Exploring the Investment Potential of Berkshire Hathaway and Its Long-Term Value

When it comes to the realm of financial decisions, few entities provoke as much discussion as certain well-known conglomerates. These firms often capture the interest of individuals contemplating where to allocate their resources for potential growth. The allure of such companies usually stems from their exceptional leadership, diverse portfolio, and long-standing market presence, which raises the question: is it a wise move to consider such a corporation as part of your portfolio?

Exploring the intricacies of these substantial organizations can reveal insights that are invaluable for both seasoned investors and those just beginning their journey in the financial sector. One must weigh various factors–historical performance, management strategies, and industry positioning–all of which can serve as indicators of what the future may hold. Understanding how these elements interplay is crucial for making informed choices.

Ultimately, every decision to engage with a particular company involves a degree of risk and reward. By diving deeper into the financial landscape that surrounds these prominent entities, you might just find the guidance needed to navigate your circumstances effectively. Join us as we dissect the potential benefits and pitfalls of placing your faith in such a revered name.

Understanding Berkshire Hathaway’s Investment Potential

Evaluating the financial promise of a particular conglomerate requires a closer look at its operational strategies and historical performance. This entity has garnered significant attention from savvy individuals seeking options that potentially yield substantial returns over time. By examining its diverse portfolio and management philosophy, one can gain insights into why it continues to attract many who aim to diversify their financial holdings.

The strength of this firm lies in its unique approach to acquiring companies. Unlike many in the market, it focuses on businesses with strong fundamentals, exceptional leadership, and the potential for long-term growth. This tactic not only minimizes risk but also positions the firm to thrive in various economic climates. Many admirers appreciate the patience exhibited by its leadership, emphasizing the importance of holding assets for extended periods, rather than chasing short-term gains.

Moreover, the financial health of this conglomerate is a key aspect that investors should consider. A consistent track record of revenue growth and a robust balance sheet indicate resilience. Additionally, the multi-industry presence provides a cushion against market volatility. When one sector experiences a downturn, the strength in other areas can help stabilize overall performance. This diversification strategy is appealing to those looking to weather economic storms.

Ultimately, understanding the strategies and principles behind this organization can reveal its potential as a cornerstone of a balanced financial strategy. Engaging with its principles may offer a reliable framework for making informed choices in asset allocation and growth objectives.

Analyzing Historical Performance and Growth

When evaluating the track record of a company in the financial landscape, it’s essential to look at its historical performance alongside its growth trajectory. By examining past trends, we can gain valuable insights into how the entity has navigated varying market conditions and the general economic environment. This analysis not only highlights the resilience and adaptability of the firm but also offers a glimpse into potential future outcomes.

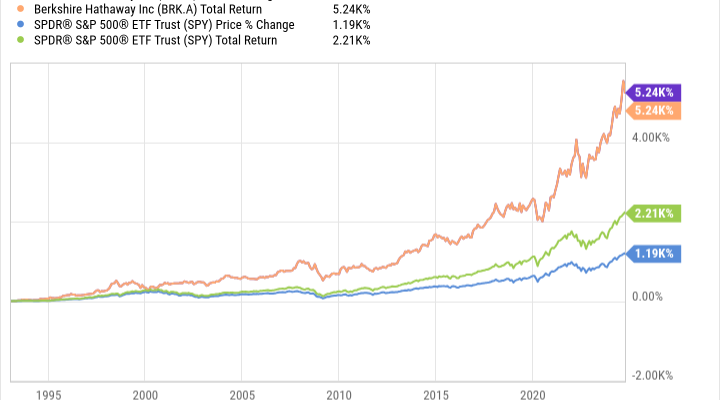

One of the key factors to consider is the compound annual growth rate (CAGR) over significant periods. This figure illustrates how the value of the company has changed over time, giving a clearer perspective than mere year-to-year fluctuations. A consistent upward trend in this metric often indicates strong management and sound business strategies, which can be attractive to prospective stakeholders.

Additionally, examining major milestones in the firm’s history–such as market expansions, acquisitions, or diversification efforts–can shed light on its operational approach. Understanding how these pivotal moments impacted overall performance allows for a more informed assessment of its trajectory. Similarly, analyzing response mechanisms to economic downturns plays a crucial role in assessing stability and resilience.

Furthermore, it’s worth noting the comparison with industry benchmarks. Evaluating how this entity performed against its peers can provide context to its achievements or setbacks. A company that consistently outperforms its competitors may suggest strategic advantages, innovative offerings, or an adept leadership team.

In conclusion, a thorough investigation into historical data and growth patterns provides a solid foundation for making informed decisions. By looking back at how a company has evolved and adapted, individuals can better contemplate its future potential in an ever-changing financial landscape.

Factors Affecting the Company’s Future Success

When considering the trajectory of any prominent corporation, several key elements come into play that can significantly influence its growth and sustainability. Understanding these factors is essential for anyone looking to gauge the potential of a business over the long haul.

First and foremost, the overall economic landscape plays a critical role. Fluctuations in the market, interest rates, and consumer confidence can all sway a company’s performance. A resilient entity often adapts effectively to these changing conditions, positioning itself favorably against competitors.

Leadership and management quality are paramount as well. The vision, strategy, and operational decisions made by those at the helm can determine the direction the organization takes. Effective leaders foster a culture of innovation, ensuring that the company remains relevant in a rapidly evolving environment.

Additionally, the diversity of the business’s portfolio significantly impacts its stability. Companies that engage in various sectors can better weather economic storms, as they are not overly reliant on a single stream of revenue. This diversification helps mitigate risk and opens up new avenues for growth.

Furthermore, technological advancements should not be overlooked. Companies that embrace new technologies can enhance efficiency and expand their market reach. Staying ahead in innovation often provides a competitive edge that is invaluable in today’s digital age.

Lastly, understanding consumer trends and preferences is vital. Companies that are attuned to the evolving needs of their customers are more likely to thrive. By maintaining a strong relationship with their market, firms can adapt better and capture new opportunities as they arise.

Absolutely stunning! The elegance and grace you carry is mesmerizing. I could watch this over and over again. Truly captivating!