Is a Credit Reflecting an Increase or a Decrease in Your Financial Situation?

When diving into the world of finance, one often encounters a variety of terms that can be quite puzzling. It’s essential to grasp these concepts to make informed decisions, whether you’re managing personal expenses, evaluating business performance, or diving into investment opportunities. The language of finance can sometimes feel like a different universe, filled with jargon that may leave you scratching your head.

One central question arises when discussing financial transactions: Does an entry represent a gain or a loss? This fundamental query is crucial for any individual looking to navigate their financial landscape effectively. Misunderstanding this could lead to unwarranted confusion regarding one’s financial standing or the performance of an organization.

In this exploration, we will break down this concept, providing clarity and helping you understand how various entries impact your overall financial health. Let’s embark on this journey to demystify the intricacies of financial terminology, so you can engage with your finances more confidently.

Understanding Financial Concepts

When diving into the world of personal finance and accounting, one term often stands out and sparks conversation. It refers to the mechanisms that either expand or contract available resources within a financial framework. This notion plays a crucial role in how individuals and businesses manage their monetary affairs, impacting everything from budgeting to investment choices.

At its core, this concept revolves around the dynamics of resources flowing in and out. It involves recognizing how certain transactions can augment one’s financial standing, enabling more proactive and strategic planning. Conversely, other actions might be seen as drawing down available assets, which requires careful consideration and management to avoid potential pitfalls.

Understanding these transactions can empower individuals to make informed decisions. Grasping the broader implications helps one not only navigate their personal finances but also enhances comprehension of financial statements and economic activities. The dance of assets and liabilities within this context highlights the importance of monitoring and evaluating each decision carefully.

In summary, having a solid grasp of these financial notions equips individuals and businesses alike to thrive in complex environments. Whether it’s building wealth or ensuring sustainability, being mindful of how resources are optimized is key to achieving long-term goals.

How Credits Affect Your Financial Statement

When it comes to managing your finances, understanding how certain entries impact your overall financial picture is crucial. Each transaction can have a specific role, shaping the way you view your financial health. Learning about these entries can equip you with the knowledge to make informed decisions that benefit your economic situation.

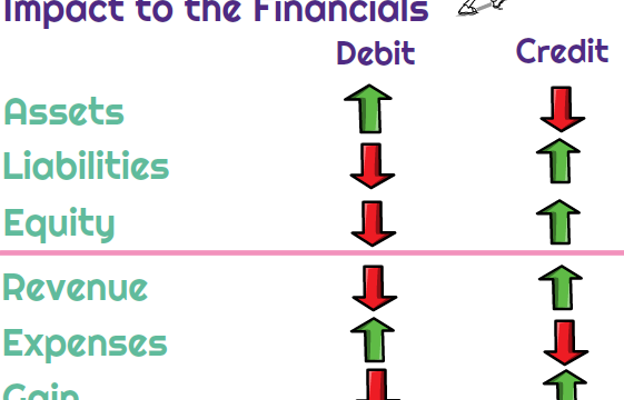

In a typical financial document, specific actions might lead to an advancement in your available resources, while others may point to a reduction. These movements are represented in various forms, such as assets or liabilities. Recognizing the nature of these transactions helps you grasp how they influence your overall balance and allows you to strategically plan your finances.

For instance, when funds are added through specific transactions, your overall assets rise, which can enhance your situation when applying for loans or assessing your net worth. On the flip side, certain expenditures might indicate a drop in resources, affecting your liquidity and financial stability. Understanding this balance can guide you in making smarter choices down the line.

Ultimately, becoming familiar with how these entries function will empower you to navigate your financial landscape more effectively. By keeping an eye on your financial statements, you can optimize your decisions, ensuring you maintain a strong economic position now and in the future.

Implications of Credit on Borrowing Power

The relationship between borrowing capacity and the entities that lend money is crucial in today’s financial landscape. When individuals seek to acquire additional funds, a number of factors come into play that can either empower or restrict their potential. Understanding how various elements interact is essential for anyone looking to navigate this complex environment.

One of the primary factors influencing borrowing ability is the history of financial behavior. Lenders often assess past patterns of managing obligations, which can significantly affect the terms offered for new loans. A positive track record can lead to more favorable conditions, while a spotty history might result in limitations or higher costs.

Moreover, interest rates and repayment timelines are directly tied to this dynamic. When individuals demonstrate responsible financial habits, they are often rewarded with lower rates, making it easier to meet repayment requirements. Conversely, those with less enticing profiles may face steeper rates, ultimately constraining their options.

It’s also essential to note that external economic factors play a role in shaping this scenario. Market conditions, such as inflation or employment rates, often influence lending policies. This means that even an individual with stellar habits could find their opportunities varying based on broader financial trends.

In summary, the implications of one’s financial history and market conditions are pivotal when considering the ability to access funds. Understanding these nuances can empower individuals to make informed decisions and strategically enhance their financial opportunities.