A Comprehensive Guide to Sending Credit to Jamaica Effortlessly

In today’s interconnected world, the ability to assist loved ones with financial support across borders has become essential. Many folks seek to provide help to family or friends who are living in beautiful island nations. The process can seem straightforward, yet understanding the specifics of it can make all the difference in ensuring your efforts are efficient and secure.

When the goal is to enhance the life of someone special thousands of miles away, there are numerous channels available to make this happen seamlessly. You might wonder what options exist and which are the most reliable or cost-effective. With a little research and the right guidance, you can navigate through the various platforms, each offering unique benefits tailored to the needs of the recipient.

Exploring the different methodologies not only empowers you but also assures that your contributions will reach their destination without hassle. With the right approach, sending support can be accomplished easily and with peace of mind.

Methods for Transferring Funds to Jamaica

When it comes to moving money across borders, there are a multitude of options available that cater to different needs and preferences. Whether you’re looking for speed, cost-effectiveness, or convenience, each method offers unique advantages to suit various situations. Understanding these choices can help you make informed decisions to ensure that resources reach their intended destination safely and effectively.

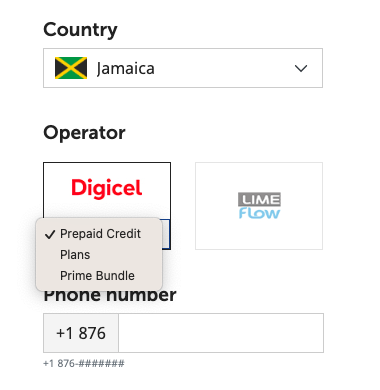

One popular approach is to utilize digital platforms, which have gained immense popularity due to their user-friendly interfaces and quick processing times. These services often provide competitive exchange rates and lower fees compared to traditional banks. It’s always wise to compare different platforms to find the best deal for your requirements.

Alternatively, traditional banking services remain a reliable means for transferring funds. Though these methods may take a bit longer than their online counterparts, they often come with added security features that can provide peace of mind. Checking with your bank can reveal specific options tailored to your circumstances, supplemented by professional guidance.

Cash transfer services are another viable route for individuals who prefer a hands-on approach. These services allow for immediate access to funds, making it convenient for recipients who may not have access to banking facilities. With locations available in numerous areas, it can be a straightforward solution for quick transactions.

Lastly, mobile applications designed for financial transactions are becoming increasingly popular. These apps often require minimal setup and allow users to transfer funds at the touch of a button. Through smartphones, you can send and receive money on-the-go, making it a modern and flexible option that fits seamlessly into busy lifestyles.

Choosing the Right Service for Remittance

When you’re looking to transfer funds internationally, picking the right platform can feel overwhelming. There are countless options available, each with its own set of features, fees, and transfer speeds. It’s essential to narrow down your choices based on what matters most to you, whether it’s affordability, reliability, or speed.

Start by comparing different providers in terms of their transfer costs. Some services might charge a flat fee, while others could take a percentage of the amount you’re moving. It’s wise to consider not only the upfront costs but also the exchange rates they offer, as a slight difference can significantly impact the total amount received.

Another important factor is the transfer time. Depending on your needs, you might want an option that processes transactions quickly. Some platforms offer instant transfers, while others may take several days. Check customer reviews to get a sense of any delays or issues that may arise, as user experiences often provide valuable insights.

Security should also be a top priority. Always opt for services that have robust security measures in place to protect your financial information. Look for well-established companies with positive reputations, as they tend to provide safer transactions and better customer support.

Lastly, consider the convenience of the service. An intuitive interface can make a big difference, especially if you’re new to online transactions. Determine if they offer a mobile app, local payment options, or customer service that aligns with your preferences.

Understanding Fees and Exchange Rates

When it comes to transferring funds across borders, there are several important factors to keep in mind. Both the costs associated with the transaction and the fluctuating value of currency play a significant role in determining the overall amount that reaches the recipient.

Fees can vary widely depending on the provider you choose. Some services charge a flat rate, while others may take a percentage of the total sum being transferred. It’s crucial to do your homework and compare options to ensure you’re getting the best deal. Every little bit counts, especially when the goal is to maximize the amount received.

Exchange rates are another key player in this equation. These rates change frequently due to market conditions, impacting how much local currency the recipient will ultimately receive. If you’re not careful, a less favorable rate can significantly reduce the net amount. Keeping an eye on these fluctuations and timing the transfer can be beneficial.

In summary, being aware of both the fees and the current exchange rate can help you navigate the complexities of international transactions more effectively. Taking these elements into account ensures that you’re making informed decisions and getting the most out of your financial transfer.