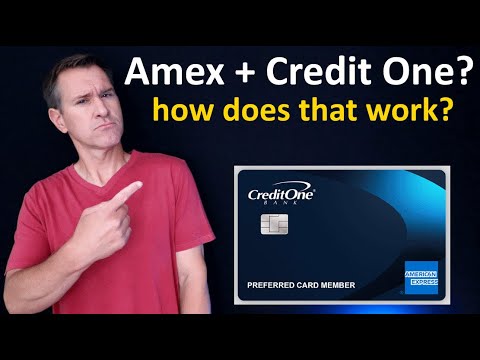

Exploring the Benefits and Drawbacks of the Credit One American Express Card

When it comes to selecting the right financial tool for your needs, many options are available that can cater to different lifestyles and spending habits. Navigating this landscape can often feel overwhelming, especially with an array of features and benefits being promoted at every turn. Understanding what each choice offers and how it aligns with your goals is crucial for making an informed decision.

In this discussion, we’ll explore a popular option that has garnered attention for its unique attributes and potential advantages. From rewards programs to customer service, there are various facets to consider when determining whether this choice fits your financial strategy. Join us as we dissect the offerings and provide insight into whether this option could be a valuable addition to your wallet.

We understand that every individual has different needs, and finding the ideal match is essential. It’s not just about having another financial tool; it’s about ensuring it’s the right fit that enhances your spending experience and meets your needs. So, let’s dive deeper and evaluate if this particular option deserves a spot in your spending routine.

Understanding the Benefits of Credit One Amex

When it comes to choosing a financial product, it’s essential to look beyond the basic functionalities and consider the perks that come along with it. Many options on the market offer unique features that can enhance your purchasing power and provide additional value. Let’s delve into some of the advantages available with this particular offering.

One of the standout aspects of this option is the potential for rewards on everyday purchases. Users can accumulate points or cash back, making it easier to enjoy some treats or save for future expenses. Additionally, these rewards can often be redeemed for a variety of items, from travel deals to shopping discounts, allowing for flexibility in how benefits are utilized.

Another appealing feature is the ability to build or improve your financial reputation. Responsible usage can lead to positive credit history and increased scores over time. This can open doors for better financial opportunities down the road, such as lower interest rates or larger funding amounts.

User-friendly management tools are also part of the package. Many individuals appreciate the convenience of tracking their spending through online platforms or mobile applications, making it simpler to stay on top of finances and budget effectively. Alerts and notifications can help ensure timely payments, further supporting financial health.

Moreover, there are often additional protections and benefits included, ranging from purchase assurance to travel insurance options. These added layers of security provide peace of mind when making significant purchases or planning trips, knowing that you have support if something unexpected occurs.

In summary, exploring the features tied to this financial offering reveals a range of benefits that cater to various needs and lifestyles. From rewarding everyday spending to valuable support tools, it’s worth considering how these aspects align with your personal finance strategy.

Comparing Credit One Amex with Competitors

When exploring different financial tools, it’s essential to weigh various options against each other. In this section, we’ll take a closer look at how this particular offering stacks up against its peers. By examining features, benefits, and potential drawbacks, we can better understand its position in the marketplace and what it might mean for everyday users.

One important aspect to consider is rewards programs. While some alternatives provide enticing bonuses for certain spending categories, others may have more straightforward points systems. This offering might appeal to those who prefer simplicity but may lack the allure of high-reward options found elsewhere.

Next, let’s delve into fees and interest rates. Many competitors offer various fee structures that can significantly impact long-term value. This option could be seen as a more accessible choice for individuals with different financial backgrounds, but it’s vital to ensure that it’s not overshadowed by higher costs when compared to others.

Customer service is another crucial factor that can influence user experience. Some brands excel in providing assistance and resolving issues quickly, while others may fall short. Evaluating support options can provide insight into how well any institution values its clientele and aims to foster lasting relationships.

Lastly, we should reflect on additional perks or features that may enhance overall satisfaction. Some offers come with travel benefits, purchase protections, or no foreign transaction fees, which could greatly influence decision-making for frequent travelers or online shoppers. It’s essential to align personal needs with what each option has to offer.

Who Should Consider This Financial Solution?

If you’re looking for a way to enhance your purchasing power and enjoy added perks, this offering might be exactly what you need. It’s designed to attract a diverse group of individuals, from frequent travelers to everyday shoppers. Whether you have established spending habits or are just starting to build your financial portfolio, understanding your needs can help you determine if this option fits your lifestyle.

Frequent travelers might find significant value in the rewards and benefits tailored for those on the go, such as travel insurance, airport lounge access, or exclusive deals with airlines. On the other hand, individuals who often make everyday purchases might appreciate the cashback options and discounts available on regular spending, like groceries or gas.

Additionally, if you’re someone who enjoys making the most out of your expenses through rewards programs, this solution could provide a great opportunity to maximize your returns. Assess your spending habits and evaluate the potential benefits to see if this offering aligns with your financial goals.