Comprehensive Guide to Understanding and Using a Credit Card Interest Calculator

Managing your finances can often feel like navigating a maze, especially when it comes to borrowed money. Many individuals find themselves in situations where they must rely on external funds to cover unexpected expenses or seize opportunities. It’s crucial to comprehend how these borrowing tools work and what long-term implications they might have on your budget.

One essential aspect to consider is how the applied charges accumulate over time. When you utilize these funding options, it’s important to know how the amounts add up, impacting your overall repayment strategy. By gaining insight into this process, you can make informed decisions and avoid unwelcome surprises when the time comes to settle your dues.

In this section, we’ll delve into the various factors that influence the total amount you owe and uncover techniques to effectively estimate your future payments. Understanding these components not only empowers you to manage your financial commitments better but also helps you to make smarter choices in the long run.

Understanding Credit Card Interest Rates

When managing your finances, it’s essential to grasp how borrowing costs work. These expenses can significantly impact your overall budget, especially if you find yourself relying on funds that are not immediately available. Let’s break down the mechanics of these charges, so you can make informed decisions.

First off, here are some key factors to keep in mind:

- Annual Percentage Rate (APR): This percentage indicates the yearly cost of borrowing. It’s a crucial figure that can vary widely.

- Variable vs. Fixed Rates: Some lenders offer rates that change based on the market, while others maintain a consistent rate over time.

- Grace Period: Many providers offer a period during which you can pay off your balance without incurring additional charges. Knowing the duration of this period can save you money.

Understanding how these elements work together is vital. For example, a lower APR is generally more favorable, but it’s also important to consider how often the rate may adjust. Do your homework to find out what type of rate you are dealing with.

Moreover, budgeting smartly can help avoid additional charges altogether. Keeping an eye on your spending and paying off your balance regularly will ensure that you don’t fall into a cycle of debt that may lead to high costs over time.

In essence, being knowledgeable about borrowing fees enables you to navigate your financial landscape more effectively. Take the time to explore different offers, read the fine print, and choose what aligns best with your financial goals.

How to Calculate Charges on Balances

Understanding how to determine the costs associated with your outstanding amounts can help you manage your finances more effectively. It’s a crucial skill that allows you to navigate your obligations and make informed decisions. Whether it’s about managing expenses or planning for repayments, having a clear grasp of these calculations is essential.

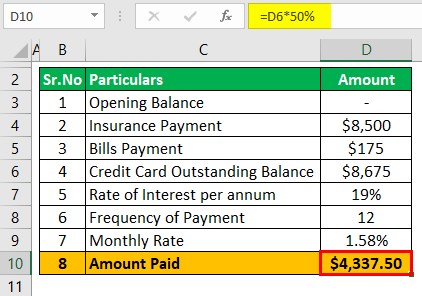

Step 1: Start by identifying the total amount that you owe. This figure serves as the foundation for your calculations. Make sure to include any additional fees that may apply.

Step 2: Next, you need to know the annual percentage rate (APR) that applies to your outstanding balance. This rate is typically expressed as a yearly figure and can be found in your account details.

Step 3: To find out how much you will incur over a specific time frame, convert the APR to a daily rate by dividing it by 365 (the number of days in a year). This provides a clearer picture of daily charges.

Step 4: Multiply the daily rate by your outstanding amount to determine the daily cost. This number gives you a straightforward understanding of how much you’re accumulating each day.

Step 5: Finally, if you want to know the overall cost for a certain period, simply multiply the daily amount by the number of days in that period. This will provide you with a total that reflects your financial responsibility over the chosen timeframe.

By following these straightforward steps, you can get a better idea of how the costs on your balances can add up, and use this knowledge to keep your finances on track.

Strategies to Minimize Credit Card Interest

Managing borrowed funds wisely can significantly impact your overall financial health. By implementing effective techniques, you can reduce the amount you owe over time, yielding substantial savings. Here are some practical strategies to keep in mind.

Pay More Than the Minimum – One of the simplest yet most effective ways to lower your total payoff is to consistently pay more than the required minimum amount. Doing so will not only shorten the duration of your balance but also help diminish the total sum owed.

Choose the Right Payment Timing – Timing can play a crucial role. If you make payments right after a purchase, you can decrease the balance before your statement is generated. This move can help improve your financial standing faster.

Take Advantage of Rewards and Promotions – Many financial institutions offer enticing deals, such as 0% promotional rates for new users or balance transfers. Capitalizing on these opportunities can provide a breather from accumulating charges.

Maintain a Solid Payment Schedule – Setting reminders or automating payments can ensure you never miss a due date. Missing payments often leads to additional fees, which can add up quickly and create more burdens.

Consider Debt Consolidation – If you have multiple borrowing sources, consolidating them into a single low-rate option can be a smart choice. This strategy simplifies your payments and usually results in more favorable terms.

Regularly Review Your Spending Habits – Keeping track of your expenses can reveal spending patterns that you might need to adjust. By prioritizing essential purchases and reducing frivolous expenses, you can minimize reliance on borrowed funds.

Taking the time to implement these thoughtful approaches can pave the way toward more financial freedom and less stress. Start today to see tangible results in managing your obligations.