Exploring the Relationship Between Credit Cards and Installment Loans

When it comes to managing finances, many people find themselves exploring various payment methods and financial tools. Two common options that often come up in discussions are revolving accounts and structured repayment arrangements. While these might seem quite different on the surface, understanding their nuances can help individuals make more informed choices about their financial well-being.

In this article, we will delve into the characteristics of these financial instruments. You might be surprised to learn how similar they can be, despite serving different purposes in our financial lives. By unpacking the key features, we can better understand how they function and when it makes sense to use one over the other. So, let’s get started on this financial journey!

Whether you are looking to spread out payments for a big purchase or simply want the flexibility to borrow as needed, knowing the distinctions and overlaps can empower you to choose the right path. So, buckle up as we explore the intriguing world of financial products and see if they really are as distinct as they appear!

Understanding Financial Instruments

When it comes to managing personal finances, individuals often find themselves navigating through various tools designed to facilitate purchases and manage expenses. Two commonly discussed types include revolving accounts and fixed repayment structures. Each serves a unique purpose and caters to different financial needs, making it essential to grasp their distinct characteristics and uses.

The first type allows consumers to borrow repeatedly up to a specified limit, providing flexibility and the option to carry balances from month to month. Users can choose to pay off their obligations in full or manage smaller payments over time, depending on their budget and cash flow. This system can be convenient, especially for unexpected purchases or emergencies.

In contrast, the second form typically involves borrowing a set amount, which is repaid through scheduled payments over a predetermined timeframe. This approach offers stability since payments remain consistent, making it easier for individuals to plan their budgets. It’s often utilized for larger expenses, like home renovations or vehicle purchases, where borrowers prefer to have a clear repayment timeline.

Understanding these various financial tools is crucial to making informed decisions and effectively managing one’s financial health. By evaluating personal circumstances and spending habits, individuals can select the right option that aligns with their goals, ensuring they utilize resources wisely and responsibly.

Differences Between Credit Cards and Installment Loans

When it comes to borrowing funds, there are several options available, each with its own characteristics and terms. Understanding the distinctions between various financial products can help you make informed decisions when managing your finances. In this section, we will explore how these two popular borrowing methods differ in function, repayment structure, and overall financial impact.

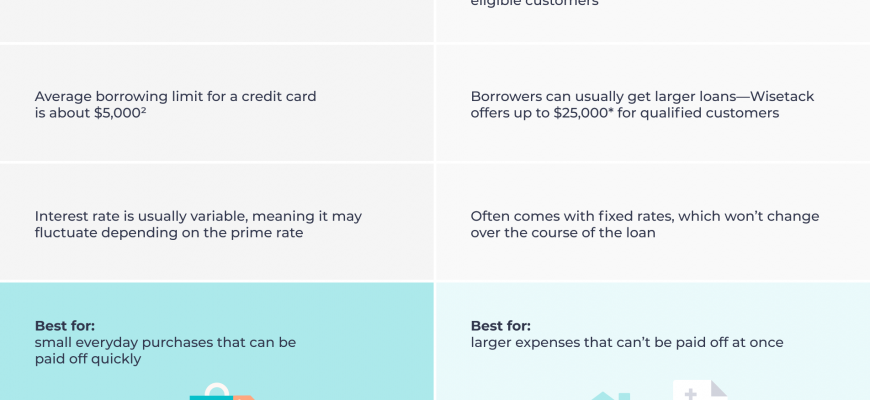

One of the primary variations lies in how funds are accessed. With revolving accounts, you have a set limit that can be utilized multiple times as long as you make the minimum required payments. On the other hand, a traditional financing option provides a lump sum upfront that you repay in fixed amounts over a defined period. This fundamental difference shapes how borrowers engage with these options and manage their expenses.

Another critical distinction is in the flexibility offered by each type of funding. Revolving accounts often allow for greater spontaneity, catering to everyday purchases, while fixed-term agreements typically involve a more static approach to borrowing. You receive a specific amount and agree to pay it back in regular installments, making budgeting easier but less adaptable to sudden changes in spending needs.

Moreover, the impact on interest rates can vary significantly. Flexible financing tends to have dynamic rates that may fluctuate based on various factors, including payment history and market conditions. In contrast, traditional plans usually come with fixed rates that provide borrowers with stability in their payments, facilitating better long-term financial planning.

Lastly, the way each method affects your financial health is worth noting. Revolving accounts can sometimes lead to a cycle of debt if not managed carefully, as ongoing access to funds may encourage overspending. Fixed agreements tend to encourage discipline, as the end date and payment amount are predetermined, which can help instill a sense of accountability among borrowers.

When to Use a Credit Card

Knowing when to pull out a piece of plastic can make a big difference in your financial game. These tools can either work for you or lead you down a path of debt if mismanaged. It’s all about timing and understanding how to harness their potential effectively.

First off, think about emergencies. Having that extra financial cushion can be vital when unexpected expenses arise, like a car breakdown or a medical bill. Instead of scrambling for cash, you’ll have quick access to funds when you need them most.

Another smart move is using your plastic for planned purchases. If you’re shopping for something big, like electronics or travel, it can be wise to utilize your resources, especially if you’re able to pay it off before interest kicks in. Plus, many of these tools come with rewards programs that can help you earn benefits while you spend.

Furthermore, consider using it for online transactions. These instruments can provide an extra layer of security when shopping online, minimizing the risk of fraud. Just ensure you monitor your statements regularly to catch any unauthorized charges promptly.

Finally, it’s a good idea to use such tools to build your credit profile. Responsible usage–like timely payments–can improve your standing and open new doors for better financial opportunities in the future. Just remember, the key lies in strategic usage to avoid falling into a trap of overspending.