Understanding the Difference Between a Credit Note and a Refund

When businesses deal with transactions, occasionally adjustments need to be made. These changes can arise for various reasons, such as a return of a purchased item or an error in billing. It’s essential to grasp the different methods available for resolving such matters, as they serve different purposes and imply distinct processes.

One common approach to handling such situations is through a documented form that provides a balance adjustment, effectively reducing what the customer owes or crediting future purchases. However, many people might wonder if this form of adjustment is essentially equivalent to receiving back funds for a previous purchase. Understanding the nuances between these two options is important for both consumers and businesses alike.

As we dive deeper into this topic, we’ll explore how these options differ, clarify any misconceptions, and help you navigate your financial transactions with confidence. By the end of this discussion, you’ll be equipped with the knowledge to make informed decisions regarding your finances, whether you’re a shopper or a seller.

Understanding the Concept of Credit Notes

When discussing transactions and financial adjustments, it’s essential to grasp the different ways businesses handle their accounts. One common practice involves providing customers with a way to account for previous purchases that may have required changes. This approach can often lead to confusion between alternatives available for correcting payment issues.

In essence, this mechanism acts as an acknowledgment of an overpayment or a return, allowing individuals to apply the value against future purchases. It serves as a level of convenience for both sellers and buyers, streamlining the exchange process without needing to handle cash or direct transfers for every adjustment.

Understanding this process helps clarify the relationship between buyers and sellers. It fosters trust and encourages repeat transactions, as customers know they have options if their purchases don’t go as expected. This system ultimately reflects a broader understanding of commerce, where flexibility plays a crucial role in customer satisfaction.

Key Differences Between Refunds and Credit Notes

When it comes to managing transactions, understanding the distinctions between various forms of reimbursement is crucial. While both mechanisms serve to address customer dissatisfaction, they operate differently and fulfill unique functions. Let’s dive into how these two methods vary from each other.

- Usage: One approach is often applied to return funds directly to a customer, whereas the other serves as a value adjustment for future purchases.

- Timeframe: Immediate retrieval of funds can happen with one method, meanwhile the alternative might delay access until later use.

- Future Purchases: A reimbursement can typically signify a closing transaction, while a value adjustment encourages ongoing customer engagement by facilitating future transactions.

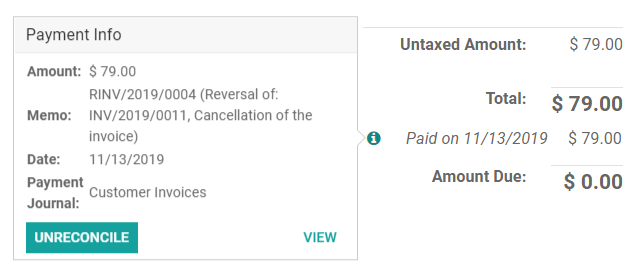

- Documentation: Each option might come with different paperwork, offering various details regarding the original purchase and how the value will be returned or adjusted.

Understanding these differences can help consumers make informed choices during transactions and ensure satisfaction with their shopping experience.

When to Use Each Financial Tool

Understanding when to utilize different financial mechanisms can streamline your transactions and maintain clarity in your records. Each tool serves a unique purpose, helping businesses and customers navigate their accounts effectively and efficiently. It’s essential to know the right time to apply these options, as it can impact cash flow and relationships.

Utilization of one mechanism is ideal for instances where a product or service has been returned due to dissatisfaction or issues. This option often provides a straightforward balance adjustment, ensuring that both parties feel content with the resolution. On the other hand, employing the other instrument becomes beneficial in scenarios where money needs to be returned directly, such as canceled orders or overpayments. This direct approach often resolves disputes and re-establishes trust swiftly.

In summary, evaluating the situation at hand will guide you to select the appropriate option. Whether adjusting invoices or processing direct payments, each tool has its place in financial management, designed to enhance transparency and facilitate smoother transactions.