Understanding the Cost Implications of Freezing Your Credit

In today’s world, where identity theft and fraud are on the rise, many individuals find themselves considering actions to safeguard their personal information. One option that frequently comes up is the process of temporarily blocking access to one’s financial profile. Knowing whether there are costs associated with this protective measure is crucial as it can impact decision-making.

It’s important to explore the concept of securing your financial identity without incurring unexpected expenses. Understanding the available services and their terms can help demystify the process. Many people are surprised to learn about the range of options that might be available to them without a price tag attached.

By familiarizing yourself with the mechanisms of protection, you can take proactive steps towards ensuring your sensitive data remains secure. Let’s dig deeper into whether these protective actions incur costs, and what you should know before proceeding.

Understanding Lockout Costs

Many people wonder about the financial implications of locking down their personal information to prevent unauthorized access. It’s a smart move, but it raises questions about any potential charges associated with the process. Knowing the facts can help you navigate the situation more comfortably and ensure you make informed decisions.

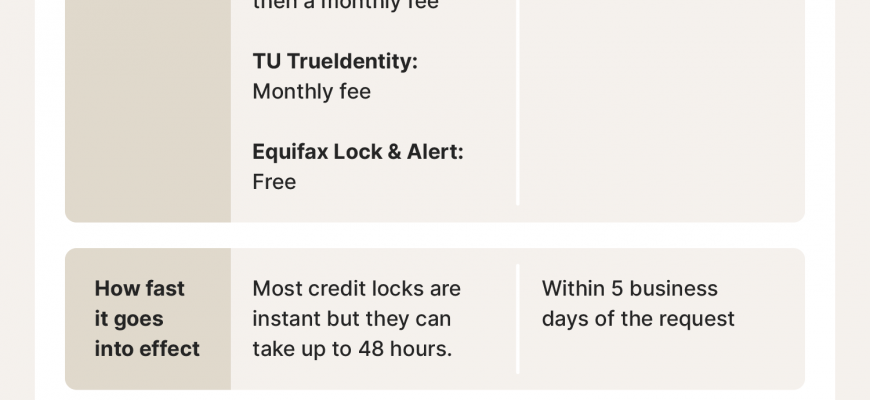

Generally, the process of restricting access to your financial profile does not incur fees. Most agencies provide these services at no cost, recognizing the importance of safeguarding consumers’ data. However, it’s crucial to stay informed, as rules may vary depending on your location or the specific agency involved.

In some cases, you may encounter administrative fees when requesting specific actions like lifting restrictions or managing your profile. While these instances are less common, it’s always good practice to read the fine print and understand any terms tied to these services. Being proactive can save you from unexpected expenses down the line.

If you decide to utilize a service that requires a fee for additional features or ongoing monitoring, weigh the advantages against the costs. Some might find value in enhanced protection, while others may prefer to stick with the basic options provided at no charge. Remember, knowledge is your ally when it comes to making the best choices for your financial security.

How to Secure Your Financial Profile Without Cost

Protecting your financial identity is crucial in today’s world of rampant scams and identity theft. Luckily, there are straightforward steps you can take to safeguard your personal information at no expense. This process might sound complicated, but it’s quite manageable, and you’ll be taking a significant step towards ensuring your financial safety.

Firstly, you’ll want to reach out to the major agencies that maintain your financial records. Each agency provides a process that allows you to restrict access to your information. This means that potential lenders or service providers will have a harder time viewing your financial history without your permission. It’s a preventative measure that helps keep your details out of the wrong hands.

To start, visit the official websites of the three primary agencies. Here, you will find clear instructions on how to initiate the restriction process. You may need to provide some identifying information, including your name, address, and Social Security number, to verify your identity. Don’t worry; these organizations take your privacy seriously and have secure systems in place.

After submitting your request, you’ll receive a confirmation. Make sure to keep this information handy, as it serves as proof of your action. Additionally, you can set a unique password or PIN. This step adds an extra layer of protection, ensuring that only you can authorize access to your records when necessary.

Finally, remember to periodically check your financial accounts for any unusual activity. Keeping an eye on your statements can alert you to potential fraud before it becomes a bigger issue. With these steps, you’re taking proactive measures to guard your information, all without spending a dime.

Benefits of Freezing Your Credit Report

Taking the step to secure your financial information can provide significant advantages. By restricting access to your personal data, you create a robust barrier against potential identity thieves. It’s like putting a lock on your garden gate–keeping out unwanted visitors while you relax inside.

One major perk is the enhanced security it offers. Without the ability for others to access your financial details, the likelihood of fraud decreases dramatically. This peace of mind allows you to focus on other aspects of your financial life without the constant worry of unauthorized activity.

Additionally, many individuals find that this protective measure simplifies their financial management. With restricted access, you can maintain better control over who can view your information, making it easier to monitor your accounts and spot any irregularities should they arise.

Moreover, the process is typically quick and straightforward. Most services allow you to initiate this protective action online, meaning you can bolster your defenses from the comfort of your home without hassle. It proves to be an effective way to safeguard your financial future, allowing you to feel more confident in your digital interactions.