Understanding the Differences Between a Credit Memo and a Refund

When dealing with financial transactions, there are terms and processes that can often lead to confusion. One area where this is particularly evident is in the realm of monetary returns. Businesses frequently provide their customers with options for recovering funds, whether due to a mistake, a product return, or other service-related issues. However, many people might not fully grasp the nuances between varied methods of compensating customers.

In this discussion, we aim to clarify a commonly posed question regarding the nature of adjustments issued by businesses. It’s essential to understand whether these adjustments function as straightforward returns of cash or serve a different purpose altogether. The distinctions may seem subtle at first glance, yet they can significantly impact both consumers and companies.

Join us as we delve into this topic, exploring the mechanisms behind financial adjustments and how they relate to customer satisfaction and business operations. We’ll unpack the terminology and help you gain a clearer view of what these financial solutions entail, ensuring you can navigate future transactions with greater confidence.

Understanding Credit Memos in Business

In the world of finance and transactions, adjustments can sometimes be necessary to maintain accurate accounting records and ensure customer satisfaction. These adjustments serve various purposes, often linked to previous purchases or agreements between parties. They help keep track of changes, whether due to errors, returns, or goodwill gestures.

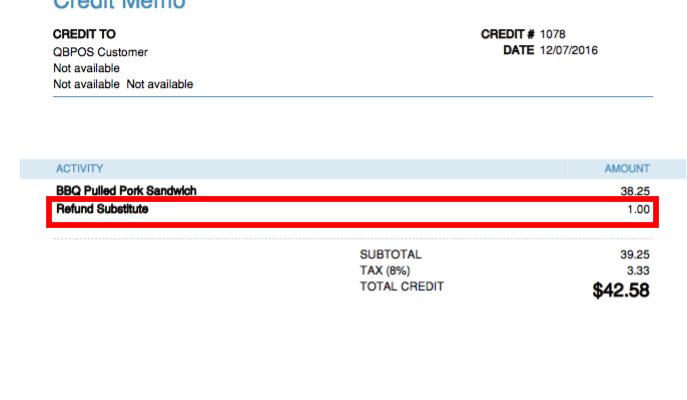

One common type of adjustment document serves to alleviate disputes and clarify balances. When there’s a need to acknowledge a reduction in a previous charge, businesses issue this type of document to confirm that a certain amount will no longer be owed. This can occur for various reasons, such as when a customer returns a product, receives a discount, or encounters a billing mistake.

This instrument also plays a key role in maintaining strong relationships with clients. By promptly addressing discrepancies and providing a transparent mechanism for adjustment, businesses demonstrate their commitment to customer care. This reinforces trust and can even encourage repeat business in the future.

From an accounting perspective, these documents offer a straightforward way to document the reduction of amounts. They help streamline record-keeping while ensuring that all parties have a clear understanding of their financial commitments. Additionally, they can assist in balancing accounts accurately, making audits and financial reviews more efficient.

In essence, this adjustment document is an important tool for businesses to manage their financial interactions while prioritizing transparency and accuracy. By fostering clear communication and ensuring correct billing practices, it contributes to a smoother operational flow.

Distinguishing Between Refunds and Credit Memos

When it comes to managing transactions, understanding the difference between various adjustment methods is crucial. Many consumers and businesses alike often get confused by the terminology used in financial exchanges. While both methods aim to rectify a financial discrepancy, they serve different purposes within the accounting and customer service realms.

One approach typically entails returning funds directly to a customer’s account. This process is straightforward; the money goes back to the payer, providing an immediate resolution to an overcharge or returned item. On the other hand, the second method involves issuing a document that can be applied toward future purchases. Instead of receiving cash back immediately, the recipient retains a voucher or balance that can offset forthcoming costs, often promoting customer loyalty.

Understanding these differences can greatly affect business practices. Choosing the right method depends on various factors, including company policies, customer preferences, and the nature of the transaction in question. It’s essential to communicate clearly with customers regarding which option is being utilized to avoid confusion and maintain a solid relationship.

Implications of Credit Memos for Accounting

Understanding how certain financial adjustments work is crucial for maintaining accurate records. These adjustments can have a significant influence on various accounting practices and ultimately affect the financial health of an organization. When a transaction needs alteration, the method chosen can modify not only the figures but also the overall accounting landscape.

From a bookkeeping perspective, these adjustments allow for more precise tracking of sales and returns. They serve as official documentation of changes and are essential for reconciling accounts. Accurate entries help organizations maintain transparent relationships with clients and suppliers, ensuring that financial statements reflect reality.

It is also important to recognize the impact on tax obligations. When adjustments are made, they can influence the taxable income or the reclaim of certain taxes. Therefore, keeping meticulous records of these adjustments is not just beneficial but necessary for compliance with regulations.

Additionally, businesses should consider the implications on cash flow. Adjustments can directly affect the money available for operations, as they may alter the timing of revenue recognition. This highlights the importance of cash management strategies in response to any modifications.

Finally, understanding these financial alterations can aid in making informed decisions. They provide valuable insights into customer behavior and product performance, enabling companies to adapt their strategies effectively. Recognizing the nuances of these records can enhance overall financial acumen and contribute to long-term success.