Understanding the Relationship Between Credit Notes and Tax Invoices

When it comes to managing finances and keeping track of transactions, understanding the documents involved is essential. You may have encountered various types of financial documentation that serve different purposes. Some are crucial for record-keeping, while others are used for adjustments in accounting. This raises a pertinent question: Are these documents interchangeable, or do they serve unique functions in the world of commerce?

To clarify the distinctions, it’s beneficial to delve into what these documents represent. One commonly used document is more of a reversal or correction mechanism for previous transactions. On the other hand, another type is typically linked to a sale, showcasing the details of a purchase, including the amounts owed and the services or goods provided. While they may seem similar at first glance, the roles they play in financial bookkeeping highlight their differences.

Understanding how these documents fit into the larger financial landscape can help businesses manage their accounting more effectively. Whether you’re a small business owner or a finance professional, recognizing the specifics of each document is vital for maintaining clear and accurate financial records. Let’s explore the nuances that set these two types of documentation apart.

Understanding the Function of Credit Notes

When it comes to financial transactions, documents that indicate adjustments are crucial for maintaining accurate records. These papers serve a specific purpose, allowing businesses to correct previous errors, reflect returns, or provide account adjustments. Understanding their role can shed light on how they interact with standard billing practices and overall accounting.

Essentially, these documents act as a formal acknowledgment of a change in the initial transaction. They can arise from various situations, such as when a product is returned or when an overcharge occurs. Instead of creating confusion, these adjustments help clarify the financial standing between parties involved, ensuring everyone is on the same page.

This mechanism not only aids in record-keeping but also enhances transparency in business dealings. By issuing such documentation, companies demonstrate their commitment to accuracy and customer satisfaction. Consequently, understanding their function becomes vital for both consumers and businesses alike, helping to navigate financial interactions with confidence.

Documentation Types: Understanding the Differences

When it comes to business transactions, there are various forms of documentation that serve different purposes. Each type plays a vital role in the financial landscape, ensuring clarity and compliance in the exchange of goods and services. Recognizing their distinctions is crucial for both buyers and sellers to maintain accurate records and navigate the complexities of financial reporting.

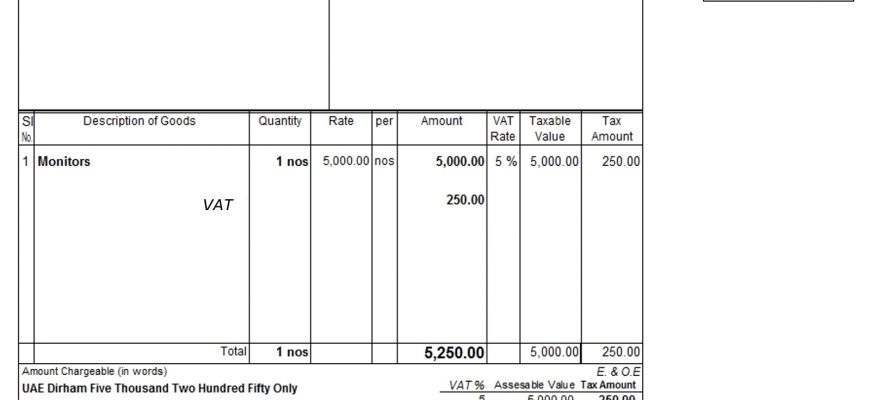

One type of document typically represents a transaction’s initial record, detailing what was purchased and the amount due. This document is essential for tracking revenue and possibly for tax obligations. On the other hand, there exists another form of documentation that acts as a counterpart to the first. Its primary role is to amend or adjust previous transactions, reflecting returns, discounts, or changes in pricing. Understanding how these two types interact can prevent misunderstandings and ensure all parties are on the same page.

While one type primarily initiates a transaction, the other serves to modify or clarify it. This introduces a vital concept in accounting practices where accurate documentation is necessary for transparency and accountability. Knowing when to use each will help in maintaining well-organized financial records and simplifying audits or financial reviews.

Implications of Using Credit Notes in Taxation

When it comes to the management of financial documents, there are several important considerations that can influence a business’s obligations and rights. The utilization of certain documents, which provide adjustments to previous transactions, can create various effects on how companies report their finances and comply with regulations. Understanding the nuances associated with these documents is essential for effective bookkeeping and maintaining proper financial standing.

One key aspect to consider is how these documents impact reported revenue. Adjustments can lead to reductions in stated sales figures, which in turn may alter the overall income a business presents for taxation purposes. This shift not only affects the current period’s financial statements but can also influence future obligations. Properly documenting and managing these adjustments becomes crucial in avoiding any potential pitfalls that could arise from discrepancies in financial reporting.

Additionally, while these documents serve to correct past transactions, they may also play a role in the relationship between a business and its clients. Clear communication about any adjustments helps ensure transparency, which can foster trust and strengthen customer relations. Failure to maintain clarity in these adjustments might lead to misunderstandings or disputes down the line, further complicating financial interactions.

Moreover, businesses must remain vigilant about the correct application of regulations surrounding these adjustments. Jurisdictional variations can introduce complexities regarding what counts as a valid alteration or correction. Companies need to fully grasp the rules applicable to their specific situation to ensure compliance and avoid penalties.

Ultimately, being informed about how adjustments affect financial reporting, customer relationships, and compliance obligations is vital for any operation. A proactive approach to managing these documents can lead to smoother financial processes and better overall management of the business’s finances.