Evaluating the Investment Potential of AT&T Stocks for Savvy Investors

When considering where to allocate your hard-earned resources, analyzing various entities in the telecommunications sector is crucial. The landscape is filled with opportunities, yet potential investors must navigate through a myriad of factors to understand the true value of any specific player. With fluctuating market conditions and shifting consumer behaviors, making informed decisions is more vital than ever.

As we delve into this topic, we’ll explore the numerous attributes that can affect the appeal of a particular entity. From its financial health and market position to industry trends and competition, there are many elements that contribute to the overall investment thesis. Understanding these aspects will help clarify whether this particular option aligns with your financial goals and risk tolerance.

Throughout this discussion, our focus will center on evaluating the critical indicators that can guide your judgment. Armed with insights and analyses, you can better determine whether engaging with this telecom provider is a savvy move for your investment strategy.

AT&T: Analyzing Current Market Performance

Today, let’s delve into the recent performance of this telecommunications giant, exploring how its shares are faring in the current economic climate. The company’s position in the market has been a topic of much discussion, particularly as it navigates through various challenges and opportunities that have arisen lately.

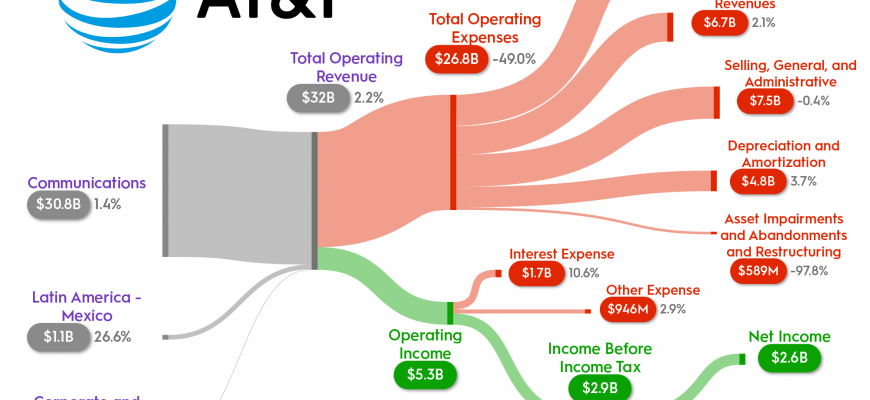

Despite facing some hurdles, this telecommunications powerhouse has shown resilience. Analysts are keenly observing its revenue streams, especially in light of the increasing competition within the industry. The effective management of its assets and investments in new technologies could play a significant role in shaping its future trajectory.

Market reactions to recent earnings reports have sparked considerable interest among investors. The company’s ability to adapt to shifting consumer demands and enhance its service offerings may be pivotal in determining its standing moving forward. Keeping an eye on key performance indicators will be essential for those contemplating involvement in this particular enterprise.

Furthermore, any discussions surrounding dividend policies add another layer of complexity to its appeal. The balance between returning value to shareholders and investing in growth initiatives is crucial. Analyzing these aspects will provide a clearer picture of what to expect from this entity in the coming months.

Key Factors Influencing AT&T’s Stock Potential

When considering an investment opportunity in a large telecommunications company, it’s crucial to evaluate various elements that could impact its future performance. Several factors play a significant role in shaping the outlook for this corporate entity, from market trends to financial health. Understanding these components assists potential investors in making informed decisions.

Market Competition remains a vital aspect. The landscape of telecommunications is highly competitive, with numerous players vying for market share. Changes in consumer preferences or technological advancements can directly affect the positioning of the company in relation to its peers.

Debt Management is another critical factor. A significant amount of debt can strain the company’s resources and limit growth opportunities. Examining how well the management handles this aspect provides insight into the long-term viability of the firm.

Dividend Policies also attract attention from potential investors. A consistent and stable dividend can signal financial health and commitment to returning value to shareholders, whereas fluctuations may raise red flags.

Furthermore, regulatory changes can impact operations and profitability. Policies related to telecommunications, data privacy, and antitrust regulations can create challenges or opportunities, influencing overall performance.

Finally, understanding consumer trends is essential. As technology advances, shifts in consumer behavior can lead to new opportunities in services or products offered, ultimately affecting the company’s bottom line. Staying ahead of these trends is vital for sustained growth.

Long-Term Outlook for AT&T Investors

When considering the future for those investing in this telecommunications giant, it’s essential to take a closer look at several factors that could influence performance over the coming years. With the industry experiencing rapid transformations, investors must assess both the opportunities and challenges that lie ahead.

One critical aspect to monitor is the company’s strategic initiatives aimed at expanding its service offerings and enhancing customer satisfaction. By embracing technological advancements and shifting towards a more digital landscape, this corporation is positioning itself to capture a larger market share and remain competitive in a crowded field. Furthermore, their focus on improving infrastructure may lead to increased efficiencies and healthier profit margins.

Additionally, investors should consider the implications of regulatory changes and market dynamics. As the telecom sector evolves, staying adaptable will be crucial. Those who pay attention to these variables may find promising prospects for growth and value appreciation over time.

In summary, while the journey ahead may have its share of uncertainties, the potential for substantial returns exists for those willing to stay committed and informed. Being proactive will enable investors to navigate the market landscape effectively and make the most of their investment journey.