Understanding the Nature of Financial Aid – Is It Really a Loan?

When exploring options for support in covering educational expenses, many people find themselves navigating a complex web of terms and conditions. It can be confusing to distinguish between various types of funds available. In this discussion, we’ll unpack what it really means when you receive support for your schooling and whether it comes with strings attached.

Often, the terminology used can blur the lines between different forms of monetary support. Some may assume that all forms of help come with an obligation to pay back later, while others might feel reassured by the prospect of receiving something without the pressure of returning it. Understanding these nuances is crucial for making informed choices about your financial pathways.

As we delve deeper into this topic, we’ll clarify the distinctions between gifts, assistive programs, and those arrangements that require repayment. By the end of this exploration, you’ll have a clearer picture of what to expect from the support you might be considering.

Understanding Financial Aid Types

When it comes to funding your education, it’s essential to grasp the different options available. There are various forms of support, each serving unique purposes and coming with different terms. It’s important to know what each type entails, as this knowledge can significantly impact your choices and financial future.

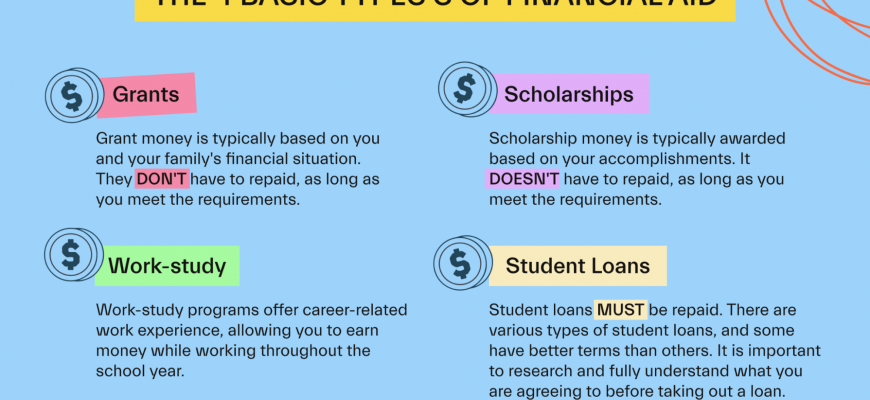

Grants are a popular form of support that does not require repayment. These funds are often awarded based on need or specific criteria, such as academic achievement or community involvement. They can be a great way to ease the burden of tuition costs, allowing you to focus on your studies rather than worrying about debt.

Scholarships are similar to grants in that they do not need to be paid back. However, they are typically given based on merit, whether that’s academic performance, artistic talent, or athletic ability. Scoring a scholarship can provide a significant boost to your finances and make a substantial difference in your overall educational experience.

Work-study programs offer a hands-on opportunity for students to earn money while attending school. These opportunities can help cover daily expenses and give you the chance to gain valuable work experience in your field of study. It’s a great way to balance your academic pursuits with practical skill development.

Lastly, private financing options are available, which often require repayment with interest. These can add financial strain, so it’s vital to carefully consider the terms before committing. Understanding the specifics of each option ensures you make informed decisions that align with your long-term financial goals.

Differences Between Grants and Loans

When it comes to funding opportunities for education, there are two main types that often get mixed up: those that provide support you don’t need to repay and those that come with a repayment obligation. Understanding the distinction between these sources can help you make more informed choices about your financial future.

First off, let’s talk about the ones you don’t have to pay back. These funds are typically awarded based on various criteria, like merit or individual circumstances, and are often aimed at helping students achieve their educational goals without the burden of repayment. You can think of them as a gift that recognizes your potential and supports your journey.

On the other hand, the other type involves receiving money upfront with the expectation that you will return it later, usually with added interest. This kind of support requires careful consideration since it can lead to financial obligations after graduation. It’s crucial to evaluate the terms and conditions, as they can vary significantly depending on the provider.

In summary, while both types of support serve the purpose of facilitating education, the key difference lies in the repayment requirement. One offers you a helping hand without the need for future payback, while the other comes with the understanding that you’ll need to settle the amount down the line. Making the right choice can have a lasting impact on your financial health as you embark on your career journey.

What to Consider Before Applying

Before you jump into the application process for any type of assistance, it’s crucial to take a moment and evaluate your situation. Understanding what you’re getting into can save you from unnecessary stress and complications down the road. Take the time to reflect on your needs and how they align with what is being offered.

First, think about the terms involved. Different programs come with varying conditions that can affect your future financial health. Consider the impact of repayments, if any, on your current and future budgets. It’s always wise to read the fine print and clarify any uncertainties before moving forward.

Next, assess your personal circumstances. Are you in a position to handle potential obligations that may arise? Evaluating your current financial status and stability can help you determine if this is the right step for you at this time. You may also want to explore alternative options that might be better suited to your needs.

Lastly, consider the long-term implications. How will this choice affect your goals and priorities? Having clarity on your financial plans and aspirations will enable you to make a well-informed decision. Remember, it’s not just about immediate benefits; it’s the overall impact on your financial future that truly matters.