Understanding the Implications of Having a 720 Credit Score and Its Impact on Your Financial Opportunities

Many individuals often find themselves curious about how their financial habits reflect on their overall standing in the eyes of lenders. Whether you’re looking to secure a loan, rent an apartment, or even land a job, having a favorable assessment can make a significant difference. It’s essential to grasp the importance of maintaining a healthy financial profile, as this often serves as a gateway to various opportunities.

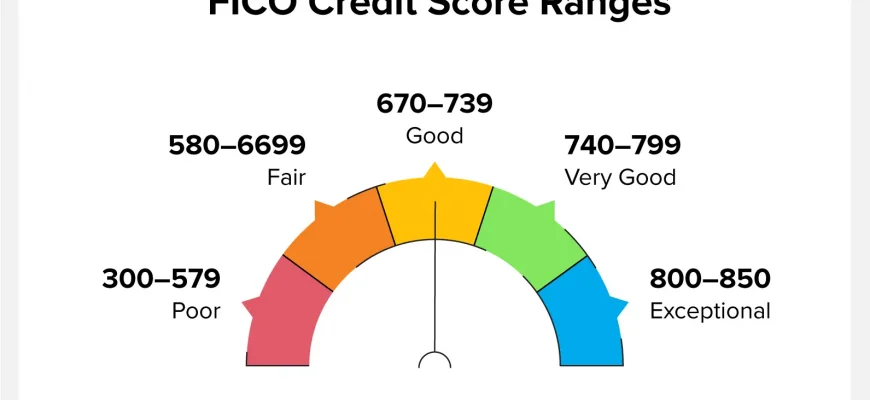

When it comes to evaluating one’s financial behavior, experts typically use a certain numerical representation to gauge reliability. A higher number suggests that you are likely to manage your obligations effectively and responsibly. But what does this really mean in practical terms, and how does it affect your life? That’s where the nuances come into play, and understanding the details can provide clarity and confidence.

In this discussion, we will delve into what it means to possess a particular level of financial representation. Is it enough to grant you access to favorable terms, or are there other factors at play? Let’s break down the implications and help you navigate this essential aspect of personal finance with ease and understanding.

Understanding Financial Ratings and Their Impact

Having a solid understanding of financial evaluations is crucial in today’s world. These assessments play a vital role in determining your access to loans, interest rates, and even rental agreements. Knowing how these evaluations work can empower you to make informed decisions about your finances and future.

Essentially, your rating reflects how reliably you manage borrowed funds and your overall financial health. A favorable evaluation can lead to more opportunities and better terms when you seek credit. However, a less favorable standing can limit your options and increase costs, which highlights the importance of maintaining a positive financial reputation.

Various factors contribute to these assessments, ranging from payment history to the overall amount of outstanding debt. The nuances of each aspect can significantly influence your standing, making it essential to stay informed and proactive in managing your financial obligations. Understanding these elements helps you navigate the complexities of financial systems and positions you for success.

Benefits of a 720 Credit Rating

Having a strong numerical rating in your financial profile can open up a world of opportunities. When individuals maintain a high level of financial responsibility, they often enjoy a range of advantages that make life a little easier and more affordable.

One of the most significant perks of a solid rating is the ability to secure favorable loan terms. Lenders are more likely to offer lower interest rates to individuals who have demonstrated a reliable history of managing their finances. This can lead to substantial savings over the life of a loan, ultimately reducing the overall cost of borrowing.

In addition to better rates, individuals with a robust financial history tend to have an easier time qualifying for various types of financing. Whether it’s a mortgage for a new home, a personal loan for a significant purchase, or a lease for a car, having a strong profile enhances your chances of approval.

Beyond loans, this level of financial trustworthiness can also influence insurance premiums. Many insurance companies consider your numerical evaluation before determining your rates. With a commendable standing, you might find that your premiums are lower, leading to further savings.

Moreover, a favorable standing can boost your bargaining power. When applying for rental properties, landlords often check financial reliability. A high rating can make your application stand out, leading to a better chance of securing your desired apartment or home.

Finally, maintaining a commendable financial reputation fosters a sense of security and peace of mind. Knowing that you are managing your finances well can reduce stress and provide confidence in your future financial endeavors. Overall, fostering a responsible attitude towards your finances brings numerous benefits that contribute to a healthier financial life.

How to Improve Your Credit Standing

Boosting your financial reputation can make a world of difference when it comes to loans, interest rates, and even job opportunities. With a few simple strategies, you can elevate your standing and gain access to better financial options. Let’s explore some effective ways to enhance your financial profile.

First and foremost, ensure that you pay your bills on time. Late payments can have a negative effect, and establishing a habit of punctuality will show lenders your reliability. Consider setting up automatic payments or reminders to help you stay on track.

Next, keep an eye on your credit utilization. Aim to use less than 30% of your available credit limits. By managing your spending and paying down existing balances, you can demonstrate responsible usage and improve your financial image in the eyes of lenders.

Another essential practice is regularly reviewing your financial report. This allows you to identify any errors or discrepancies that could harm your reputation. If you spot mistakes, don’t hesitate to dispute them; correcting inaccuracies can lead to significant improvements.

Don’t forget about the longevity of your accounts. Keeping older accounts open, even if they’re not frequently used, can enhance the history aspect of your profile. A long and stable financial background reflects positively on your overall standing.

Lastly, limit the number of new accounts you apply for in a short period. Each application can trigger a hard inquiry that may temporarily lower your standing. Being selective about new openings helps present you as a more stable borrower to lenders.

By implementing these tips, you’ll be on your way to enhancing your financial reputation, unlocking better opportunities, and enjoying greater peace of mind in your financial dealings.