Understanding the Role and Importance of Credit Rating Agencies in Financial Markets

When it comes to making informed financial decisions, understanding an individual or entity’s trustworthiness is crucial. Many people rely on specialized organizations that assess and score the financial integrity of businesses and governments. These evaluations help stakeholders feel more secure when investing, lending, or engaging in any monetary transaction.

The key players in this field play a significant role in shaping financial landscapes. By analyzing various economic factors, they provide insights that guide investors, lenders, and even policymakers in their decisions. It’s fascinating to see how these assessments influence the flow of capital and the very stability of markets.

In this discussion, we’ll explore the origins, functions, and implications of such evaluative services. Understanding their purpose and impact can empower individuals and organizations to navigate the complex world of finance with greater confidence. After all, in a world driven by numbers, the need for clarity and trust remains ever-present.

Understanding Credit Rating Agencies

Have you ever wondered how certain organizations gauge the reliability of borrowers? These entities play a crucial role in assessing the trustworthiness of individuals and companies when it comes to repaying debts. Their evaluations impact everything from loan approvals to investment decisions, serving as a guide for lenders and investors alike.

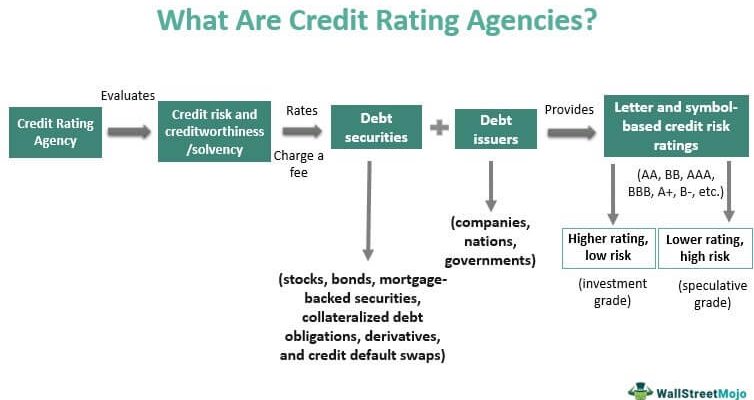

The primary function of these institutions is to analyze financial health and potential risks associated with borrowing. They utilize a variety of metrics and data points, translating complex financial information into more digestible scores. This process helps stakeholders make informed decisions about lending and investment opportunities.

In essence, these evaluators provide a snapshot of financial stability, allowing banks and investors to navigate the often murky waters of lending. Their insights not only foster transparency in the market but also contribute to economic stability by mitigating the risks inherent in financing.

While some might view their work as purely technical, the influence these firms wield is far-reaching. They can shape market dynamics and determine the cost of borrowing based on their assessments. Consequently, understanding how these organizations operate can empower borrowers and investors to make smarter decisions in a competitive financial landscape.

The Role of Credit Evaluations in Finance

When it comes to the world of finance, assessments of an entity’s reliability are key to understanding its risk profile. These evaluations serve as vital indicators for investors, lenders, and businesses alike, empowering them to make informed decisions. By distilling complex financial information into understandable metrics, assessments provide clarity in a landscape often clouded by uncertainty.

In essence, these evaluations help gauge the likelihood of timely repayments on borrowed funds, whether it be for a corporation seeking to expand or an individual looking to purchase a home. By analyzing various factors, such as financial history and current economic conditions, they offer a comprehensive view of potential financial behaviors.

Moreover, such evaluations play a critical role in shaping the cost of borrowing. Entities with stronger assessments typically enjoy lower interest rates, as they are viewed as less risky by lenders. Conversely, those with weaker evaluations may face higher costs, which can significantly impact their ability to finance projects or manage expenses.

Additionally, these evaluations contribute to market stability. When investors have access to reliable assessments, they can allocate their resources more effectively, fostering a healthier economic environment. This trust encourages the flow of capital, benefiting both borrowers and lenders in the long run.

In conclusion, the significance of these evaluations in the financial ecosystem cannot be overstated. They facilitate decision-making, influence borrowing costs, and promote market confidence, ultimately contributing to the smooth functioning of economic systems.

How Financial Assessments Impact Borrowing Costs

When it comes to securing funds, the evaluations of an entity’s financial health play a significant role in determining the cost associated with borrowing. Lenders meticulously analyze these assessments to gauge the level of risk they might encounter. This process influences not only the amount offered but also the terms under which it is provided.

High evaluations generally indicate lower risk, which means borrowers are likely to enjoy more favorable interest rates. On the other hand, lower evaluations can signal a higher risk, leading to steeper costs as lenders seek to offset potential losses. This dynamic creates a direct correlation: as the perceived reliability of a borrower decreases, so do the prospects of obtaining affordable financial support.

Moreover, these assessments can also affect the overall borrowing experience. A poor evaluation can restrict access to many funding options, confining borrowers to less favorable lenders or even prohibiting them from obtaining necessary resources altogether. As a result, understanding how these evaluations work is crucial for anyone looking to navigate the complex landscape of loans and financing.