Exploring the Nonprofit Status of Credit Unions and What It Means for Members

Many people find themselves asking whether these community-focused financial entities prioritize people over profits. It’s a legitimate question, as the operations of such organizations can often be confusing. While they exist to serve their members rather than generate wealth for shareholders, understanding their true nature requires digging a bit deeper.

At the heart of this conversation lies the model that differentiates these institutions from traditional banks. Rather than aiming to maximize earnings, their primary goal is to support and uplift their members through lower fees, better interest rates, and tailored services. But does this mean they operate under the umbrella of altruism, or is there more to the story?

Exploring their structure and objectives can shed light on how they balance community service with financial sustainability. Unpacking the motivations behind their operations allows us to better appreciate their role in the financial landscape, and ultimately, whether they align with charitable principles.

Understanding the Nature of Cooperative Financial Institutions

When you think about financial organizations, the first thing that comes to mind might be traditional banks. However, there exists a different kind of establishment designed with a distinct mission in mind. These entities operate on principles that prioritize community engagement and member participation over profit maximization.

So, what sets these institutions apart? At their core, they are built on the idea of mutual assistance among members. This means that the focus is on serving individuals and their needs rather than simply generating revenue for shareholders. The structure encourages collaboration and a sense of belonging, often resulting in more personalized services and favorable terms.

Moreover, the governance model is quite democratic. Members typically have a say in decision-making processes, allowing them to influence the direction of the organization. This democratic approach fosters a strong community feeling, where each participant has a stake in the collective success of the institution.

In essence, these financial establishments are designed to serve their members in a way that promotes financial well-being, stability, and a sense of unity. Understanding this unique approach can help individuals make informed choices when considering where to manage their finances.

Benefits of Nonprofit Financial Institutions

When it comes to managing your money, choosing an organization that prioritizes the community over profit can make a significant difference. These institutions operate with the goal of serving their members rather than enriching shareholders, which leads to a variety of advantages for those who choose to bank with them.

One of the most appealing aspects is the lower fees. Because these organizations don’t aim to maximize profits, they often offer fewer charges and more competitive rates on loans and savings. This can lead to substantial savings for individuals and families who are looking to manage their finances effectively.

Additionally, many members delight in the personalized service they receive. Smaller, community-focused institutions typically foster a relationship-based approach, allowing staff to better understand your needs and provide tailored financial advice. This sense of belonging creates a welcoming environment where members are valued.

Another highlight is the commitment to community development. These entities often invest back into the local area through various initiatives, helping to create jobs and support local businesses. By banking with them, you also contribute to these positive changes, ensuring your money helps to strengthen your community.

Lastly, they tend to offer financial education and resources that empower members to make informed decisions. This focus on education not only benefits individuals but also enhances financial literacy within the community, creating a more informed populace.

Differences Between Cooperative Financial Entities and Traditional Banks

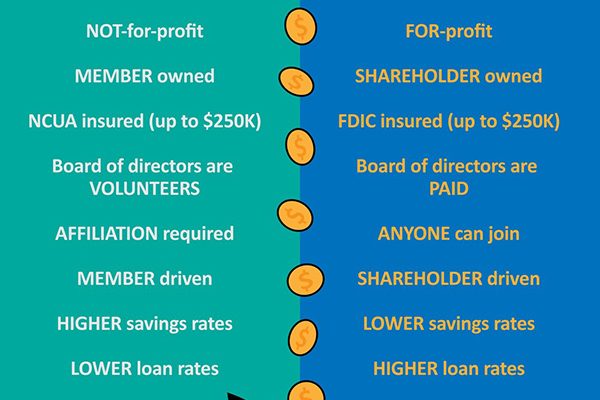

When it comes to managing your finances, there are two main players in the game: cooperative financial entities and traditional banks. While both aim to provide similar services, they operate under completely different philosophies and structures. Understanding these distinctions can help you make informed choices about where to place your money and how to access financial services.

One of the most significant differences lies in their ownership models. Cooperative financial entities are typically owned by their members, meaning that individuals who use these services have a say in how the organization is run. In contrast, traditional banks are profit-driven corporations accountable primarily to shareholders, which might lead to different priorities when it comes to customer service and community involvement.

Another point of contrast is the cost of services. Cooperative entities often have lower fees and interest rates compared to traditional banks, which may enhance member satisfaction. Since these financial groups are focused on serving their members rather than maximizing profits, they frequently offer a more personable experience and tailored services.

Additionally, the range of financial products can vary. While both types of institutions provide savings accounts, loans, and other common offerings, the specific terms, interest rates, and conditions may differ significantly. It’s always wise to shop around and compare the options available to you based on your financial needs.

In summary, choosing between a cooperative financial entity and a traditional bank involves more than just the services offered. The underlying philosophies, ownership structures, and costs associated can greatly impact your overall experience. So take the time to learn about each and decide which one aligns better with your financial goals.