Understanding the Differences Between Credit Unions and Banks and Their Financial Roles

When it comes to financial institutions, many people often find themselves navigating a complex landscape filled with various options. Each option seems to offer a unique set of benefits, services, and operational styles. Among these, a particular type of organization serves communities in ways that often spark debates about its classification and role in the broader financial ecosystem.

Understanding the similarities and differences between these entities can be quite enlightening. On one hand, they provide fundamental financial services like loans, savings accounts, and other products. On the other hand, they operate with distinct philosophies and structures that set them apart from traditional establishments. As you dig deeper, you might find that these entities challenge common perceptions about what it really means to be a financial service provider.

This exploration is not just about semantics; it touches on various aspects, such as governance, membership, and customer relations. Many people may use the terms interchangeably without realizing that the differences can have real implications for consumers. So, let’s dive into what these organizations are and how they fit into the financial world.

Understanding the Structure of Cooperative Financial Institutions

When it comes to financial organizations aimed at serving members rather than maximizing profits, their foundation is truly fascinating. These entities operate on principles of cooperation, providing various services while prioritizing community and individual needs over shareholder returns.

At their core, such institutions are rooted in the idea of mutual assistance among members. This democratically governed model ensures that everyone involved has a voice in decision-making processes. Instead of focusing solely on commercial gains, the emphasis shifts toward fostering relationships, building trust, and enhancing the overall financial well-being of all participants.

Members typically enjoy access to a wide range of offerings, including loans, savings accounts, and financial education. The profits generated are often reinvested into the institution or returned to members in the form of better rates and lower fees. This unique approach not only empowers individuals but also strengthens the community as a whole.

In essence, these organizations operate with a service-oriented mindset, setting themselves apart from traditional profit-driven entities. By prioritizing the needs of their members, they create a supportive environment that promotes financial literacy and responsible borrowing.

Key Differences Between Financial Institutions

When it comes to managing your finances, there are two main types of organizations that often come to mind: traditional financial establishments and their member-focused counterparts. While they may seem similar at first glance, there are some fundamental distinctions that set them apart, affecting how they operate, serve customers, and structure their services.

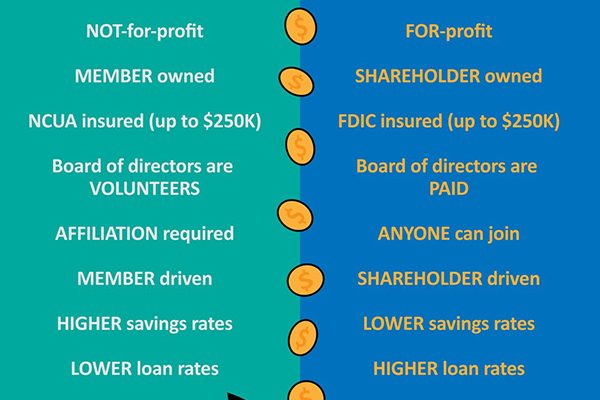

First off, let’s talk about structure. The member-driven establishments operate on a cooperative model. This means that individuals who use their services are also stakeholders. In contrast, traditional financial institutions are typically for-profit entities owned by shareholders, leading to differing priorities when it comes to service and profit distribution.

Next, consider the way they offer products and services. Member-focused institutions often provide a more personal touch, with the aim of meeting the needs of their members rather than maximizing profit. In contrast, traditional establishments might focus on competitive rates and fees that could prioritize their bottom line over individual customer needs.

Another important difference lies in the accessibility of funds. Member-focused establishments tend to have fewer branches and ATMs, especially in rural areas. Traditional establishments, on the other hand, often have an extensive network, making it easier for customers to access their money regardless of location.

Finally, let’s not forget about fees and rates. Member-oriented organizations generally offer lower fees and better interest rates on loans and deposits compared to their for-profit counterparts. This can lead to significant savings for members over time, providing a more beneficial financial experience overall.

Advantages of Choosing a Cooperative Financial Institution

When it comes to managing your finances, opting for a cooperative financial institution can offer some unique benefits that you might not find elsewhere. These organizations are designed to serve their members, which often translates to a more personalized experience and a focus on community needs.

One of the standout features is the lower fees associated with services. Many of these establishments prioritize keeping costs down, which means you’re likely to encounter fewer service charges compared to traditional money establishments. This aspect can significantly save you over time.

Another key advantage is the better interest rates on loans and deposits. Since these institutions aim to provide value to their members rather than generate profit, they often offer more competitive rates that can enhance your financial growth.

You’ll also find a strong emphasis on customer service. Employees are typically more invested in helping you and addressing your needs, leading to a more satisfying experience overall. This personal touch can make a real difference, especially when you need guidance or assistance with your finances.

Furthermore, these organizations often build strong connections within the community, which can foster a sense of belonging. By becoming a member, you not only gain access to services but also become part of a larger mission to give back and support local initiatives.

In summary, choosing an institution focused on its members can lead to lower fees, better rates, attentive service, and a stronger community link. These benefits can enhance your financial journey and create a lasting positive impact on your life.