Exploring Whether a Credit Application Functions as a Legally Binding Contract

When individuals seek assistance from financial institutions, they often find themselves filling out various forms and documents. These processes are designed to gather essential information about the prospective borrower and assess their suitability for receiving funds. However, the implications of these submissions can sometimes be unclear, leading to questions about their true nature.

Essentially, when someone expresses their intention to receive monetary support, it’s crucial to understand the responsibilities and obligations that may arise from such an intention. This leads us to ponder: are these preliminary steps merely a gateway to approval, or do they carry deeper legal significance? It’s important to delve into what these inquiries entail and how they relate to the broader financial landscape.

As we explore this topic further, we’ll uncover the nuances of these interactions, shedding light on the relationships formed between applicants and financial entities. This discussion will help clarify whether such processes create binding obligations or if they’re simply part of a larger dialogue in the realm of personal finance.

Understanding Financial Requests and Agreements

When individuals seek to borrow money or acquire a service, they often encounter a process that requires them to disclose personal and financial information. This process serves as a means to evaluate a person’s ability to repay the borrowed funds or fulfill the agreed-upon terms. It’s essential to recognize the implications of this procedure and how it may lead to a formal understanding between the parties involved.

At its core, providing details about one’s financial situation serves not just as a means of assessment, but also as a foundation for a binding arrangement. Once the assessing party reviews the submitted information, a decision is made that could result in various obligations for both the requester and the lender or service provider. This dynamic elevates the initial disclosure from a mere conversation to a framework of expectations.

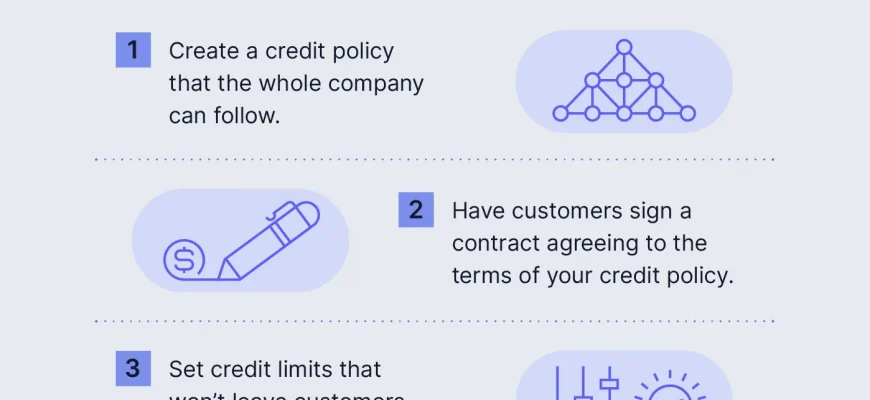

Establishing Terms: Once the approval is granted, it leads to a phase where specific terms are outlined. These stipulations clarify what is expected from each side, including repayment schedules, interest, and any other responsibilities. Here, clarity is crucial to avoid misunderstandings that could arise later. The initial submission essentially becomes a stepping stone towards a more formal understanding.

Legal Considerations: While submitting personal details might seem informal, it carries legal weight. Once the arrangement is agreed upon, both parties are typically bound by those stipulations. It’s wise for individuals to fully grasp the implications of their disclosures and the commitments they are entering into, as it can have lasting effects on their financial well-being.

Ultimately, the journey from the initial request to the formal agreement is significant. Recognizing the transition from sharing information to entering a relationship governed by specific terms can aid individuals in making informed choices. Understanding this process not only helps in navigating the financial landscape but also empowers people to approach similar situations with confidence.

Legal Implications of Credit Applications

When individuals seek financial assistance, there are various forms they often fill out. Understanding the legal ramifications associated with these processes is crucial for both borrowers and lenders alike. Misunderstanding these implications can lead to unintended consequences.

One important aspect to consider is that the information provided during these procedures can have significant legal weight. Here are some key points to think about:

- Disclosure of Information: Applicants must provide accurate details about their financial history. Failing to do so may result in serious repercussions.

- Assessment of Eligibility: Lenders have the right to evaluate the submitted material to gauge risk and make informed decisions.

- Legal Obligations: Once submitted, an individual’s details can create binding responsibilities that may require adherence to specific terms.

Furthermore, it’s essential to understand what happens if any discrepancies arise. The repercussions can include:

- Legal action for providing false statements.

- Denial of future financial opportunities.

- Impact on one’s creditworthiness and reputation within financial circles.

Ultimately, being cognizant of the legal aspects involved in these processes can help individuals navigate the financial landscape more effectively and responsibly.

What Happens After You Apply?

Once you’ve submitted your request for financing, the journey has only just begun. Although it might feel like you’re in a holding pattern, various steps are unfolding behind the scenes to assess your situation and determine the next course of action.

Initially, the financial institution will evaluate the information you provided, examining your background and financial health. This stage is crucial, as it helps them gauge the level of risk involved in extending you funds. You can expect to receive notifications regarding any additional documentation they may require or updates on your status.

As they sift through your details, it’s not uncommon for them to reach out with questions or clarifications. This exchange can help provide a clearer picture of your financial profile, ensuring all aspects are considered before a decision is made.

Once the evaluation is complete, you will typically receive a formal response about the outcomes. This communication may include terms, conditions, and any next steps you should take moving forward. It’s essential to review everything carefully, as the terms will directly affect your financial commitments in the future.

In summary, the period following your submission is filled with assessments, inquiries, and ultimately a decision that will shape your financial pathway. Staying informed and engaged during this process can make a significant difference in your experience.