Evaluating the Current Viability of Bitcoin as an Investment Opportunity

In recent years, the realm of digital currencies has garnered immense attention, prompting individuals and institutions alike to assess the potential gains and pitfalls of these emerging assets. As the landscape continues to evolve, many find themselves pondering the viability of allocating resources into this innovative financial frontier. With volatility and speculation at the forefront, questions abound regarding the prudence of such decisions.

Amid fluctuating market trends and regulatory discussions, enthusiasts and skeptics are engaging in spirited debates about the long-term outlook of these digital tokens. A compelling factor lies in their decentralized nature, which promises both opportunity and risk. Investors often weigh the allure of potential returns against the backdrop of market unpredictability.

As we delve deeper into this topic, it’s essential to explore key indicators, historical performance, and emerging trends that could shape future opportunities. Understanding the multifaceted nature of this asset class may provide clearer insights for those contemplating their next financial move. Join us in navigating this intriguing terrain, as we uncover whether placing your trust in this decentralized currency is a wise course of action.

Current Market Trends for Bitcoin

The cryptocurrency landscape has been evolving rapidly, attracting both seasoned investors and newcomers curious about digital assets. Recent fluctuations in the market have sparked conversations about the viability and future prospects of these decentralized currencies. It’s essential to stay informed about the current trends and patterns that define this space.

One noteworthy trend has been the increasing institutional interest in the cryptocurrency realm. Major financial institutions are beginning to recognize the potential of these assets, leading to potential price movements and heightened market activity. Additionally, analysts have observed a growing number of retail investors dipping their toes into the market, creating a diverse mix of participants that can influence price dynamics.

Moreover, regulatory developments continue to shape the environment. Governments worldwide are grappling with how to approach digital assets, which can significantly impact market sentiment. The introduction of clearer regulations may provide a sense of security for investors, while overly restrictive measures could create uncertainty.

Another aspect to consider is the technological advancements within the ecosystem. Innovations like Layer 2 solutions aim to enhance scalability and transaction speeds, which can attract more users. As the infrastructure improves, it could foster a more robust market that supports broader adoption.

Finally, keeping an eye on macroeconomic factors is crucial. Economic indicators, inflation rates, and global events often play a role in how these digital currencies perform. As the world navigates through various economic challenges, the response from this segment can provide insights into its resilience and adaptability.

Assessing Cryptocurrency’s Long-Term Viability

As we delve into the future of decentralized currencies, it’s essential to consider the factors influencing their endurance in the financial landscape. The notion of whether a digital asset can maintain its relevance and security over time involves evaluating various elements, such as technological advancements, regulatory environments, and market adoption.

Technological Innovations: The evolution of blockchain technology plays a crucial role in the overall sustainability of these digital currencies. Continuous improvements, such as scalability solutions and enhanced security protocols, can significantly bolster public confidence and usability. If the underlying technology can adapt to growing demands, it enhances the asset’s chances of thriving in the long run.

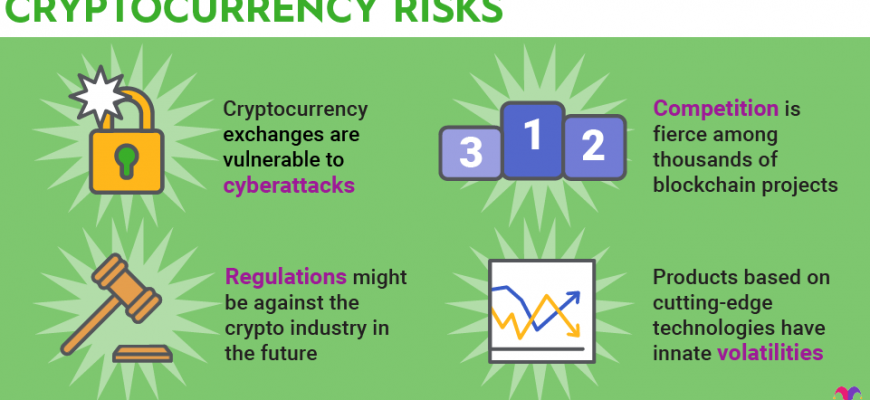

Regulatory Landscape: Government policies and regulations can heavily sway the perception and functionality of any digital currency. A supportive regulatory framework can foster an environment in which these assets can flourish, while restrictive measures could stifle growth and innovation. Monitoring shifts in legislation is vital for understanding potential risks and opportunities.

Market Adoption: Widespread acceptance among consumers and businesses is an encouraging sign for any currency. If more platforms and merchants start accepting decentralized currencies for transactions, it indicates a strengthening foundation for their longevity in the financial ecosystem. The more users see practical benefits, the more likely they are to engage with and trust these assets.

Ultimately, evaluating the long-term potential of such currencies requires a multifaceted approach. It’s a blend of technological promise, regulatory clarity, and market enthusiasm that will determine whether these assets can maintain their position in the rapidly evolving financial world.

Factors Influencing Cryptocurrency Investments Today

Understanding the dynamics of digital currency markets requires analyzing a variety of elements that can sway the potential for profitability. Each factor carries its weight in determining the overall landscape for those considering entering or expanding their positions within these markets.

- Market Volatility: The unpredictable nature of digital assets often leads to rapid price fluctuations. Traders must stay alert to capitalize on these changes.

- Regulatory Environment: Government policies and regulations can significantly impact the market’s stability. News about potential laws or restrictions can either bolster or undermine confidence.

- Technological Advances: Progress in blockchain technology and security can enhance the appeal of various cryptocurrencies, affecting their long-term viability.

- Mainstream Adoption: As more businesses and individuals start accepting digital currencies, their value proposition increases, attracting new participants to the market.

- Market Sentiment: Public opinion and media coverage can create hype or fear, influencing buying and selling decisions at a massive scale.

- Macroeconomic Factors: Economic indicators, such as inflation rates and currency fluctuations, play a crucial role in how investors perceive the safety of digital assets compared to traditional financial options.

These elements, among others, interact in complex ways, shaping the choices of those involved in this ever-evolving realm. It’s essential to stay informed and consider how each factor may affect personal strategies for engaging with digital currencies.