A Comprehensive Guide to Understanding Your Financial Aid Award Letter

Navigating the path of higher education can be overwhelming, especially when it comes to deciphering the documentation that outlines the assistance you’ll receive. When you receive that important communication from your institution, it’s crucial to grasp its contents fully. This guidance will help you unravel what’s included, allowing you to make informed decisions for your academic journey.

Many students find themselves puzzled by the details presented in this essential correspondence. Whether it’s the variety of funding sources, amounts, or conditions tied to them, getting a clear picture is vital. By breaking down each component, you can understand not just what is being offered, but also how to effectively utilize it for your educational expenses.

Diving into the specifics can open the door to a clearer understanding of your opportunities. You’ll be better positioned to plan your finances, seek additional resources if necessary, and ultimately, focus on what truly matters: your studies and personal growth. Let’s get started on making sense of this important document.

Understanding Your Financial Aid Offer

When you receive your assistance proposal, it can feel a bit overwhelming at first. This document is crucial as it outlines the resources available to help you fund your education. Taking some time to dissect the information will empower you to make informed decisions.

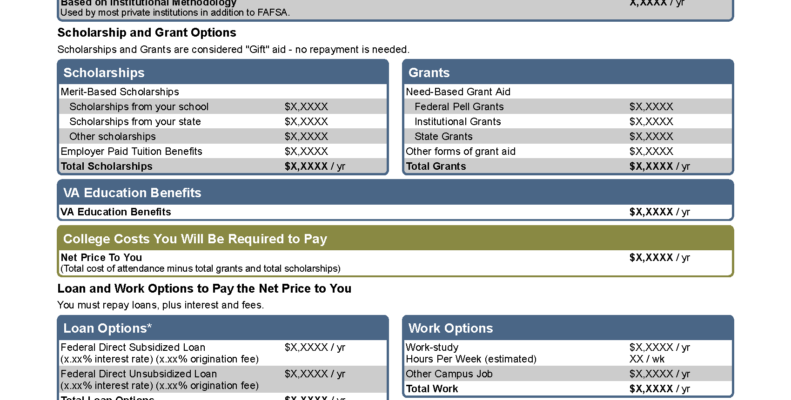

Start by identifying the different components of the offer. You’ll likely encounter grants, scholarships, loans, and work-study opportunities. Each type has its own terms and implications, so knowing what you’re looking at is essential. For instance, grants and scholarships are often considered ‘free money,’ while loans will need to be repaid down the line.

Next, pay attention to the amounts listed. They might fluctuate based on factors like your academic progress or changes in enrollment status. It’s wise to ask questions or seek clarification on any points that seem unclear. Remember, understanding the terms helps you avoid unnecessary surprises later.

Finally, take a moment to compare your options. If this funding doesn’t cover all your expenses, you may need to explore other alternatives. Being proactive about financial strategies can ease the burden and allow you to focus more on your studies rather than worrying about your finances.

Deciphering Key Terms and Figures

Understanding the jargon and numerical values in your support documentation can seem overwhelming at first. However, breaking down each component makes it easier to grasp what assistance is available to you. Let’s explore some of the important terms and numbers that you’ll likely encounter in this crucial paperwork.

Cost of Attendance (COA) refers to the total expenses for a student during an academic year. This figure typically includes tuition, fees, housing, food, transportation, and additional personal expenses.

Expected Family Contribution (EFC) is a number that reflects the family’s financial strength and is used to determine eligibility for various types of assistance. The lower the EFC, the more need-based support you may qualify for.

Grants are funds that do not require repayment, making them an excellent option for those in need. These funds often come from federal or state programs, and understanding the specifics of these offerings can significantly impact your budget.

Scholarships are another form of non-repayable funds, and they may be awarded based on merit, athletic ability, or other criteria. It’s worthwhile to explore different scholarship opportunities that fit your profile.

Loans typically require repayment, often with interest. Knowing the terms of any borrowed funds, including interest rates and repayment schedules, is vital for future financial planning.

In addition to these terms, paying attention to deadlines and requirements associated with each type of support can greatly affect your funding experience. Being proactive and well-informed will empower you to make the best decisions for your educational journey.

Next Steps After Receiving the Letter

Once the official correspondence has landed in your hands, it’s time to shift gears and focus on what comes next. Understanding the details presented in this document is crucial, but so is planning your next moves. Here’s a quick guide to help you navigate the process smoothly.

Start by carefully reviewing all the information provided. Take note of the different types of support outlined, along with the amounts awarded. Make sure to check any associated conditions or requirements that may be tied to these benefits. This step will help you grasp the full picture and avoid any surprises down the road.

Once you have a solid understanding of your options, consider your financial needs and how this assistance fits into your broader budget. It’s wise to prepare a plan that includes tuition, housing, and daily expenses while keeping in mind any necessary actions you may need to take in relation to this support.

If you have questions or uncertainties, don’t hesitate to reach out for clarity. Contact the relevant office or representative to discuss any specifics that may confuse you. Building a good rapport with these individuals can be beneficial throughout your academic journey.

Lastly, if you feel comfortable, share your experience with peers or family members. Sometimes, discussing your situation can yield valuable insights or alternative perspectives you hadn’t thought of before. Keep the conversation going as you make sense of your next academic chapter.