Understanding Whether a Credit Limit Is Calculated Monthly or Annually

Ever wondered how financial institutions determine your purchasing power? It’s crucial to grasp this concept, as it affects your day-to-day transactions and overall financial health. Many individuals find themselves puzzled about the duration over which these spending capabilities are calculated and what that means for their wallets.

When you explore the mechanics behind this aspect of personal finance, you’ll discover that there are different approaches to defining how much you can spend and when. Is it a short-term assessment or a long-term arrangement? This figuring out can have significant implications for your budgeting and spending habits.

Let’s dive into the nuances of this topic to clear up any confusion. By understanding the framework of how your purchasing potential is structured, you can make more informed decisions and better manage your financial activities. Get ready to enhance your knowledge and navigate your financial landscape with confidence!

Understanding Credit Limits Periodicity

When it comes to available financing, it’s important to grasp how often these thresholds reset. The frequency with which this availability is reviewed can greatly affect your spending power. Knowing whether it’s adjusted on a regular basis or follows a longer timeline helps in managing personal finances more effectively.

Typically, financial institutions assess one’s borrowing capacity at specific intervals. This cycle can influence everything from your purchasing decisions to your overall financial health. Understanding this rhythm not only aids in anticipating potential changes but also supports better budgeting practices.

Many individuals often find themselves confused by the nuances surrounding these assessments. It’s essential to clarify how often you might expect to see an uptick in what you can access. This knowledge empowers consumers to plan purchases, take advantage of opportunities, and avoid unnecessary pitfalls.

Ultimately, being aware of this aspect enhances your ability to navigate financial choices with confidence. Embracing the timing of these evaluations can lead to informed decision-making and a healthier relationship with your finances.

Monthly Limits: What You Need to Know

Understanding the restrictions on expenditure is crucial for managing your finances effectively. These constraints can significantly influence your spending habits and overall financial health. Knowing how they work can help you make informed decisions and avoid unwanted surprises.

First and foremost, it’s essential to recognize that these constraints typically reset at the beginning of each cycle. This means you will have new opportunities to utilize available resources on a regular basis. It’s like hitting the refresh button, allowing you to plan your purchases and investments wisely.

Another important aspect is the way these allowances can impact your financial planning. By keeping track of how much you can spend within the designated time frame, you can allocate funds more effectively. This encourages responsible budgeting and can even enhance your spending power as you learn to navigate your resources creatively.

Lastly, staying informed about your current status is key. Various tools and applications can help you monitor your usage in real time, making it easier to adhere to your financial goals. Remember, knowledge is power when it comes to managing your economic landscape!

Yearly Restrictions Explained

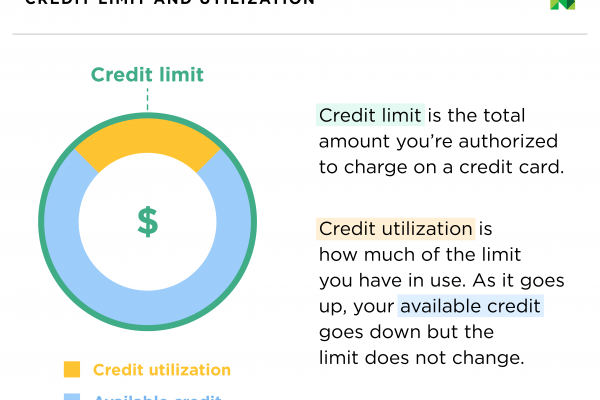

Understanding how financial boundaries are set on your account can be quite important for managing your spending habits. These boundaries determine the maximum amount you can utilize within a specific timeframe, impacting both your budgeting and purchasing decisions.

Typically, users encounter set amounts that reflect what they can spend over a particular period. These parameters can often influence your purchasing power and dictate your financial planning. It’s crucial to grasp how these conditions are calculated and how they might change based on various factors such as income, repayment history, or usage patterns.

Throughout the year, you may notice that the guidelines affecting your account can evolve. Financial institutions periodically reassess these thresholds based on your interactions with the service, which might include factors like timely payments or spending trends. Familiarizing yourself with these changes can lead to better decision-making when it comes to your finances.

The importance of being aware of these restrictions can’t be overstated. They serve not only as a safeguard for lenders but also as a tool for you to maintain sound financial health. By being proactive about understanding and managing these constraints, you can navigate the world of spending with greater confidence and awareness.