Exploring the Pros and Cons of a Career as a Credit Analyst

When exploring potential paths in the finance sector, one might wonder about the responsibilities and rewards associated with a role focused on assessing risks and determining the viability of lending to individuals and organizations. This profession plays a critical role in shaping financial decisions and strategies, ultimately influencing both businesses and consumers. But what does it really entail, and is it a fulfilling choice for aspiring professionals?

Individuals in this field dive deep into numbers and data, analyzing trends and making informed predictions. They work closely with various stakeholders, helping to ensure that financial transactions are not only profitable but also aligned with the organization’s goals. This position demands a blend of analytical prowess and interpersonal skills, creating a dynamic work environment that can be both challenging and rewarding.

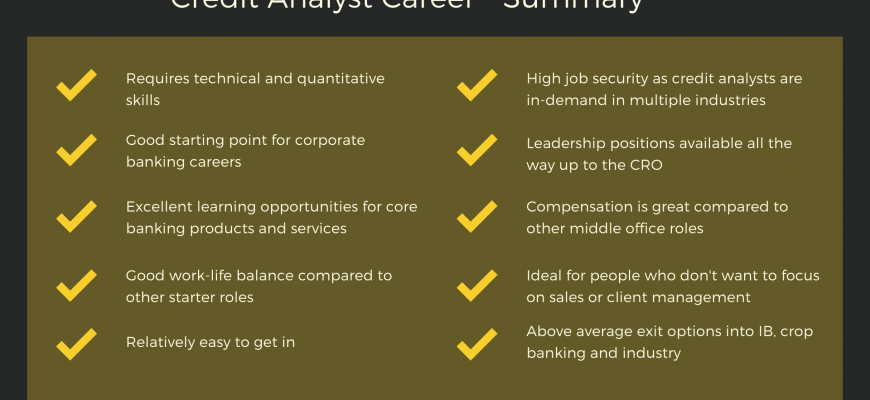

As you consider whether this line of work aligns with your interests and strengths, it’s essential to weigh the pros and cons. From the intellectual stimulation of problem-solving to the potential for career advancement, this role offers a unique blend of experiences. Whether you’re a numbers enthusiast or someone who thrives in a collaborative atmosphere, understanding the intricacies of this profession is key to determining if it’s the right fit for you.

Responsibilities and Skills of a Credit Analyst

In this section, let’s explore the key duties and necessary abilities that individuals in this profession should possess. It’s a role that requires a blend of analytical thinking, attention to detail, and effective communication skills to assess the financial standing of individuals or organizations.

Key Responsibilities:

First and foremost, one must thoroughly evaluate financial documents such as balance sheets and income statements to gauge potential risks. Additionally, conducting comprehensive market research and benchmarking is crucial for making informed assessments. Crafting thoughtful reports and presenting findings to stakeholders ensures transparency and aids decision-making processes.

Essential Skills:

To excel in this field, proficiency in analytical tools and software is vital for efficient data handling and interpretation. Strong numerical skills are a must, coupled with the ability to communicate complex information clearly. Moreover, having an eye for detail and critical thinking capabilities allows for the identification of patterns and anomalies that may indicate financial distress.

Ultimately, balancing these responsibilities and skills can lead to a successful and rewarding career in this dynamic area of finance.

Career Prospects in Credit Analysis

Exploring the future opportunities within the financial assessment sector can be quite exciting. Professionals in this field play a crucial role in evaluating the feasibility of lending and investment decisions. As the economy evolves, the need for skilled individuals who can interpret financial data and assess risk remains strong.

The demand for expertise in this area continues to grow, thanks to ever-increasing complexities in financial markets. Organizations constantly seek talented individuals who can provide insightful evaluations and ensure sound fiscal practices. This presents a myriad of openings in various industries ranging from banking to corporate finance.

Moreover, advancements in technology and data analysis are transforming the landscape. As the reliance on sophisticated analytical tools increases, staying ahead of the curve becomes essential. Professionals who can harness these technologies to improve assessments will find themselves in high demand.

For those considering a path in this arena, the potential for career progression is promising. With experience, individuals can advance to senior roles, take on managerial responsibilities, or even transition into related fields like risk management or portfolio strategy. Networking and continuous education also play a vital role in enhancing one’s career trajectory.

Comparing Financial Roles

When considering a career in finance, it’s essential to explore various professions within the industry and how they stack up against one another. Each role comes with its own responsibilities, skill sets, and opportunities for growth, making it crucial to understand how they differ. Let’s dive into how one position compares to others in the financial realm.

For instance, while some professionals focus on evaluating the creditworthiness of individuals and organizations, others might specialize in market analysis or investment strategies. The analytical approach in this field often involves assessing data and trends, but the specific focus varies greatly. This diversity means that some may find themselves drawn to the more interpersonal aspects of finance, like relationship management, while others may prefer a more data-centric environment.

The role involving risk assessment entails diving deep into financial statements and economic scenarios. In contrast, positions centered around portfolio management require a more hands-on approach to decision-making and client interaction. Balancing these different aspects can help you identify which path aligns with your personal strengths and career aspirations.

Another role worth noting is that of a financial planner, where the focus is primarily on helping clients achieve their personal financial goals. This role emphasizes communication and relationship-building, differing significantly from the investigative and analytical nature of the aforementioned position. Understanding these nuances can illuminate which areas of finance resonate most with your skills and interests.

Ultimately, while exploring various avenues in finance, consider what aspects excite you the most. Whether you prefer working with data, engaging with clients, or managing investments, each role offers unique challenges and rewards. The key is to find the right fit for your career ambitions and lifestyle.