Maximizing Your Transactions How to Effectively Use a Credit Card with Zelle

In today’s fast-paced world, managing financial transactions seamlessly is more crucial than ever. The ability to send money quickly and efficiently has transformed the way people interact with their finances. With various platforms available, understanding how to navigate them can greatly enhance your experience and allow you to make the most of your resources.

Integrating different payment methods into these platforms can provide additional benefits and flexibility. By linking certain financial tools to your preferred service, you can unlock potential rewards and enhance your purchasing power. This approach not only simplifies the process but also opens doors to using your funds in a more efficient manner.

Whether you’re considering utilizing rewards programs or simply seeking convenience in your transactions, knowing the steps to connect your financial assets can make all the difference. The journey to mastering these features will help you manage your finances with ease and confidence, all while enjoying the perks that come along with it.

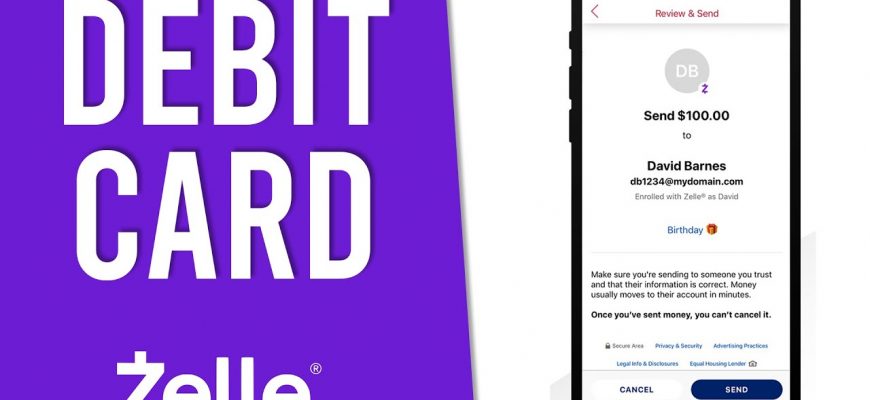

Understanding Zelle Payment System

In today’s fast-paced world, sending and receiving money has become easier than ever. With the rise of various digital platforms, individuals can transfer funds in just a few taps on their smartphones. This innovative method simplifies transactions, making it a preferred option for many when it comes to managing finances.

The system allows users to connect their bank accounts, enabling seamless transfers between friends, family, or even businesses. Unlike traditional methods, which may involve waiting for processing times, this platform offers instant transfers, ensuring that money reaches its destination quickly. It’s ideal for splitting bills, paying rent, or sending a gift.

Security is a major consideration in any financial transaction. This service incorporates various protective measures to safeguard users’ information and funds. By utilizing encrypted technology, it aims to create a secure environment for its transactions.

Adopting this digital payment tool can significantly streamline financial interactions. Its user-friendly interface makes it accessible to people of all ages, catering to both tech-savvy individuals and those less familiar with technology.

Linking Credit Cards to Zelle

Connecting a financial instrument to a digital payment platform can enhance your transactions’ flexibility and convenience. Many users appreciate the idea of pairing their payment methods with online services for seamless transfers. It’s a handy way to manage finances without too much hassle.

When considering linking your financial account, a few important steps should be taken into account to ensure a smooth process:

- Check Compatibility: Make sure the service supports your chosen method of payment.

- Log In: Access your online banking account or the specific application where the procedure occurs.

- Locate Payment Settings: Find the section dedicated to managing payment methods.

- Add New Method: Select the option to incorporate a new financial source.

- Enter Details: Provide the necessary information, ensuring accuracy for seamless transactions.

- Confirm Linkage: Follow any prompts to verify and finalize the connection.

Once completed, you will enjoy the benefits of quicker transactions, and greater ease when sending or receiving funds with friends and family. Keep in mind to monitor your transactions regularly to ensure everything operates smoothly and securely.

Benefits and Risks of Credit Card Use

When it comes to modern financial transactions, tapping into a revolving line of funds can be both advantageous and potentially perilous. Understanding the dual nature of this approach is essential for making informed decisions. On one hand, there are perks that can enhance purchasing power and streamline expenses, while on the other, there are pitfalls that could lead to financial troubles if not managed wisely.

One of the primary benefits includes the ability to earn rewards or cash back, which can add value to everyday spending. Additionally, individuals often enjoy greater protection against fraud, thanks to regulatory measures that make it easier to dispute charges or report unauthorized transactions. This added layer of security can provide peace of mind while shopping or paying bills.

However, the allure of immediate access to funds may encourage overspending, leading to a cycle of debt that’s hard to escape. High interest rates can exacerbate this situation, making it difficult to manage monthly obligations if balances aren’t cleared in a timely manner. Late payments could also result in fees, further complicating financial health.

In summary, while this financial tool offers compelling benefits, it’s crucial to recognize and carefully consider the accompanying risks. A balanced approach can ensure that one enjoys the rewards without falling into the traps that may lead to fiscal distress.

Wow;you’re stunning! This video just made my day;your charm and beauty are unreal!