Comparing the Benefits of Credit Cards and Debit Cards for Your Financial Needs

When it comes to managing your finances, the choice between using a particular form of payment can significantly influence your spending habits and overall financial health. In today’s world, where convenience is key, understanding the nuances of these options is essential. Each method offers unique benefits and drawbacks, tailored to different lifestyles and needs.

Some individuals find comfort in tapping into immediate available funds, while others appreciate the flexibility that comes with a system that allows for borrowing. It’s crucial to weigh the risks and rewards of each approach, considering how each aligns with your personal financial goals and routines. The decision often hinges on factors such as budgeting, spending patterns, and the desire for rewards or protection associated with each option.

In this discussion, we’ll explore the implications and advantages of both choices, shedding light on their roles in everyday transactions. By gaining insight into their functionalities and limitations, you’ll be well-equipped to determine which option aligns best with your financial strategy and lifestyle preferences.

Advantages of Credit Cards Explained

When it comes to managing finances, having a plastic companion can make a world of difference. They offer a range of perks that can enhance your spending experience and provide additional security. Understanding what makes these financial tools appealing can help you make informed decisions about your spending habits.

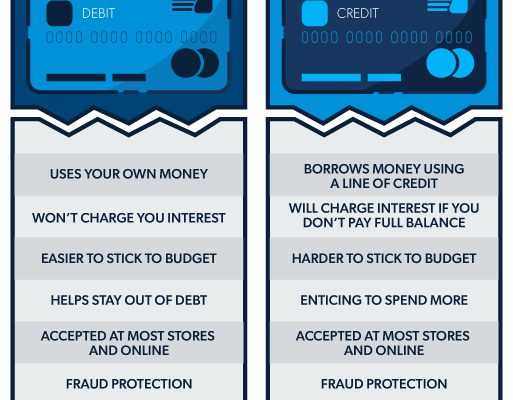

One major advantage is the ability to borrow funds temporarily, allowing for more flexibility in budgeting. This can be particularly helpful in emergencies or when making larger purchases. Instead of depleting your savings, you can opt to pay later while enjoying immediate access to the goods or services you need.

Another notable benefit lies in the rewards and incentives that many providers offer. From cashback on purchases to travel points, these perks can turn everyday spending into something more rewarding. Savvy users can capitalize on these programs, gaining extra value for their usual purchases.

Protection is also a critical aspect of using these financial tools. Most options come with fraud protection measures, ensuring that users aren’t liable for unauthorized transactions. This security can provide peace of mind when shopping online or in-store, knowing that your finances are safeguarded.

Additionally, timely payments can positively impact your financial reputation. Building a solid history can help you qualify for favorable interest rates and loans in the future. A good standing opens doors for better financial opportunities as you progress through life.

Finally, many find that these options facilitate tracking expenses more effectively. With monthly statements that categorize spending, keeping tabs on finances is easier, allowing for better budget planning and spending habits.

Understanding Debit Cards Benefits

When it comes to managing daily finances, one option stands out for its straightforward approach to spending and budgeting. This method allows individuals to access their own funds directly, offering a sense of control that’s appealing to many. By using this tool, users can easily keep track of their expenses while enjoying various perks that come with it.

One significant advantage is that spending is limited to the available balance, promoting responsible financial habits. There’s no risk of debt accumulation since transactions are made using existing money rather than borrowing. This feature helps users stay grounded in their budgeting efforts, making it easier to avoid overspending.

Additionally, many institutions offer attractive incentives, such as low fees and rewards programs. Users can find opportunities to earn cash back or discounts on purchases, enhancing their overall experience. Security is another essential aspect; these financial tools often come with safeguards that protect against unauthorized transactions, giving peace of mind while shopping.

Moreover, convenience plays a crucial role in the appeal. With widespread acceptance at retailers and online platforms, users can make purchases quickly and effortlessly. Many also feature mobile apps that enable easy monitoring of transactions, making it simple to stay updated on spending habits.

Lastly, exploring this payment method can lead to a simpler lifestyle. It encourages individuals to think twice before spending and can be an excellent stepping stone to better financial management, as users learn to prioritize needs over wants.

Choosing the Right Option for You

When it comes to managing your finances, selecting the most suitable payment method can significantly impact your spending habits and savings. Each type of tool offers unique features that cater to different lifestyles, and understanding these can help you make an informed decision.

First, consider your spending habits and how often you find yourself needing to make purchases. If you tend to pay off your balance each month, some options might allow you to earn rewards or cashback. On the other hand, if you prefer to manage your available funds without the temptation of overspending, you might lean towards a choice that requires you to use only what you have on hand.

Moreover, think about the convenience factor. Some prefer digital solutions that allow for quick transactions, while others find peace of mind in using physical currency. Additionally, be mindful of any potential fees associated with different options, as they can vary greatly and affect your overall expenses.

Ultimately, the choice revolves around your personal preferences and financial goals. Take the time to assess your needs, and don’t hesitate to explore various options to find the one that aligns perfectly with your lifestyle.