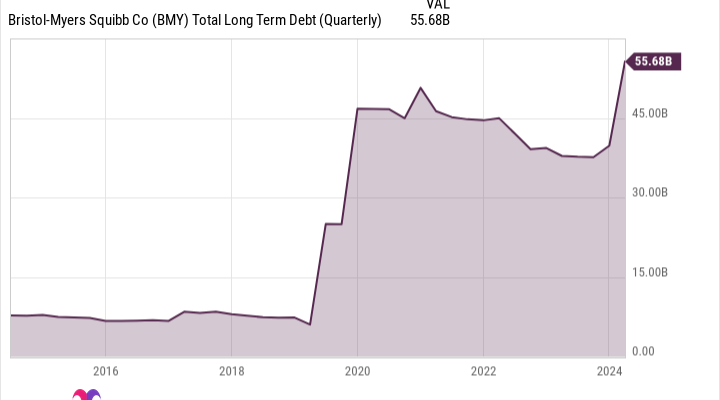

Understanding the financial health of a company can significantly influence investment decisions. In this section, we’ll dive into the performance metrics and underlying indicators that reflect the organization’s economic standing. By examining revenues, expenses, profitability, and growth trends, we can paint a clearer picture of its viability in the market.

Revenue Trends: One of the first things to consider is how sales numbers have evolved over time. A steady increase can indicate a robust business model and strong demand for products or services. On the contrary, declining revenues might raise red flags about market competitiveness or customer preferences.

Expenditure Analysis: Equally important is the examination of costs associated with operations. Controlling expenses while maintaining quality is crucial for sustaining profit margins. Assessing how effectively the firm manages its expenditures can reveal much about its operational efficiency.

Profitability Ratios: Key metrics such as net profit margin, return on equity, and earnings per share offer insights into the overall financial performance. Higher profitability ratios often suggest superior management performance and a favorable economic environment.

Growth Potential: Future growth prospects hinge on a company’s ability to innovate and expand. Indicators such as research and development investments and market expansion initiatives can demonstrate long-term strategy and vision. Understanding these factors can provide depth to evaluations regarding potential returns.

In summary, analyzing a corporation’s financial performance involves a comprehensive look at various aspects, including revenue streams, cost management, profitability ratios, and growth opportunities. Each of these elements contributes to a nuanced understanding of its market position and future outlook.

Market Trends Affecting BMY Stock

Understanding the current landscape of the financial markets is crucial for making informed decisions about any investment. Recent developments, both globally and domestically, have created a dynamic environment that influences various sectors. Observing these shifts can provide insight into how they impact specific companies within a competitive field.

One notable trend is the increasing focus on biotechnology and pharmaceutical advancements. The rapid progression of medical technologies, particularly in areas like immunotherapy and personalized medicine, suggests that firms operating in these domains may see a surge in demand for their products and services. This can significantly sway investor sentiment and market performance for companies engaged in innovative treatments.

Additionally, changes in regulatory frameworks are critical to watch. Recent updates in healthcare policies can alter the landscape, affecting operational costs and market access. Firms that adapt to these new regulations may find themselves in a stronger position, potentially enhancing their attractiveness to investors.

Moreover, global economic conditions, including inflation rates and interest policies, play a pivotal role. As these factors evolve, they can influence funding availability for research and development. Companies that manage to secure financing effectively amidst these fluctuations may showcase resilience and growth potential, thus drawing interest from market participants.

Finally, being aware of consumer preferences and shifts in public health narratives can help pinpoint which organizations are poised for success. A growing emphasis on wellness and preventative care could usher in new opportunities for companies that align their strategies with these trends. Keeping track of these indicators can serve as a valuable guide for anyone looking to navigate the complexities of today’s market.

Expert Opinions on BMY Investment Potential

When considering any opportunity in the financial landscape, it’s essential to gather insights from seasoned professionals. Their perspectives can provide clarity on whether the current trends signal a favorable moment for engagement or caution.

Recently, analysts have been diving deep into the metrics and forecasts surrounding this particular entity. Here’s a roundup of some notable viewpoints:

- Several experts highlight robust financial health and a diverse portfolio as significant drivers for future growth.

- Others point out the ongoing research and development initiatives, underscoring the potential for groundbreaking discoveries that could enhance market positioning.

- A number of analysts express optimism based on recent performance metrics, suggesting that the underlying fundamentals support a bullish outlook.

On the flip side, some voices caution against haste. They emphasize:

- The impact of regulatory challenges that may impose obstacles in the near term.

- Persistent market volatility, which could affect overall sentiment and performance.

- The importance of monitoring geopolitical events that may influence operational aspects significantly.

In summary, while there are compelling arguments in favor of engaging with this opportunity, a balanced view requires consideration of both the positive outlook and the potential hurdles. Ultimately, informed decision-making based on expert analyses can pave the way for strategic exploration in this arena.