Guidelines for Using a Credit Card to Make Zelle Payments

In today’s fast-paced world, the way we manage our finances has evolved significantly. People are looking for convenient methods to transfer funds quickly without the hassle of traditional banking processes. The need for efficient monetary exchanges has led to innovative solutions that cater to various preferences and styles.

One of the more popular options is the ability to facilitate monetary transfers using various payment alternatives. Many individuals find this approach beneficial, as it combines simplicity with speed, allowing them to transact on the go. By leveraging the right platforms, users can experience a heightened level of flexibility when handling their finances.

This guide will explore the various aspects of utilizing specific payment systems for seamless transactions, giving you the insights needed for informed choices. Understanding the nuances of these methods will empower you to take charge of your financial interactions more effectively.

Understanding Zelle Payment Options

When it comes to transferring funds quickly and conveniently, there are various avenues to explore. One popular method stands out due to its ease of use and growing popularity among users. Understanding the different ways to utilize this service can help maximize its benefits and streamline transactions.

Account Choices are essential for users to consider. Most people link their personal checking accounts to access these services, enabling swift transfers without additional fees. It’s important to ensure that your bank or financial institution supports this option for a smooth experience.

Payment Methods provide more flexibility than one might expect. While many individuals typically associate this service with direct bank transfers, alternative platforms exist that can enhance functionality. Exploring these options might uncover features tailored to specific needs, catering to a broader audience.

Lastly, do keep in mind the significance of security. As with any financial transaction, taking precautions is vital to safeguard personal information. Understanding available protections can foster confidence and promote a worry-free environment for users embracing this modern approach to personal finance.

Linking Your Credit Card to Zelle

Establishing a connection between your financial instrument and the application can enhance your payment experience significantly. This simple process allows users to utilize additional funding sources for their transactions, making it a convenient option for many. Understanding the steps involved will set you up for smooth interactions in the future.

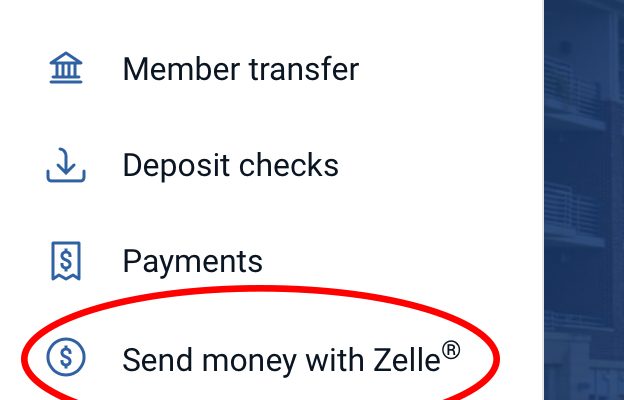

To begin, you’ll typically need access to your banking app or the associated website. Within the application, look for the appropriate section that deals with payment methods or settings. From there, you can select an option to integrate a new funding source. Just follow the prompts to add your financial tool securely.

Be sure to verify your identity during this process. Your institution may require authentication steps to ensure safety, protecting both you and your information. Once everything is set up, you’ll enjoy the benefits of having an additional payment avenue readily available whenever needed.

Keep in mind that fees might apply for certain transactions, so it’s wise to check with your financial provider. Staying informed about any potential charges helps you manage your finances better. Now that you’re ready to leverage this feature, you can enjoy a seamless experience whenever needed.

Tips for Using Zelle Effectively

Maximizing the potential of this money transfer service can make your transactions smoother and more efficient. Knowing a few practical strategies can enhance your experience and ensure you get the most out of it.

Firstly, always double-check the recipient’s information before initiating a transaction. Mistakes can lead to sending funds to the wrong person, which can be difficult to rectify. Taking a moment to confirm details can save you a lot of hassle later on.

Consider keeping track of your outgoing transfers. This can help manage your budget and avoid any surprises when it comes to your finances. Moreover, setting a limit on how much you want to send within a certain time frame can help maintain control over your spending.

Additionally, familiarize yourself with transaction limits imposed by your financial institution. Understanding these boundaries can prevent frustration during peak times when you might need to transfer larger amounts.

Lastly, remember to communicate clearly with the recipient. A quick message indicating that a transfer is coming their way can make things easier and ensure that both parties are on the same page. This can enhance trust and improve the overall experience.