Is AMC a Smart Investment Choice for Stock Buyers

With the dynamic nature of financial markets, many individuals find themselves pondering the merits of particular companies in their investment journey. The landscape can be both thrilling and daunting, as options abound and information flows in from every direction. It’s essential to examine various factors that may influence your decision-making process when considering ventures within this realm.

In recent times, one particular entity has garnered attention among enthusiasts and investors alike. The buzz around its performance raises questions about its potential trajectory and overall viability. By taking a closer look at its fundamentals, market positioning, and recent developments, you can equip yourself with essential insights that may aid in determining whether this venture aligns with your financial goals.

As you delve into this analysis, keep in mind the importance of conducting thorough research and considering various viewpoints. Engaging with up-to-date news, expert opinions, and the latest trends will serve as invaluable tools in assessing the choices available to you. After all, informed decisions are the cornerstone of successful investing.

Understanding AMC’s Market Position Today

Today, it’s crucial to take a closer look at the landscape surrounding this entertainment company and its influence in the industry. Several factors play a role in shaping its current standing, including competition, consumer trends, and financial performance. By examining these elements, we can gain insights into where this entity fits within the broader market framework.

In recent months, shifts in viewer habits and preferences have had a significant impact on how this company operates. The rise of streaming platforms has changed the way people consume entertainment, pushing traditional cinema to adapt or risk obsolescence. This adaptation is not just about maintaining relevance but also about seizing new opportunities to captivate audiences.

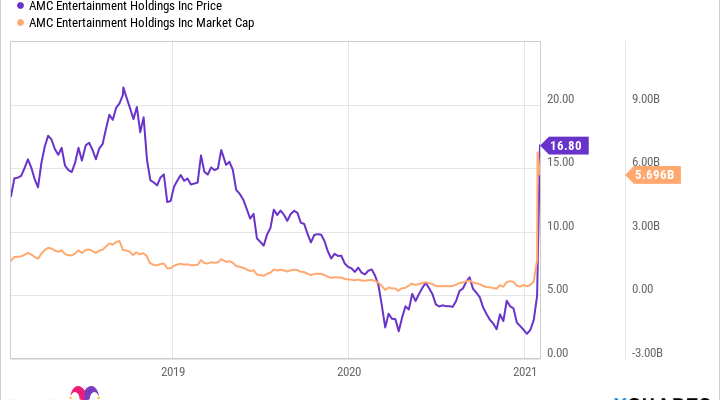

Additionally, there’s been a noticeable fluctuation in financial performance, influenced by various external factors such as market conditions and economic trends. Investors often keep a vigilant watch on revenue streams and audience turnout to gauge future potential. The ability to innovate and diversify services could play a pivotal role in a company’s ability to thrive in these challenging environments.

Lastly, sentiment around this specific company fluctuates frequently, often driven by both market trends and social media narratives. These conversations can heavily influence public perception and, in turn, investor confidence. Thus, understanding the buzz surrounding this brand is as important as evaluating financial metrics.

Key Financial Indicators and Performance

When evaluating potential investments, understanding crucial financial metrics and overall performance is essential. These indicators offer insights into an entity’s health and future prospects, helping investors make informed decisions. By analyzing revenue trends, profitability ratios, and other vital statistics, one can gauge how well the company is navigating its industry landscape.

One major factor to consider is revenue growth, which reveals how well the business is expanding its market presence. Consistent increases in sales can indicate a strong operational strategy and customer demand. Additionally, examining profit margins gives an idea of cost management efficiency and overall profitability. A healthy margin suggests that the company retains good control over expenses while maximizing income.

Furthermore, balance sheet strength is another critical element. Evaluating assets vs. liabilities helps determine financial stability and whether the entity can weather economic fluctuations. Ratios like debt-to-equity can unveil how reliant the organization is on borrowed funds, which is essential for understanding risk levels.

Lastly, market trends and future outlooks can significantly impact potential performance. Observing industry movements and competitor actions allows for a broader perspective on where the company may stand in the coming years. Combining these elements provides a comprehensive overview of the investment landscape, essential for making astute choices.

Investment Risks and Opportunities Ahead

When considering a venture in the financial markets, it’s essential to weigh both the potential hazards and the prospects that lie ahead. Understanding these factors can help you make more informed decisions, ensuring that you’re not just following the crowd but rather charting your own course.

- Volatility: The market can swing unexpectedly, leading to rapid changes in value. This unpredictability can be both a risk and an opportunity for strategic entrants.

- Market Trends: Keeping an eye on emerging trends can reveal new avenues for growth. Industries evolve, and those willing to adapt may find lucrative prospects.

- Financial Health: Assessing the underlying financials of any entity is crucial. Strong fundamentals can provide a buffer during downturns, while weak performance may pose significant risks.

- Competitive Landscape: Understanding the rivalry within the sector can highlight strengths and weaknesses. New players can disrupt traditional models, opening doors for savvy investors.

Staying updated with news and market sentiments helps navigate the complex landscape. Engaging with various perspectives can enhance your understanding and enable you to identify both risks and opportunities more effectively.

- Research: Conduct thorough analysis on potential ventures.

- Diversification: Distribute your investments to mitigate risk.

- Timing: Identifying the right moment to enter or exit can have a lasting impact.

- Long-term Vision: Prioritize a strategic, long-term approach over short-term gains.

In conclusion, engaging with the financial marketplace is a journey filled with both uncertainties and possibilities. By being proactive and informed, you’ll be better equipped to navigate the rollercoaster ride ahead.