Understanding the Implications of a 650 Credit Score and Its Impact on Your Financial Future

When it comes to managing your finances, one of the key indicators that lenders often look at is your financial rating. This number can significantly impact your ability to secure loans, obtain favorable interest rates, and even rent a place to live. However, many people find themselves wondering what a particular figure truly means for their financial future.

Some might categorize it as merely satisfactory, while others may view it as a stepping stone to better opportunities. It’s crucial to grasp how this rating shapes your financial landscape and what steps can be taken to improve it if necessary. After all, achieving a solid standing involves more than just knowing the number; it requires understanding the broader implications involved.

In the upcoming sections, we will explore what this specific value signifies, how it compares to others, and what strategies you can employ to enhance your standing in the eyes of lenders. Whether you’re planning to buy a home, take out a loan, or simply want to understand your financial health better, recognizing the importance of this rating is an essential first step.

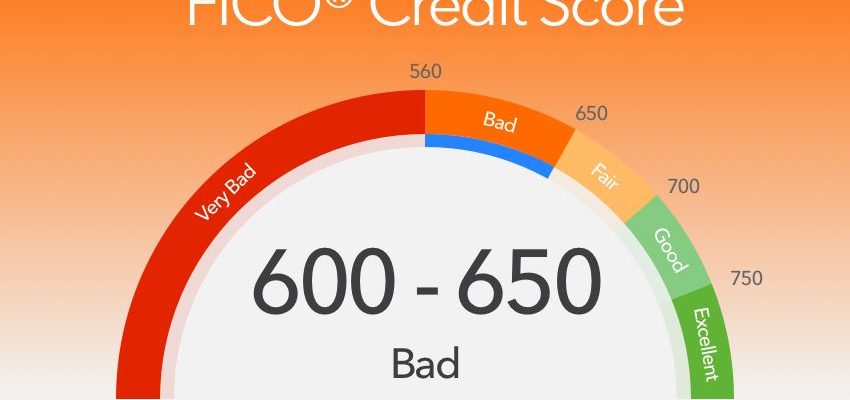

Understanding a 650 Credit Score

When it comes to numerical values that represent your financial health, it’s essential to grasp what each figure signifies. A score that falls within a particular range can open doors or present challenges in various aspects of financial life. This section will delve into the implications of having a number like this in the broader context of lending and personal finance.

A score around this mark typically suggests that you have some experience with borrowing and repayment patterns. However, it might also indicate a few bumps along the way. Lenders use these metrics to assess risk, meaning your standing can influence approval opportunities and interest rates when seeking loans or credit lines.

It’s worth noting that different lenders have varying standards. What seems acceptable for one institution might not be the case for another. Therefore, understanding the nuances can empower you to make informed decisions, whether you’re applying for a mortgage, auto financing, or even a credit card.

In the grander picture, maintaining or improving your number can be an achievable goal with careful planning and responsible financial behavior. Strategies such as consistent payment practices, keeping balances low on available resources, and regularly monitoring your financial health can contribute significantly to enhancing your standing.

Ultimately, this figure represents a snapshot of your financial journey, reflecting both your achievements and areas for growth. By taking proactive steps, you can work towards developing a more favorable profile over time.

Impact of Ratings on Loans

When it comes to obtaining financing, the evaluation of an individual’s financial behavior plays a pivotal role. This assessment influences the terms and availability of loans significantly. Understanding how these ratings affect your borrowing potential can empower you to make informed decisions, whether you are considering a mortgage, an auto loan, or a personal loan.

Here are some key points to consider regarding how these evaluations impact your borrowing experience:

- Interest Rates: Higher evaluations often lead to lower interest rates, making loans more affordable over time.

- Loan Amounts: Positive evaluations typically allow for larger sums to be borrowed, which is crucial for significant purchases like homes.

- Approval Chances: A solid rating increases the likelihood of loan approval, whereas lower ratings may result in rejection.

It’s essential to regularly check your financial evaluations and understand their implications. Maintaining a healthy status can not only ease the process of acquiring loans but also save you a substantial amount of money in the long run.

Here are some steps to improve your evaluations:

- Pay bills on time to demonstrate reliability.

- Keep your utilization rates low to show responsible credit usage.

- Limit new applications to avoid raising flags.

Overall, staying informed and proactive about your financial evaluations can open many doors when it comes to securing loans.

Improving Your Rating Strategies

Boosting your financial standing is an essential step toward achieving your monetary goals. Whether you’re aiming for a better loan option or simply want to improve your overall financial health, there are several practical methods you can adopt to enhance your profile. It’s all about understanding what influences your position and taking proactive steps to make improvements.

1. Timely Payments: One of the simplest yet most effective strategies is to ensure that you pay all of your bills on time. Delayed payments can have a significant impact, so setting up reminders or automatic payments can help you stay on track.

2. Reducing Debt: Keeping your outstanding balances low is crucial. Focus on paying down any existing debts, especially those with high interest rates. Strategies like the snowball or avalanche method can help you systematically eliminate what you owe.

3. Regular Reviews: Regularly checking your financial records allows you to spot any errors or discrepancies that may affect your standing. Challenge any inaccuracies you find, as they can hinder your progress.

4. Limit New Applications: Each application for a financial product can slightly impact your standing, so it’s wise to space out any new requests. Only apply for what you really need and when you feel confident in your situation.

5. Diversification: Having a mix of different types of accounts can be beneficial. Consider balancing revolving credit lines with installment loans, as this can show lenders that you can manage various financial responsibilities.

Improving your financial profile is a journey, not a sprint. By implementing these strategies and remaining committed to your goals, you’ll gradually see positive changes over time. Remember, consistency is key!

I was hooked from the very first second! You’ve got such a talent for making engaging videos.

Wow;your beauty and grace are absolutely captivating! Stunning video!