Understanding Whether a Good Credit Score Truly Matters for Your Financial Health

In today’s financial landscape, maintaining a solid standing can open many doors. Whether you’re considering a loan, aiming for a new apartment, or planning a big purchase, the importance of your financial reputation cannot be overstated. But what does it really mean to have a favorable standing? Are we discussing numbers, perceptions, or something more profound?

While navigating through various financial opportunities, individuals often find themselves questioning the value of a robust reputation. It’s not just about the digits on a screen; it reflects your ability to manage finances wisely and meet obligations over time. This perception affects your borrowing potential, the interest rates available to you, and even the overall trust that lenders place in you. But how much does this matter? And what are the tangible benefits of being perceived positively in the financial world?

As we delve deeper into this topic, we’ll explore the implications of maintaining a strong financial image and how it can impact various aspects of daily life. We will also discuss how individuals can achieve and sustain this level of esteem in the eyes of lenders and institutions. Join us as we explore the intricacies of this vital component of personal finance.

Understanding Ratings: Importance

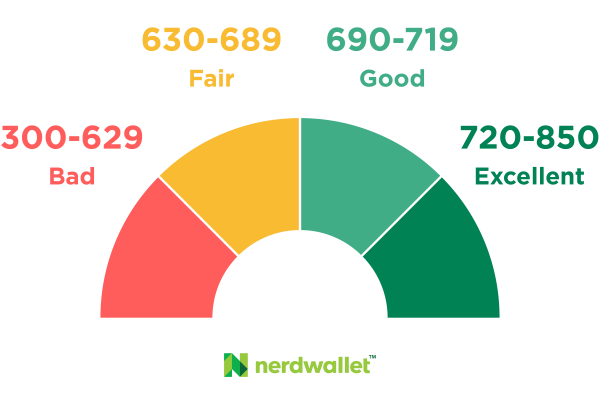

When it comes to managing your finances, having a solid understanding of numerical evaluations can make a huge difference. These numerical representations reflect your financial history and behavior, influencing various aspects of your economic life. They serve as a vital tool for lenders, helping them assess your reliability and predict future financial interactions.

The weight of these evaluations cannot be underestimated; they can determine your eligibility for loans, influence interest rates, and even affect rental agreements. Essentially, maintaining a favorable standing in this area opens doors to better offers and opportunities, allowing you to navigate your financial future with confidence.

Furthermore, being aware of how these evaluations work empowers you to take control of your financial decisions. By understanding what factors contribute to your rating, you can actively work towards improving it, ensuring that you present yourself as a trustworthy borrower. In a world where financial decisions are often based on these metrics, knowledge is indeed power.

Factors Influencing Your Credit Rating

Understanding what impacts your financial reputation is crucial for anyone looking to make informed decisions. Various elements come into play that can either enhance or diminish how lenders perceive your financial habits. Let’s explore these aspects in detail to help you navigate your financial journey more effectively.

Payment History: This is a pivotal factor. Consistently meeting your obligations showcases reliability and financial responsibility. Late payments, on the other hand, can leave a mark that might take time to recover from.

Credit Utilization: This refers to how much of your available credit you are using at any given time. Keeping this ratio low signals that you manage your resources wisely. Striking a balance is essential; using too much could raise red flags.

Length of Credit History: The duration that you’ve had access to funds and how you’ve managed them over time matters too. A longer history tends to provide a more comprehensive view of your behavior, which may work in your favor.

Types of Accounts: Having a diverse mix of financial products can be beneficial. Lenders appreciate borrowers who can handle various types of accounts, such as loans and revolving credit, as it demonstrates adaptability and financial understanding.

New Inquiries: Each time you apply for new financing, a hard inquiry is recorded. While a few inquiries may not be detrimental, numerous applications in a short time can signal desperation, which lenders often view unfavorably.

By keeping these aspects in mind, you can take meaningful steps towards improving how lenders evaluate your financial habits, setting the stage for better opportunities in the future.

Improving Your Financial Health Effectively

When it comes to managing your financial standing, there are plenty of strategies that can lead to a more favorable situation. Focusing on the right habits and practices can help you achieve your financial aspirations. It’s all about being mindful of how your actions impact your overall financial well-being.

First and foremost, keeping an eye on your payment history is crucial. Making payments on time can significantly benefit your financial image. Additionally, staying within your limits and avoiding unnecessary debt can enhance your profile over time. This discipline creates a solid foundation for better financial interactions in the future.

Another vital aspect involves monitoring your financial evaluations regularly. By understanding where you currently stand, you can identify areas that require improvement. Utilizing various resources to access this information allows you to make informed decisions, paving the way for enhancement.

It’s also essential to cultivate a balanced mix of accounts. Having different types of financial products, such as loans and revolving accounts, can reflect positively on your profile. Just remember to manage them wisely and not overextend yourself.

Lastly, if you face any setbacks, don’t hesitate to reach out for guidance. Consulting with professionals can provide valuable insights and strategies tailored to your unique situation. Remember, the journey to improving your financial health is ongoing, and every step you take counts.