Understanding the Process of Determining Your Potential Financial Aid Amount

When it comes to pursuing education, navigating the terrain of available resources can feel overwhelming. Many individuals are eager to uncover the level of assistance they might secure to alleviate their expenses. The journey begins with gaining insight into various options designed to support students financially.

Before diving into specific numbers, it’s essential to recognize the factors influencing the type of resources one might qualify for. From personal circumstances to academic achievements, numerous elements come into play. By taking the time to familiarize yourself with these aspects, you can better prepare for the process ahead and maximize your opportunities.

Equipped with the right tools and knowledge, you’ll be able to embark on this exciting venture. Understanding the overall framework and the key players in the support landscape can lead to informed decisions and potentially unlock doors you never knew existed. Embrace the journey and explore the ways to enhance your financial journey.

Understanding Financial Aid Eligibility

When it comes to exploring support options for your education, figuring out your qualifications can be a bit daunting. It’s essential to grasp the various factors that contribute to your potential for receiving assistance. This journey often involves navigating through a variety of criteria that institutions and programs utilize to determine who may benefit from resources.

Income level is a significant element that many consider. Generally, lower incomes can enhance your chances of being offered support. Additionally, family circumstances play a role as well; dependencies and household size can influence eligibility standards. Moreover, the type of institution–whether it’s a community college, university, or vocational school–can affect available resources.

Another crucial aspect is your academic performance. Many programs look favorably upon strong grades and consistent coursework, as this often indicates a commitment to your education. Enrollment status is also vital; full-time students may have more opportunities compared to part-time learners. Finally, factors like residency and special circumstances, such as being a veteran or having a disability, may open additional doors for support.

Estimating Your Expected Family Contribution

Understanding what your expected family contribution (EFC) means is key to navigating the world of educational expenses. This figure represents the amount your household is anticipated to contribute toward your educational journey. Keeping in mind various factors that affect this calculation can help in gaining clarity on your financial responsibilities.

Your income, assets, and family size are just a few elements that come into play when determining the EFC. Factors like the number of siblings in college or special family circumstances can also influence this number significantly. Taking a closer look at these variables will provide a clearer picture of what you might be expected to contribute.

An effective way to begin your estimation is to utilize online calculators designed specifically for this purpose. These tools typically ask for detailed information about your finances and family situation. While estimates may vary, they serve as a helpful guide to prepare for discussions regarding educational finances.

Remember to gather necessary documentation ahead of time, as having your financial information organized will support a more accurate estimation. This proactive step not only demystifies the process but sets a strong foundation for informed decisions regarding your academic pursuits.

Exploring Different Types of Financial Support

When it comes to pursuing education, various forms of assistance can help lighten the load. These options can come from multiple sources, each designed to ease the burden of costs associated with learning. Understanding the diverse types of support available can empower individuals in making more informed choices for their academic journeys.

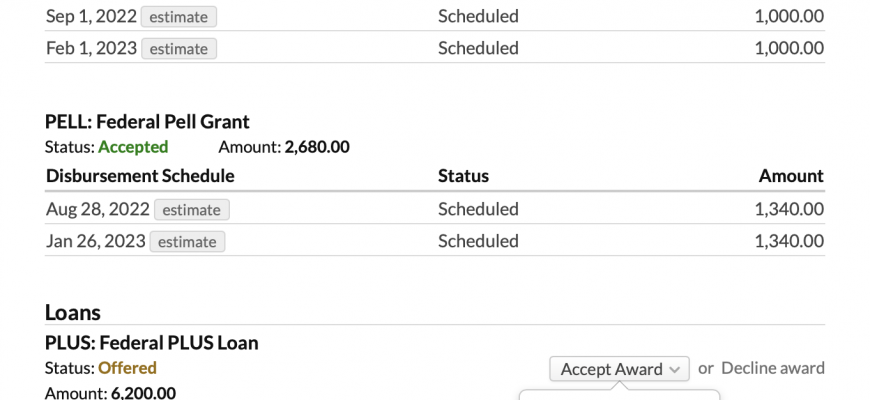

Scholarships represent one of the most sought-after resources. They stand out because they do not require repayment, allowing students to focus on their studies without the looming stress of debt. Generally awarded based on merit, character, or special talents, scholarships can significantly offset tuition expenses.

Grants are another avenue worth considering. Similar to scholarships, these funds do not necessitate repayment. They typically target specific criteria, such as financial need or particular fields of study. Grants can be awarded by federal or state government bodies, institutions, or private organizations.

Loans provide additional support but come with the responsibility of repayment. They can be federal or private, offering various terms and interest rates. While loans can help bridge the funding gap, it’s crucial to evaluate the long-term implications of borrowing based on individual financial circumstances.

Work-study programs offer a unique approach by allowing students to earn money while pursuing their education. These positions may be on-campus or with approved off-campus employers and provide a great opportunity to gain experience while offsetting costs. Each of these methods plays a role in ensuring education remains accessible, and the right mix may vary for everyone.