A Comprehensive Guide to Obtaining a Credit Card Successfully

In today’s fast-paced world, acquiring a reliable means for managing expenses and making purchases has become essential for many individuals. Whether you’re planning to buy that new gadget or need assistance during unexpected situations, this financial instrument offers a convenient solution. Understanding the steps involved in obtaining this resource can pave the way for smoother transactions and better financial planning.

Before diving into the specifics, it’s important to recognize the various options available to you. Each choice comes with its own set of features and benefits that can cater to your unique needs. With a bit of research and some straightforward steps, you’ll find navigating this landscape is not as daunting as it may seem.

The journey involves exploring eligibility requirements, gathering necessary documents, and making informed decisions. Embracing this process can lead to a valuable addition to your financial toolkit, enhancing your purchasing power and providing security when you need it most. Let’s uncover the essential elements that will help you embark on this endeavor with confidence.

Understanding Credit Card Basics

When it comes to borrowing funds, there are essential concepts that everyone should grasp. These financial tools can provide convenience and flexibility, but they also come with responsibilities and potential pitfalls. Knowing the foundational elements is crucial for making informed decisions.

Interest Rates play a significant role in the overall expense. These are the fees charged on the outstanding balance, and they can vary widely. It’s important to pay attention to whether the rate is fixed or variable, as this can affect your repayments.

Another critical component is the limit. This is the maximum amount you can borrow at any given time. It is determined by various factors including your creditworthiness. Staying within this boundary is essential to avoid extra charges.

Additionally, understanding rewards and benefits can help you maximize your use of these financial instruments. Some options offer cash back or travel perks, providing added value for your spending habits.

Fees also deserve attention, as they can quickly add up. Common charges include annual fees, transaction fees, and late payment penalties. Being aware of these can save you from unexpected costs.

Lastly, maintaining a positive payment history can significantly influence your financial profile. Timely repayments not only keep your costs down but also contribute to a good standing, enhancing your future borrowing potential.

Applying for Your First Card

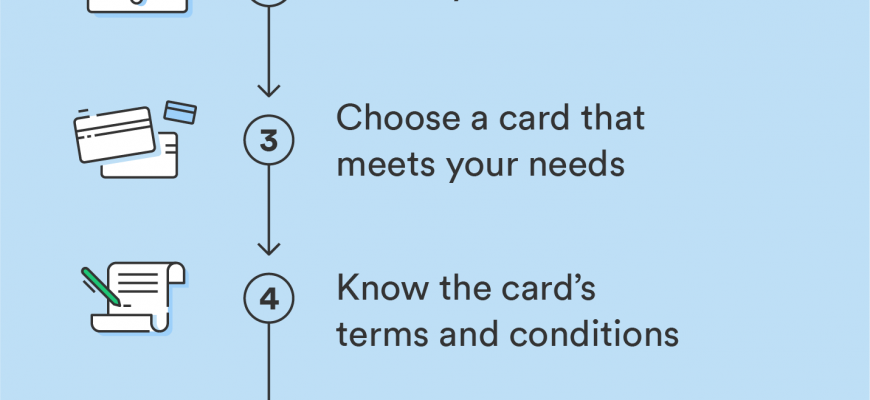

Starting your journey with a new financial tool can be both exciting and a bit daunting. The process often involves several steps, from understanding what options are available to navigating through necessary paperwork. It’s essential to approach this decision with care, as it can lay the groundwork for your future monetary endeavors.

Begin by researching various options suited for newcomers. Many institutions offer specific products designed to help individuals build their credit history. Look for features that align with your spending habits and lifestyle. You may discover rewards programs or low fees that appeal to you.

Once you’ve narrowed down your choices, it’s time to gather your paperwork. Most places will require basic identification, proof of income, and possibly a credit report if you have one. Having everything ready will streamline the application process and demonstrate your preparedness.

After submitting your application, patience is key. Approval times can vary, and you might receive a decision within a few minutes or a few days. If you’re approved, you will need to familiarize yourself with the terms and conditions. Understanding the interest rates and payment due dates will help you manage this new financial relationship responsibly.

Launching into this new chapter can be rewarding. With careful planning and a clear understanding of your finances, you can make the most of this opportunity. Welcome aboard the journey to financial empowerment!

Managing Your Funds Responsibly

Being in control of your finances is essential for a stable and stress-free life. Practicing responsible habits ensures that you can handle unexpected expenses and make the most of your available options. It’s all about finding the right balance and making informed decisions that align with your goals.

Start by keeping track of your spending. Knowing where your money goes can help you identify areas for improvement. Setting a budget allows you to allocate funds wisely, ensuring that you cover essentials while also saving for future needs. Regularly reviewing your financial habits can empower you to make changes when necessary.

Always be mindful of your obligations. Meeting deadlines for payments not only helps maintain a good standing but also builds a positive reputation. In time, this will open doors to better opportunities. Sidestepping late fees and interest charges keeps your finances on track and prevents setbacks.

Educate yourself about the terms associated with your financial tools. Understanding interest rates, repayment schedules, and benefits can aid in making smarter choices. Additionally, being aware of your rights and responsibilities can protect you from potential pitfalls.

Lastly, consider seeking advice from trusted sources. Whether it’s talking to experienced friends or consulting financial advisors, gaining insight can provide clarity. Don’t hesitate to ask questions–knowledge is key to navigating the financial landscape effectively.