A Comprehensive Guide to Registering for Universal Credit

In today’s world, many individuals and families find themselves in need of a helping hand. Navigating the various options available can seem overwhelming, but understanding the process is crucial. Support systems are in place to provide relief, especially during challenging times.

Whether you’ve recently faced job loss, have a low income, or are experiencing other financial hardships, there is a pathway to access the essential resources you require. The process may involve a few steps, but with the right information, you can smoothly transition into receiving the aid you deserve.

This guide will unravel the essentials you need to know about accessing financial resources. By demystifying the steps involved, you’ll be empowered to take control of your situation and secure the support you need in a clear and straightforward manner.

Understanding Requirements for Economic Support

When considering the benefits system, it’s crucial to grasp what qualifications are necessary to access financial assistance. This support is designed to help individuals facing challenges in their financial situation, but there are specific criteria to meet before receiving help.

Here are some key aspects that determine eligibility:

- Residency: Applicants must be residing in the country where the assistance is provided.

- Age: Usually, individuals must be at least a certain age before they can qualify for assistance.

- Income Level: Your income situation will be assessed to ensure you truly need the support.

- Work Availability: Depending on your ability to work or your current employment status, eligibility may vary.

- Personal Circumstances: Factors such as family size and any disabilities may influence the assessment.

It’s essential to prepare the necessary documentation that reflects your situation accurately. This might include proof of identity, income statements, and other relevant information. Understanding these particulars will pave the way for a smoother experience when applying for assistance.

Step-by-Step Application Guide

When you’re ready to explore available financial support options, navigating the application process can seem daunting. This guide will walk you through each stage, ensuring you feel confident and well-prepared as you take the necessary steps towards assistance.

First, gather all required documents. You’ll need information about your identity, finances, and any relevant employment details. This preparation will streamline the entire process and reduce potential delays.

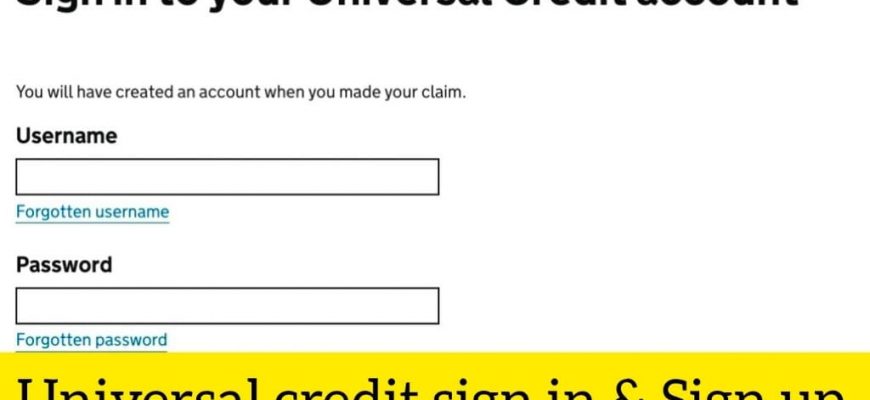

Next, visit the official website where you can initiate your application. It’s designed to be user-friendly, making it easier to find the right section. Take your time reading through the instructions and make sure to follow them closely.

Once you begin the application, be honest and accurate with the information you provide. Double-check your entries to avoid any mistakes that could slow down the process. If you’re unsure about any questions, don’t hesitate to seek assistance.

After submitting your application, keep an eye on your email or postal mail for updates. It’s crucial to stay informed about any further steps or additional information required. Patience is key, as processing times may vary.

Finally, if you’re approved, congratulations! Make sure to understand the terms of your assistance and what to expect moving forward. If you run into any challenges, there are resources available to help you navigate through them.

Common Mistakes to Avoid When Applying

Applying for financial support can be tricky, and many people stumble over some common pitfalls. Awareness of these missteps can save you time and ensure your application goes smoothly. Let’s explore a few issues to watch out for.

Incomplete Information: One of the biggest errors is failing to provide all necessary details. Make sure you fill out every section and double-check that nothing is missing. Incomplete applications can lead to delays or even rejection.

Ignoring Deadlines: It’s crucial to be mindful of dates. Missing application deadlines can result in you having to wait longer for assistance. Always mark important dates on your calendar and prepare your documentation well in advance.

Not Checking Eligibility: Some individuals apply without confirming if they meet the criteria. Before you begin, take time to review the qualifications to avoid wasting effort on an application that won’t be considered.

Neglecting Supporting Documents: Many underestimate the importance of supplementary paperwork. Ensure you gather all required documents in advance. This can include identification, proof of income, and housing details, which need to be submitted along with your application.

Rushing Through the Process: In the rush to get things done, mistakes are likely to occur. Take your time to read each question carefully and provide thorough answers. Sloppy work can result in having to start