Understanding the Importance of Your Annual Credit Report and How to Obtain It

Have you ever wondered what really goes on behind the scenes of your financial life? It’s like a hidden world where numbers and information merge to create a detailed picture of your financial responsibility. Each element of this picture tells a story, reflecting your borrowing behavior and overall trustworthiness in the eyes of lenders. Knowing more about this can help you navigate your financial journey with confidence.

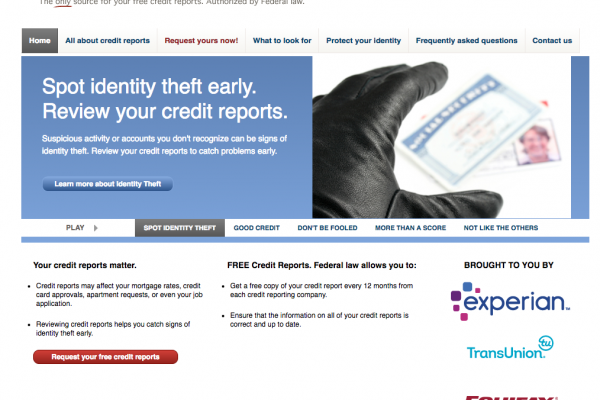

In today’s fast-paced economy, keeping track of your financial standing is more crucial than ever. Many people are surprised to learn that they have access to a comprehensive overview of their financial history at no cost every year. This resource provides valuable insights into how your finances are perceived and can influence many aspects of your financial life, from getting a loan to renting an apartment.

By understanding how to review and interpret this vital information, you empower yourself to make informed decisions. It becomes easier to spot any discrepancies or areas for improvement in your financial habits. It’s not just about knowing your score; it’s about grasping the narrative written by your financial choices. Let’s dive deeper into this essential tool and discover how it can benefit you.

Understanding the Importance of Financial Assessments

When it comes to managing your finances, knowing what’s happening with your personal information is crucial. These assessments play a vital role in various aspects of your financial health, from borrowing to insurance premiums. Keeping track of your financial standing can lead to better opportunities in life.

Regularly checking these documents helps ensure that all the information is accurate and up-to-date. Errors can occur, and spotting them early can save you from future complications. Plus, understanding your financial profile allows you to make informed decisions, whether it’s applying for a loan or negotiating better terms with lenders.

Moreover, monitoring your financial assessments contributes to greater awareness of your spending habits and creditworthiness. This insight empowers you to build a robust financial future and work towards improving your overall economic well-being. Embracing this practice can lead to a healthier relationship with your finances, ultimately paving the way for achieving your goals.

How to Obtain Your Annual Credit Report

Checking your financial history is crucial for maintaining a healthy economic life. Luckily, there are straightforward methods to gain access to this information. It’s important to know how to get this data so you can keep tabs on your financial standing and ensure all the details are accurate.

The first step is to visit the designated website where you can ask for your information. This is typically a government-supported platform that offers a way to retrieve your details without any charge. Be prepared to provide some personal information to verify your identity, including your name, address, and Social Security number.

Once you’ve accessed the site, you’ll usually find simple prompts guiding you through the requesting process. You may have the option to receive your details online immediately or via mail within a few weeks. If you choose the online option, it’s usually quicker, allowing you to review your information in real time.

After you retrieve your data, take the time to examine it carefully. Look for any errors or unfamiliar accounts that might indicate identity theft. If you spot anything amiss, it’s crucial to take action promptly, ensuring that your financial reputation remains intact.

Remember, monitoring your financial history regularly can prevent issues and help you stay informed about your economic situation. Don’t delay–make it a part of your routine to keep your personal details in check!

Common Errors in Financial Histories and Solutions

It’s not uncommon to find inaccuracies in your financial histories, and these mistakes can have a significant impact on your life. Often, individuals don’t even realize there are discrepancies until they face issues regarding loans or other financial services. Understanding the types of errors you might encounter is the first step in addressing them effectively.

One prevalent issue is outdated information. For instance, a closed account might still appear as active. This can mislead lenders and affect your financial standing. The solution? Regularly reviewing your records and disputing any outdated or incorrect entries with the appropriate agency can help rectify the situation.

Another common mistake involves erroneous late payments. Sometimes, payments made on time are mistakenly reported as late, often due to clerical errors. If you find yourself in this predicament, gather your payment records. Then, reach out to the relevant organization to rectify the incorrect information swiftly.

Identity theft is another serious concern that can lead to significant inaccuracies. If your personal information has been compromised, fraudulent accounts could be opened in your name without your knowledge. Monitoring your financial details is crucial here; if you spot something suspicious, report it immediately to the required authorities and take steps to secure your identity.

Lastly, there might be balance discrepancies that don’t reflect your actual financial situation. Ensure you check for any misunderstandings or miscalculations related to your balances. If you identify a mistake, contact the reporting agency with documentation to support your claim and request an investigation.

By being proactive and addressing these issues as they arise, you can maintain a clearer financial record and safeguard your financial future.