Exploring the Process and Benefits of Applying for a Credit Card

Venturing into the world of financial tools can be both exciting and daunting. Many individuals find themselves considering options that can enhance their purchasing power and provide convenience in everyday transactions. Navigating these choices may come with a host of questions and uncertainties, but understanding the basic concepts is crucial to making informed decisions.

In this section, we’ll dive into the essentials of acquiring one of these financial instruments. It’s not just about filling out a form; it’s a step toward financial management and personal growth. Whether you seek to build your credit history, earn rewards, or simply enjoy the perks that come with such tools, knowing the process is vital.

We’ll explore various aspects, from the prerequisites needed to take the plunge to the advantages that await you on the other side. By the end, you’ll be better equipped to navigate this new terrain with confidence and clarity.

Understanding the Benefits of Plastic Money

When it comes to managing finances, having the right tools at your disposal can make a world of difference. One such tool is a special type of payment method that offers a host of advantages beyond simply making purchases. Whether it’s earning rewards, building a solid financial history, or gaining access to emergency funds, these financial instruments have much to offer.

One of the standout features is the ability to earn rewards for spending. Many people enjoy receiving points, cash back, or travel miles just for making everyday purchases. This turns routine expenses into opportunities to save or indulge later. Additionally, responsible usage of this payment method helps individuals establish and improve their creditworthiness, which can be invaluable when seeking loans or other financial products in the future.

In case of unforeseen expenses, having this financial option can also provide a safety net. It allows users to handle emergencies without derailing their budget. Moreover, numerous providers also offer purchase protection, fraud monitoring, and various insurances that add another layer of security to transactions. With all these benefits, it’s clear why this financial tool has become a popular choice for many people today.

Steps to Successfully Obtain a Financial Instrument

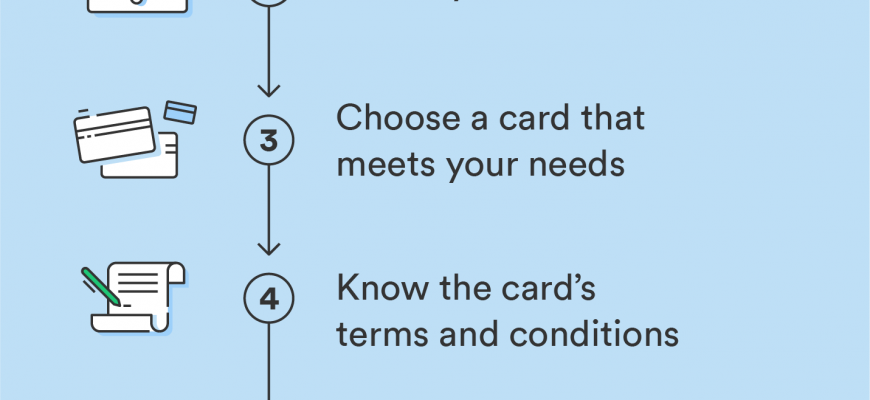

Getting a financial instrument can open up a world of opportunities, but the process might seem a bit daunting at first. With a little bit of knowledge and preparation, you can navigate through the essential steps and increase your chances of being accepted. Let’s break down the journey into manageable parts, making it easier for you to achieve your goals.

The first step is to assess your financial situation. Understanding your income, expenses, and any existing obligations will give you a clearer picture of what you can handle. This preparation ensures that you’re aware of your financial standing before moving ahead.

Next, it’s crucial to review your credit history. Request your credit report and check for any discrepancies or issues that might affect your application. Addressing mistakes beforehand can significantly enhance your profile and make you a more attractive candidate.

Afterward, research the various options available in the market. Different programs offer varying benefits, interest rates, and terms. By comparing these offerings, you can choose one that aligns with your needs and preferences.

Gathering the necessary documentation is also vital. Be sure to have your identification, income proof, and any other required paperwork ready. Having everything organized will streamline the process, making it less stressful.

Finally, complete the submission process accurately. Take your time to fill out the required forms with careful attention to detail. Once you’ve checked everything twice, you can submit your information with confidence and wait for the next steps.

Following these steps will help you navigate the journey successfully and set you on the path toward achieving your financial aspirations.

Common Mistakes to Avoid When Applying

When seeking a new financial instrument, it’s essential to navigate the process smoothly. Many individuals make certain blunders that can negatively impact their chances or lead to unfavorable terms. Let’s explore some typical pitfalls you should steer clear of during this important journey.

Neglecting Research: One of the biggest errors is failing to thoroughly investigate the options available. Skimming over the details can result in overlooking fees, rewards, or terms that don’t align with your needs.

Ignoring Your Credit History: It’s crucial to be aware of your credit standing before diving in. Many applicants overlook reviewing their credit reports, which can lead to surprises when they encounter unexpected denials or poor offers.

Overlooking the Fine Print: It’s easy to get caught up in attractive promotions and benefits, but always remember to read the terms and conditions. Hidden clauses can turn a great deal into a costly mistake.

Submitting Multiple Requests: While exploring your options is wise, making several inquiries at once can hurt your standing. This often results in hard inquiries that might signal financial instability to lenders.

Underestimating Income Documentation: Some individuals fail to prepare their financial records adequately. Providing incomplete or inaccurate information may generate delays or outright rejections.

Rushing the Process: Finally, don’t rush this important decision. Taking your time allows you to make an informed choice that aligns with your financial wellness goals.