Exploring the Advantages of Credit Unions Compared to Traditional Banks

When it comes to managing your finances, there are various institutions available that cater to your needs. Each option presents its own unique set of features, benefits, and drawbacks, making the choice a significant one. Have you ever wondered how one type of institution stacks up against another? The differences can greatly influence your overall experience, from loans to savings and even customer service.

Many individuals find themselves pondering this question: which financial establishment truly aligns with their lifestyle and financial goals? Both options have loyal followers, and understanding the nuances of each can help you make an informed decision. While one may prioritize community engagement and personalized service, the other might focus on technology and larger reach.

In this discussion, we’ll delve into the characteristics that set these two types of establishments apart. By analyzing their offerings, organizational structures, and member experiences, you’ll gain a clearer picture of what each has to offer in terms of value and convenience.

Understanding the Benefits of Credit Unions

Many people find themselves weighing the advantages of different financial institutions when it comes to managing their money. One type of organization often stands out for its unique approach and community focus. These institutions prioritize members over profits, creating a more personalized experience for those who choose to engage with them.

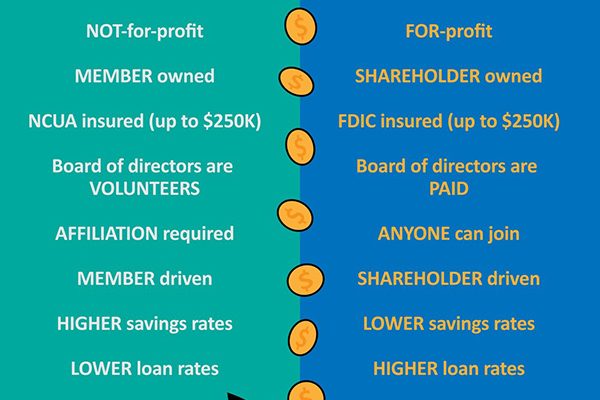

One of the key advantages of these financial establishments is the lower fees and interest rates they typically offer. This is largely due to the fact that they operate on a not-for-profit basis, meaning any earnings are returned to members in the form of reduced costs and better rates. This creates significant savings over time, especially in areas like loans and account maintenance.

Additionally, their commitment to member service often translates to a more supportive environment. With a focus on building long-term relationships, these institutions usually provide tailored financial guidance and support. Members often feel more like part of a family, which can lead to a more positive banking experience.

Moreover, these organizations frequently offer a variety of financial products and services similar to larger institutions, ranging from savings accounts to loans and investment opportunities. By maintaining a diverse portfolio of offerings, they cater to the needs of their community members while ensuring accessibility and reliability.

Finally, many people appreciate the local aspect of these establishments. By serving specific communities or groups, they often foster a sense of belonging and shared purpose. This connection can create a more rewarding experience for members, as they are participating in an institution that supports their community as a whole.

Comparing Interest Rates: Financial Institutions vs. Alternatives

When it comes to choosing a place for your finances, one of the key factors to consider is how much you’ll earn or pay in interest. The world of financial services offers various options, each with its own approach to handling rates. While both types of institutions aim to provide value to their customers, their methods and offerings can vary significantly.

Traditionally, one type of establishment tends to offer higher returns on savings accounts and lower fees on loans. This can be particularly appealing if you’re looking to maximize your savings or minimize your borrowing costs. On the other hand, the alternative establishment might provide different incentives and options that could align more closely with your financial goals.

Moreover, the atmosphere and personal service can vary greatly between the two. Customers often report feeling more valued in one environment, which can translate into a more personalized experience. As you weigh your options, it’s essential to investigate the interest offerings from both sides, examine any hidden fees, and consider the overall impact on your finances.

Ultimately, it’s about matching your financial needs with the right services. By taking the time to explore the interest rates and additional benefits each type of institution provides, you’ll be better equipped to make an informed choice that suits your lifestyle.

Membership and Community Focus

When it comes to financial institutions, the sense of belonging and community often plays a significant role in how people interact with them. Many members find a unique connection to organizations that prioritize the needs of individuals over profit. This relationship is driven by a commitment to serving local interests, fostering a genuine closeness that can be hard to replicate elsewhere.

In these member-centric establishments, the focus shifts from just transactions to building relationships. Each person is seen as part of a larger family, where the emphasis is placed on support and shared goals. Local initiatives often see strong backing, making a meaningful impact on the surrounding area and creating a sense of pride among those involved.

Furthermore, participation in the decision-making process is typically encouraged. Members often have a voice in shaping policies and practices, which enhances engagement and ensures that the organization’s direction aligns with community values. This collaborative environment not only strengthens ties but also fosters trust and strengthens financial resilience within the group.

Ultimately, the relationship members share with these institutions goes beyond mere finances. It is about empowerment, building a solid foundation for personal and collective success. The genuine care and focus on community make these spaces truly enriching for all involved.