A Comprehensive Guide on Using Your Credit Card with Zelle

In today’s fast-paced world, sending money to friends or family has never been easier. There are numerous applications available that allow users to move their funds effortlessly. However, many individuals may find themselves unsure of the best approach to facilitate these transactions–especially when it comes to utilizing various payment options.

Understanding the process can make all the difference. Whether you’re looking to settle a lunch bill or send a gift, knowing how to navigate these services efficiently can save time and eliminate potential headaches. Let’s explore some handy tips and tricks to enhance your experience and ensure smooth transfers.

It’s important to recognize that not all methods of sending money are created equal. Each offers distinct features and benefits, and being informed can help you choose the perfect fit for your specific needs. This guide will delve into the intricacies of using alternative payment methods for transactions, providing insight into how to maximize convenience while ensuring safety and security.

Understanding Payment System

In today’s fast-paced world, transferring funds has become incredibly convenient. This innovative solution allows individuals to send and receive money quickly, making it easier to handle everyday transactions. It aims to eliminate the hassles often associated with traditional methods, offering a seamless experience for both parties involved.

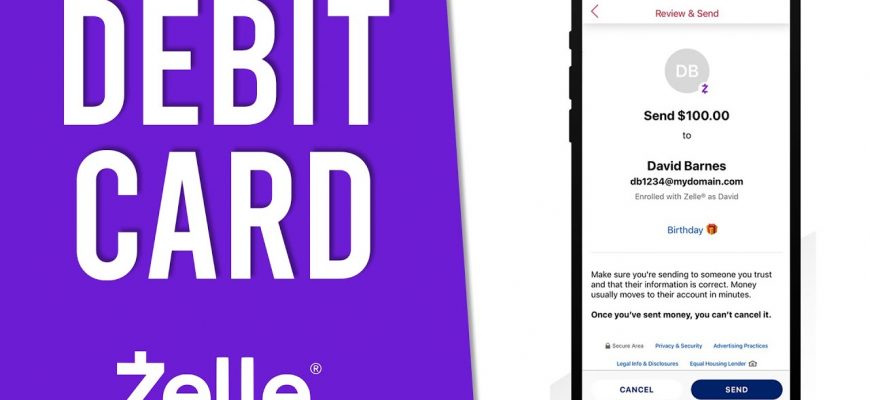

This particular system works through a mobile app or web interface linked to a user’s bank account. By using just an email address or phone number, users can initiate transfers within minutes. This process is designed to ensure that transactions are secure and straightforward, catering to the needs of a growing digital economy.

As more people embrace electronic payment methods, understanding how this platform operates becomes essential. By familiarizing yourself with the features it offers, you can make the most of your financial interactions, whether it’s splitting a bill among friends or sending funds to family members. The flexibility and efficiency of this method make it a popular choice for many, reshaping how we think about transactions.

Using Credit Cards for Transactions

Making payments online has never been easier, and using alternative funding methods can offer convenience and speed. Many people enjoy the flexibility of utilizing a specific type of financial instrument for their transactions, which allows for swift exchanges without the need for immediate cash on hand.

One major benefit of leveraging this popular payment option is the added layer of security it provides. When you opt for an electronic transfer using such a method, your sensitive information is often shielded from potential fraud. Moreover, the ability to earn rewards or cashback on everyday purchases can be an appealing aspect for many users.

While considering this approach, it’s essential to familiarize yourself with any applicable fees or restrictions. Not all platforms accept this method, so doing some research can save you from unexpected surprises during the transaction process. Always ensure that you’re aware of the terms before proceeding, as this can make a significant difference in your user experience.

Using this payment method is about finding the perfect balance between convenience and security. Embrace the advantages, but stay informed to make the most out of your digital financial activities.

Alternatives to Zelle for Payments

When it comes to sending money or settling bills, there are several options available that cater to different needs. These services can provide users with the convenience and flexibility they seek, often with unique features that might suit specific situations better.

Venmo is a popular choice among younger demographics. It allows users to easily transfer funds to friends and family, all while providing a social feed to share transactions. This aspect makes it enjoyable for many, as it adds a layer of social interaction to financial exchanges.

PayPal is another heavyweight in the realm of online transactions. Known for its robust security measures, it accommodates both personal and business payments. Users appreciate the ability to link various bank accounts and utilize a user-friendly app to manage their funds efficiently.

Cash App has gained traction due to its simplicity and user-friendly interface. It offers the ability to send money quickly, along with features like investing in stocks and Bitcoin. For those looking for a streamlined experience with additional financial options, this is a great contender.

Google Pay and Apple Pay are great choices if you’re already integrated into their respective ecosystems. These platforms allow seamless transactions in stores and online, making them perfect for tech-savvy users who value efficiency.

Each of these alternatives has its pros and cons, so exploring them can help determine which one aligns best with specific needs. Whether prioritizing ease of use, security, or additional features, there’s likely a service that fits the bill perfectly.