Understanding the Nature of a Credit Note as a Financial Asset

When we talk about financial documents that can change the way businesses operate, there’s one that often raises questions among entrepreneurs and accountants alike. It seems straightforward, but its implications can be a bit more complex than what meets the eye. This particular instrument can play a crucial role in managing cash flow and balancing accounts, leaving many to ponder its true nature and significance.

Imagine a situation where a company needs to adjust its financial statements due to a return or an error in billing. This document becomes essential in helping maintain transparency and accuracy in financial dealings. But does it truly hold value in the broader financial landscape? Understanding this is key for anyone navigating the world of commerce.

The exploration of this topic reveals not only its operational role but also touches on how various organizations account for it within their balance sheets. Deep diving into this subject will help clarify its standing and importance, allowing businesses to make more informed decisions in their financial management strategies.

Understanding Notes in Accounting

When diving into the world of financial records, it’s essential to grasp how various documents function and their implications for business transactions. One particular type of document often surfaces in discussions about maintaining accurate financial statements and tracking transactions effectively. These forms serve as vital tools for businesses, allowing them to manage discrepancies, returns, and adjustments, all while maintaining clear communication with clients.

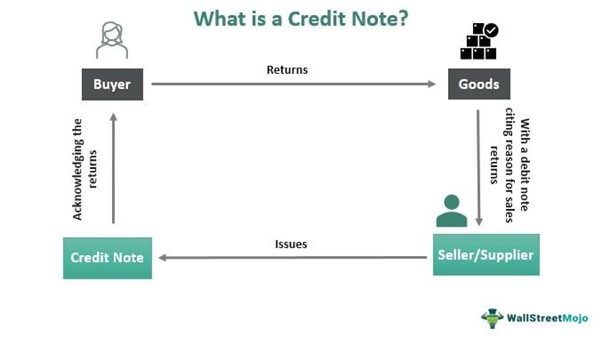

Essentially, this paperwork acts as a formal acknowledgment of a financial adjustment resulting from previous transactions. They can arise due to various reasons, such as product returns or service discrepancies, and they often provide a means to rectify previous billing errors. Understanding their role not only helps in accurate record-keeping but also fosters stronger relationships with customers by demonstrating transparency and responsiveness to their needs.

In accounting practices, these documents flow seamlessly into the broader narrative of a company’s financial health. While they may not appear to hold intrinsic value at first glance, they directly influence the dynamics of receivables and payables. By recognizing the significance of these adjustments, businesses can better navigate their financial landscapes and ensure accurate reporting during audits and financial reviews.

Evaluating the Financial Impact of Credit Notes

Understanding the financial implications of adjustments can significantly shape a company’s cash flow and overall profitability. These adjustments often arise from various scenarios such as returned products, pricing discrepancies, or service issues. By delving into how these modifications affect the finances, businesses can make informed decisions that enhance their financial health.

When a company issues an adjustment document, it alters the ledger balance, which can either improve or reduce accounts receivable. It’s crucial to assess how such transactions influence liquidity and financial ratios. Keeping track of these entries ensures that the financial statements reflect the true economic situation of the business.

Additionally, these adjustments can impact customer relations. Satisfied clients may appreciate the responsiveness to their needs, which can, in turn, lead to repeat business and enhanced brand loyalty. On the flip side, if mishandled, it could lead to dissatisfaction and lost sales opportunities.

Moreover, analyzing how these documents are handled within the accounting processes can uncover areas for efficiency. Streamlining the workflow can reduce processing time and improve accuracy, ultimately benefiting the bottom line. Thus, a thorough evaluation is essential for maintaining a healthy financial standing.

When to Classify a Document as a Resource

Understanding when to categorize a particular transaction reflection as a resource can be a bit tricky. It’s essential to consider the context in which this reflection is used and how it impacts your financial landscape. Typically, these documents arise from returns, adjustments, or overpayments, and how you treat them in your accounting can influence your overall financial picture.

Recognition Timing: The timing of recognition plays a crucial role. If the document is linked to past transactions that have financial implications, it can be seen as a resource. This means that once it is issued and acknowledged, it potentially represents future benefits, such as reducing liabilities or offsetting future purchases.

Future Benefits: When evaluating the significance of the document, consider the anticipated future advantages. If it allows you to claim funds back or reduce amounts payable in the future, it’s wise to treat it as a resource. The expectation of receiving value from this documentation is a major factor in its classification.

Relevance to Financial Statements: Additionally, consider how it fits into your financial reporting. A document that impacts your balance sheet positively should be categorized appropriately to reflect a more accurate financial position. This ensures that stakeholders have a clear understanding of the company’s financial health.

Conclusion: By assessing the timing, expected benefits, and its relevance to financial reports, you can make informed decisions about whether to classify such documentation as a resource. Understanding these aspects can help you maintain precise financial records and support informed business decisions.