Understanding the Concept and Purpose of a Credit Note

In the world of commerce, transactions don’t always go as planned. Sometimes, the goods delivered might not meet expectations, or there could be an overpayment. In these instances, businesses often resort to a specific type of document that serves as a means of reconciling accounts. This tool plays a crucial role in maintaining smooth relationships between buyers and sellers, ensuring that everyone walks away satisfied.

Essentially, this document acts as a form of acknowledgment from a seller regarding changes in the original agreement. Whether correcting an error, offering compensation, or reflecting a return, it provides clarity and transparency in financial dealings. It’s not just a piece of paper; it holds significance for both parties involved, allowing for adjustments to be made without causing friction.

As we delve deeper into what this financial instrument entails, we’ll explore its purpose, how it’s utilized, and why it matters to both businesses and consumers alike. Understanding this concept can empower individuals to navigate transactions more effectively and enhance their grasp of financial interactions.

Understanding the Concept of Credit Notes

When we talk about transactions and financial exchanges, it’s essential to comprehend the tools that help businesses manage their operations smoothly. One such tool is a document that serves as a means to rectify previous financial interactions, allowing companies to adjust amounts due or received. This mechanism ensures that both parties can maintain clarity and fairness in their financial dealings.

At its core, this type of document acts as a form of acknowledgment from a seller to a buyer, often issued when there is a need to reverse part of a transaction. Whether it’s due to a return, an overcharge, or a discount, it’s crucial for both sides to record these adjustments accurately. As a result, the overall financial records remain transparent and trustworthy, fostering a good relationship between involved entities.

Understanding how this tool functions can significantly enhance your grasp of business operations. For instance, when a customer returns a purchased item, the retailer may issue a specific document that deducts the appropriate amount from the account. This not only helps in adjusting the finances but also aids in tracking returns and maintaining accurate inventory levels. Therefore, knowing how to navigate these financial instruments is beneficial for both economic entities and their clientele.

When to Issue a Credit Memo

There are moments in business when circumstances change, and adjustments need to be made. Whether it’s due to an error in billing, a returned item, or a customer dissatisfaction, these situations require a formal acknowledgment that a financial correction is necessary. Understanding when to create such documentation can help maintain good relations with your clients and ensure clear communication regarding transactions.

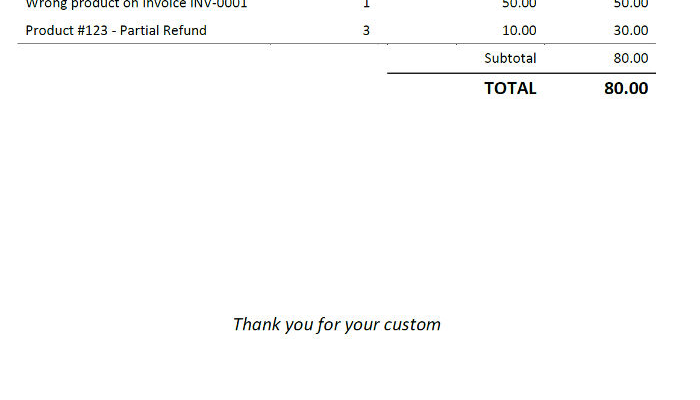

One common scenario is when a product is returned due to defects or errors. In these cases, it’s essential to provide a formal acknowledgment that the sale has been altered, allowing the customer to receive their funds back or apply it to future purchases. Similarly, if the service provided did not meet expectations, issuing an adjustment becomes important to uphold the integrity of your business.

Another instance might arise from overcharging. If an invoice includes incorrect pricing or additional services that were not rendered, a formal adjustment can clarify the situation and reassure your clients that their concerns are taken seriously. Keeping your financial records transparent fosters trust and loyalty.

Lastly, promotional discounts or mistakes in applying them during transactions can necessitate such documentation. When discounts are not reflected correctly, it’s crucial to rectify the situation openly. This not only resolves potential disputes but also reinforces customer satisfaction.

The Impact of Credit Notes on Accounting

When it comes to financial management, certain documents play a pivotal role in maintaining accurate records and ensuring smooth transactions. One such document, often overlooked, can significantly influence how businesses account for their transactions and manage their financial health.

Understanding the effects of such documents is essential for both small and large enterprises. Here are some key aspects to consider:

- Adjustment of Revenue: These documents help in adjusting sales figures, providing a clearer picture of earnings. This ensures that the revenue reported reflects actual income.

- Inventory Management: They can indicate returns and adjustments in stock levels. This is crucial for maintaining accurate inventory records and avoiding discrepancies.

- Tax Compliance: Properly issued documents assist in compliance with tax regulations, as they often impact the taxable income reported by a business.

- Customer Relationships: They can enhance trust and satisfaction among clients when issues are handled effectively, leading to potential loyalty and repeat business.

In summary, the influence of such documents stretches beyond simple transactional adjustments. They are integral to the overall financial landscape of an organization, impacting not only internal processes but also external relationships. Understanding their importance can lead to more informed decision-making and better financial practices.