Exploring the Effectiveness of a Quantitative Tool for Managing Credit Control

In today’s fast-paced financial landscape, managing resources effectively is crucial for both businesses and individuals. A structured method of assessing financial obligations and available assets can significantly influence decision-making processes. By employing measurable strategies, organizations can enhance their fiscal stability and streamline their operations without losing sight of their long-term goals.

These strategies are not merely about tracking figures. They represent a comprehensive approach to understanding economic dynamics and predicting future trends. When implemented correctly, these systems provide valuable insights, allowing entities to navigate the complexities of financial planning with confidence.

As we dive into this fascinating subject, we’ll explore various frameworks that help businesses stay on track. From statistical evaluations to risk assessment models, the emphasis will be on how numerical analysis can empower management practices and optimize financial outcomes. Let’s unpack the nuances behind these methodologies and discover the benefits they bring to the table.

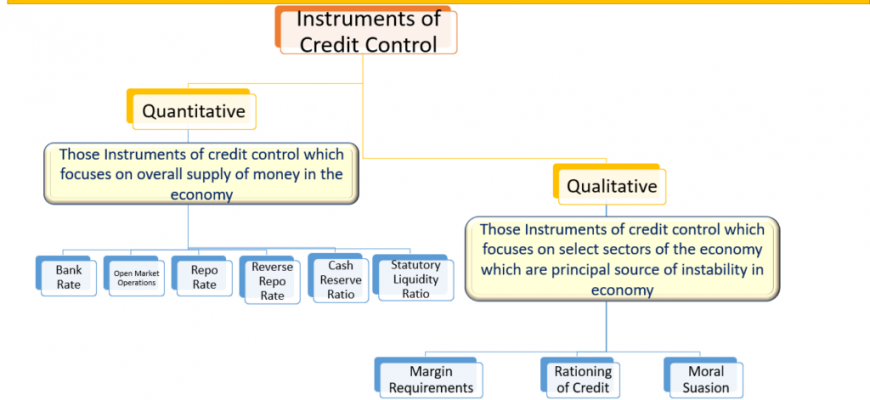

Understanding Quantitative Credit Control

Managing financial risks and ensuring stability in lending practices can be quite a challenge for institutions. It involves applying methods that allow for the assessment of borrower capabilities, as well as mechanisms to mitigate potential losses. Effectively handling these aspects leads to better decision-making and strengthens the financial framework of the organization.

At its core, this concept revolves around utilizing numerical methodologies to analyze data related to borrowers’ financial behavior. By leveraging statistical insights, organizations can predict potential defaults and adjust their strategies accordingly. This predictive approach not only helps in safeguarding assets but also fosters healthier relationships with clients through informed lending processes.

The crux lies in the importance of understanding market trends and borrower profiles. Institutions often analyze past performance, creditworthiness, and other relevant factors to create a comprehensive picture of risk. This ongoing evaluation enables them to refine their lending criteria and make adjustments as necessary, ensuring that they remain resilient in a dynamic economic environment.

Additionally, integrating these analytical practices into everyday activities can streamline operations. With a systematic approach to assessing financial health, organizations can prioritize resources and focus on offering services that align with individual client circumstances, ultimately enhancing service quality and client satisfaction.

As the financial landscape continues to evolve, it becomes imperative for institutions to adopt and refine their assessment strategies rigorously. Embracing innovative methodologies can significantly enhance their ability to navigate uncertainties, making them more robust in the face of potential threats.

Benefits of Analytical Instruments in Finance

When it comes to managing finances, having the right instruments at your disposal can make all the difference. These resources provide clarity and precision, allowing organizations to make informed decisions rather than relying on intuition alone. By leveraging data-driven approaches, businesses can navigate complex financial landscapes with greater ease.

One of the main advantages of these analytical methods is their ability to uncover trends and patterns that might not be immediately visible. With a closer look at historical data, companies can forecast future performance, assess risks, and create more effective strategies. This foresight is invaluable, enabling businesses to stay one step ahead of their competitors.

Moreover, these resources promote operational efficiency. By automating the analysis process, organizations can save time and reduce human error, leading to more accurate outcomes. Teams can focus on interpreting results and developing actionable insights instead of getting lost in endless calculations.

Additionally, incorporating these instruments fosters a culture of accountability. When decisions are backed by solid data, it becomes easier to justify choices and track outcomes. This transparency builds trust among stakeholders and helps in sustaining long-term relationships.

Finally, these advanced methods can aid in attracting investment. Investors are more likely to be drawn to companies that utilize precise analytical approaches, as it signifies a well-organized and strategic mindset. As a result, businesses that harness these resources often find themselves better positioned to secure funding and achieve growth.

Challenges in Implementing Credit Control Measures

When it comes to managing financial transactions, businesses often face various hurdles in establishing effective strategies. The journey involves ensuring that the process runs smoothly while also safeguarding financial health. Some of these obstacles can significantly impact overall efficiency and profitability.

One major issue is the lack of accurate data. Without reliable information, making informed decisions becomes nearly impossible. Organizations may struggle to assess the risk associated with customers, leading to poor choices that can ultimately affect cash flow.

Additionally, there can be resistance from employees who may feel overwhelmed by new processes. Adapting to changes requires time and training, and often, team members are hesitant to embrace new methodologies. This reluctance can stall progress and diminish the effectiveness of initiatives.

Another challenge stems from inconsistent policies across departments. When there isn’t a unified approach to managing finances, misunderstandings and errors can arise, causing further complications. Aligning all teams on the same strategy is crucial for success.

Lastly, external economic factors can pose significant challenges. Fluctuations in market conditions, regulatory changes, and customer behaviors can all influence how well a business can implement its financial strategies. Staying adaptable and prepared for these variables is essential for any organization aiming for long-term stability.