Explore Three Effective Strategies for Securing Financial Aid Opportunities

Navigating the world of support can often feel overwhelming, yet there are many opportunities waiting to be discovered. Each route offers unique advantages and can significantly ease the burden of expenses associated with education or other pursuits. With some exploration and research, individuals can uncover options that align with their personal and professional goals.

From scholarships that recognize excellence and dedication, to grants designed to assist those in need, the landscape is rich with possibilities. Additionally, programs offering loans can serve as a valuable resource, enabling access to resources that might otherwise be out of reach. The key is understanding which avenues best suit one’s circumstances and aspirations.

By taking the initiative to explore and apply for available resources, one can transform financial challenges into stepping stones toward success. Embracing these opportunities not only enhances educational experiences but also paves the way for a brighter future. So, let’s dive into some recommended approaches that can lead to deserved support.

Understanding Government Financial Assistance

Government support programs offer a safety net for individuals and families in need. These initiatives aim to alleviate the burden of expenses and help people achieve greater stability. They’ve become an essential resource for those encountering various financial challenges, from education to daily living costs.

One popular option includes grants, which provide funds that don’t need to be repaid. These are often awarded based on specific criteria and can significantly reduce educational expenses. Another form is low-interest loans, designed to help cover costs while ensuring manageable repayment terms. Lastly, scholarships represent an excellent opportunity for students, as they can be awarded based on merit, need, or other achievements, providing vital assistance in pursuing higher education.

Exploring these avenues requires research and understanding of eligibility requirements, but the potential benefits can be life-changing. Accessing resources like government websites or local organizations can help clarify the options available, guiding individuals toward the best solutions for their circumstances.

Exploring Scholarships and Grants Opportunities

Diving into the world of financial support can be an enriching experience, as it opens doors to numerous possibilities. Numerous organizations and institutions are eager to lend a helping hand to students, making education more accessible. By understanding what is out there, individuals can discover valuable resources that may significantly alleviate the cost of their studies.

Scholarships are often merit-based, celebrating achievements in academics, athletics, or the arts. They typically do not require repayment, making them an attractive option for many learners. Various foundations, universities, and even companies offer scholarships tailored to specific criteria, so it’s worth investigating all available avenues that align with personal strengths and aspirations.

Grants, on the other hand, usually focus on financial need. Government entities and educational institutions provide these funds to support students who might struggle to afford their education. Exploring local, state, and federal opportunities can uncover hidden gems that provide significant assistance, ensuring a smoother path toward educational goals.

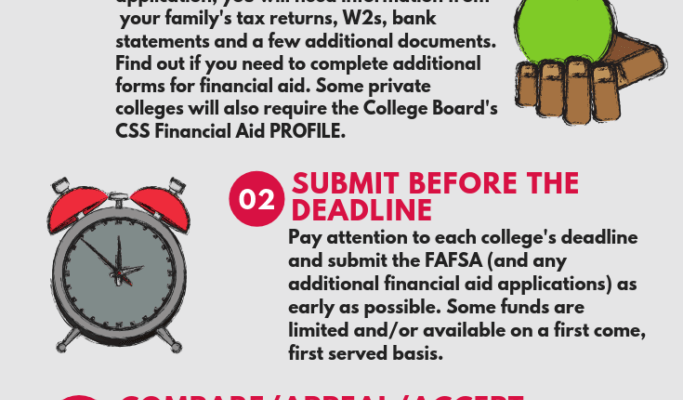

Both scholarships and grants can be combined to create a comprehensive support package, allowing students to concentrate on their studies rather than worrying about tuition fees. The key is to start early, conduct thorough research, and tailor applications to highlight unique qualities and circumstances.

Leveraging Student Loans and Repayment Plans

Student loans can be a useful tool in managing education expenses, allowing individuals to pursue their academic goals even when resources are limited. Navigating through the options available isn’t always straightforward, but understanding how to use these loans effectively can make a significant difference in one’s financial journey.

When exploring student loans, it’s essential to know the types available. Here are some common categories:

- Federal Loans: These are often subsidized, meaning the government covers the interest while you’re in school, making them a more favorable choice.

- Private Loans: Offered by banks or credit unions, these may come with higher interest rates and less flexible repayment options.

- Graduate and Parent Loans: While these target advanced degree seekers and parents of students, they often carry different terms and conditions.

Once you’ve secured funding, paying back those amounts can seem daunting. However, various repayment strategies can ease the burden:

- Income-Driven Repayment Plans: These adjust monthly payments based on earnings, making them more manageable for those with fluctuating incomes.

- Graduated Repayment: Starting with lower payments that gradually increase over time, this plan is designed for those expecting their income to rise significantly.

- Loan Forgiveness Programs: Available for public service workers and certain professions, these can eliminate remaining balances after a set period of consistent payments.

By understanding these options and how to manage repayment effectively, borrowers can minimize financial strain while focusing on their educational aspirations.